The bankruptcy of major players like FTX and Alameda Research and their recent high-volume Ethereum (ETH) transactions are being carefully followed by the cryptocurrency world, especially since these transactions may have triggered significant price drops in ETH’s value. The most recent transactions by both companies could have been the main reasons for the downturn in ETH.

FTX and Alameda Research’s Transactions Make Headlines

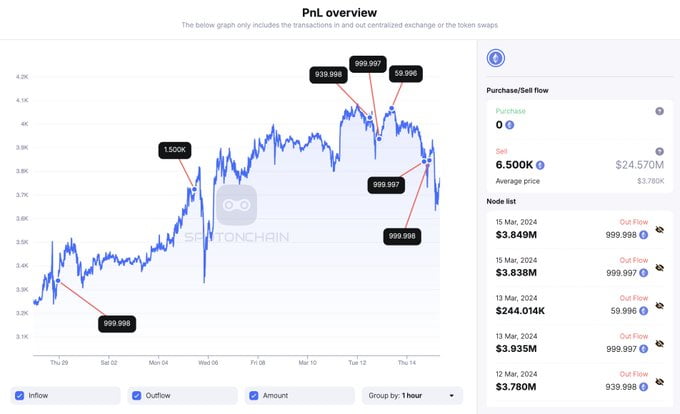

According to the on-chain data provider Spot on Chain, FTX and Alameda Research recently executed a series of transactions consisting of 6,500 ETH, valued at $24.57 million, and deposited the ETH into the Coinbase exchange. This activity has led analysts to speculate about a potential correlation between the transactions of FTX and Alameda Research and Ethereum‘s price movements.

FTX and Alameda Research have been significantly active in the Ethereum market lately, executing multiple transactions. These include the transfer of $24.57 million worth of ETH to Coinbase, as well as other assets totaling $6.26 million. Interestingly, Ethereum’s price notably dropped after most of these transactions, leading to commentary on a potential causal relationship between the companies’ actions and ETH’s price volatility.

In addition to Ethereum’s price movements, an analysis of the recent transactions by FTX and Alameda Research reveals a strong correlation on this front. Ethereum has consistently experienced declines in market value following the transactions by FTX and Alameda Research. Graphical representations confirm this relationship, and it would not be incorrect to say that the actions of these major players could affect Ethereum’s price in the short term.

Ethereum Price Analysis

From a technical standpoint, the ETH chart currently shows the formation of a significant downtrend line along with resistance around $3,850. Key resistance levels correspond to the 50 percent Fibonacci retracement level, indicating several potential obstacles for further upward movement. A successful break above $3,880 could signal a revival in bullish momentum, potentially pushing Ethereum towards $4,000.

Conversely, failure to surpass $3,850 could lead to further downward movement towards the first expected support around $3,680 and a major support area around $3,600. Along with these, a break below $3,500 for the altcoin king could plunge the price towards a deeper drop to $3,350.