Former US President Donald Trump is making headlines with allegations of owning Ethereum (ETH). However, these claims are being taken over by cryptocurrency news. Recent reports have revealed that Trump has a cryptocurrency address holding over $2.8 million worth of Ethereum.

Exciting Anticipation in Cryptocurrencies!

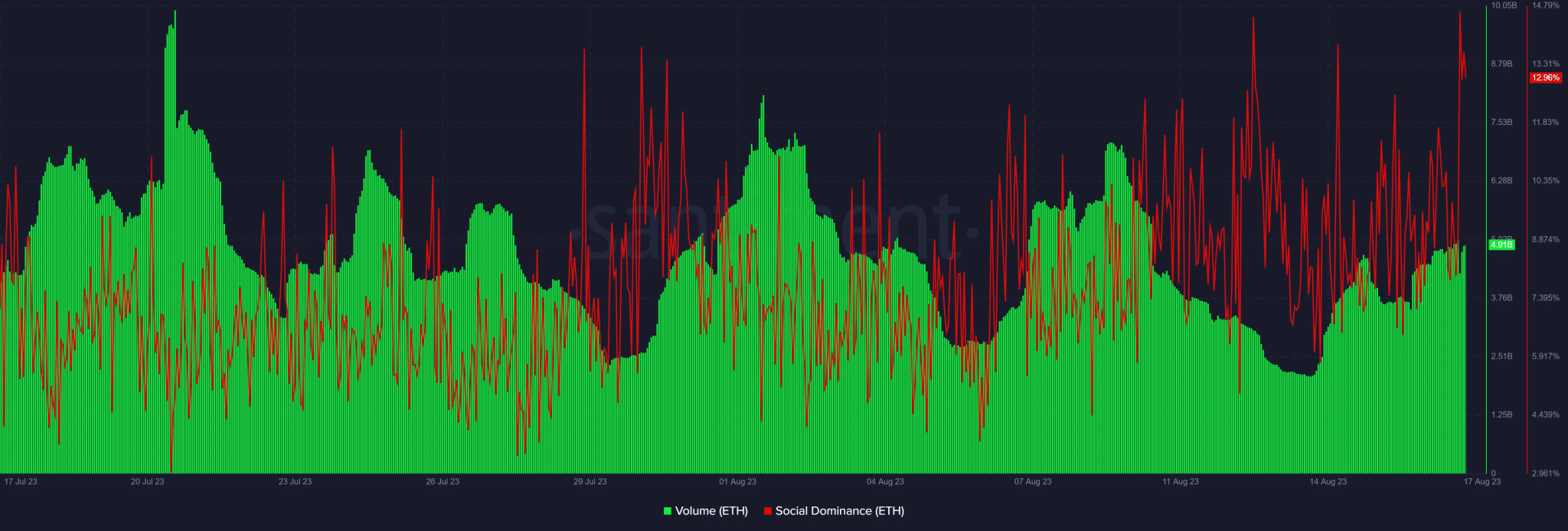

The cryptocurrency market reacted with great excitement to the news in the past 24 hours, based on the amount of social interactions. The number of social interactions related to Trump’s ETH assets triggered up to 5.6 million interactions per hour. In other words, there is a lot of social conversation and excitement regarding the former President’s cryptocurrency portfolio.

This increase in social engagement was particularly evident in ETH’s social dominance, which reached its highest monthly level in the past 24 hours. There has also been an increase in volume in the past four days. However, this did not lead to a surge in demand. Additionally, ETH’s price movement was trending downwards during the same period, which could indicate a reflection of selling pressure in volume.

The increase in social dominance demonstrated that ETH gained significantly higher visibility in the past 24 hours. However, it also suggested that Trump’s excitement over cryptocurrencies may not have a significant impact on market sentiment, as it expanded its downside during the same period.

Crucial Data on ETH!

ETH bears have taken control in the past few days and exerted enough selling pressure to push it below long-term support. At the time of writing, ETH is trading at $1,808. The Relative Strength Index (RSI) of ETH has fallen below its midpoint, indicating a preference for bearish sentiment in the market.

The supply of ETH held by the top addresses has been steadily increasing in the past four weeks. At the time of writing, it was at its highest level in the past four weeks. This confirms that ETH whales have been taking advantage of the dip by buying at low price levels. Whale accumulation can often be a healthy sign. However, the recent decline in ETH has also resulted in lower profitability, as indicated by the Market Value to Realized Value (MVRV) ratio, which is close to its lowest point in the past four weeks.