The crypto sector, already beleaguered with lawsuits, is facing an escalating crisis with the FTX crypto exchange at its epicenter. Once hailed as a prodigy, Sam Bankman-Fried’s enterprise is under scrutiny, with the lawsuit revealing customer funds misuse. With the case currently in court, an intriguing comment has emerged from one of the auditors overseeing FTX’s bankruptcy process.

FTX Trial Continues

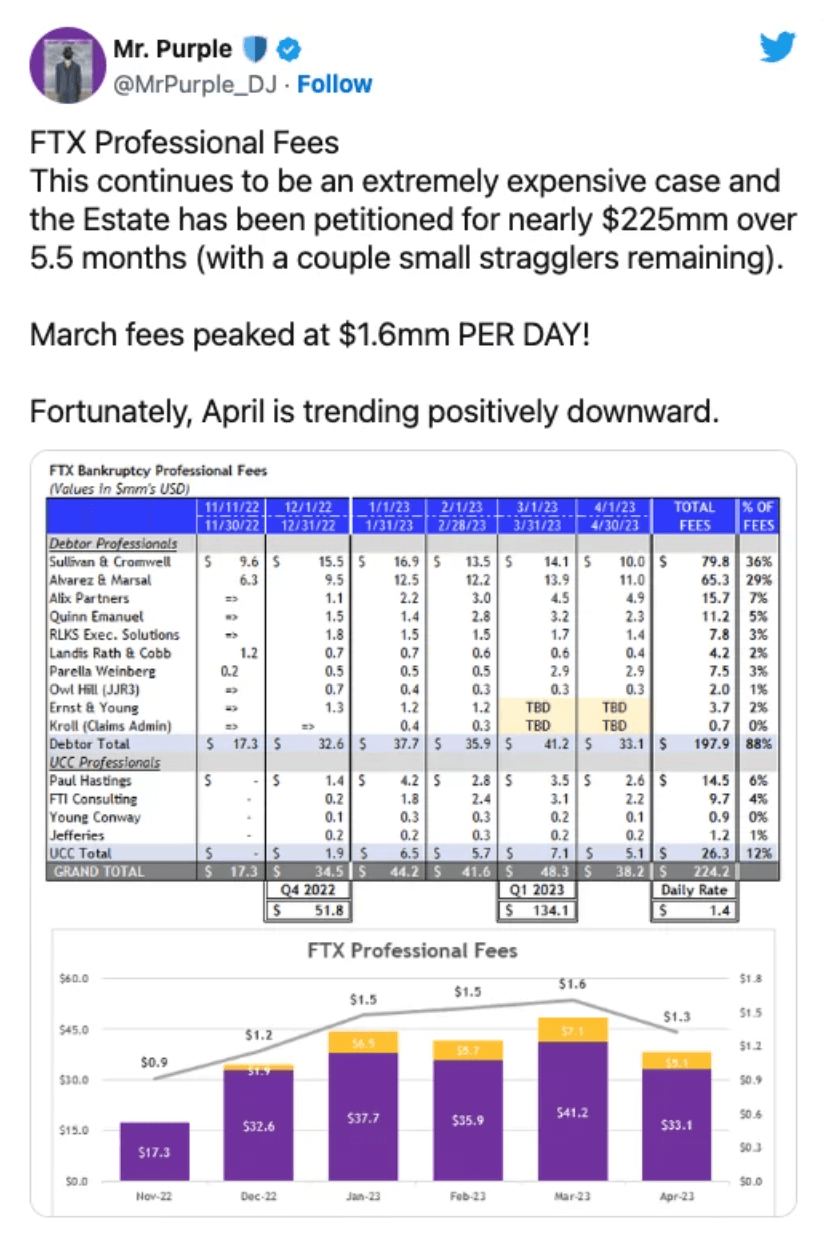

The FTX case, only seven months into the bankruptcy process, appears to have accumulated legal and administrative fees totaling over $200 million. An independent auditor considers this sum reasonable, pointing out the extreme workload the case has required.

Court-appointed auditor Katherine Stadler discussed law firms’ transaction fees in her 47-page final report. She deemed the fees associated with the bankruptcy process, which began on November 11, 2022, to be reasonable.

Stadler noted that FTX’s largely unregulated financial system contributes to the case’s scale, which is substantial considering the exchange’s size. The high costs are justifiable, considering the corporate records, existing management scheme, and global investigations involved.

Court records published a few days before this report revealed that daily transaction fees could reach $1.6 million. This represents the fees charged by the teams handling the lawsuit and bankruptcy.

Jaw-dropping Costs in FTX Case

Stadler suggested that the FTX case “could become even more expensive” and that the $200 million figure is just the starting point. Lawyers involved in the case are charging hourly rates ranging from $388 to $2,165. Among the 242 lawyers working on the case, 46 charge more than $2,000 per hour.

New York-based law firm Sullivan & Cromwell commands the highest fee and has so far billed $42 million, followed by Alvarez & Marshall at $28 million. It seems that the FTX case costs will continue to rise exponentially.