As the market eagerly awaits spot Ethereum ETFs, Mike Novogratz’s leading crypto investment firm Galaxy Digital appears to be expanding its Ethereum (ETH) investments following a 10% increase in ETH price over the last week, which has led to the highest price levels in two years.

Galaxy Digital’s Ethereum Acquisition

According to the on-chain data analysis platform Lookonchain, on February 20, Mike Novogratz’s Galaxy Digital withdrew a total of 26,000 ETH from Coinbase and Binance.

Lookonchain reports that the 26,000 ETH withdrawn by Galaxy Digital in the last 24 hours was valued at $76.2 million at the time of writing. Data provided by Etherscan highlighted transactions, four on Binance and one on Coinbase Prime. Galaxy Digital had made similar Ethereum purchases last year as well.

In October of the previous year, just before a significant rally, Galaxy Digital had taken long positions in Bitcoin (BTC) and Ethereum (ETH) on the Aave and Compound platforms. Research on Galaxy Digital suggested that one of the spot Bitcoin ETFs could host an influx of $14.4 billion in its first year.

Current Ethereum Price Status

While all this was happening, the US Securities and Exchange Commission (SEC) postponed the decision on the Ethereum (ETH) exchange-traded fund (ETF) expected to be jointly offered by Invesco and Galaxy Digital, marking a significant decision.

James Seyffart, an analyst frequently mentioned during the Bitcoin ETF era at Bloomberg Intelligence, had a strong expectation that spot Ethereum ETF approvals could come as soon as May this year.

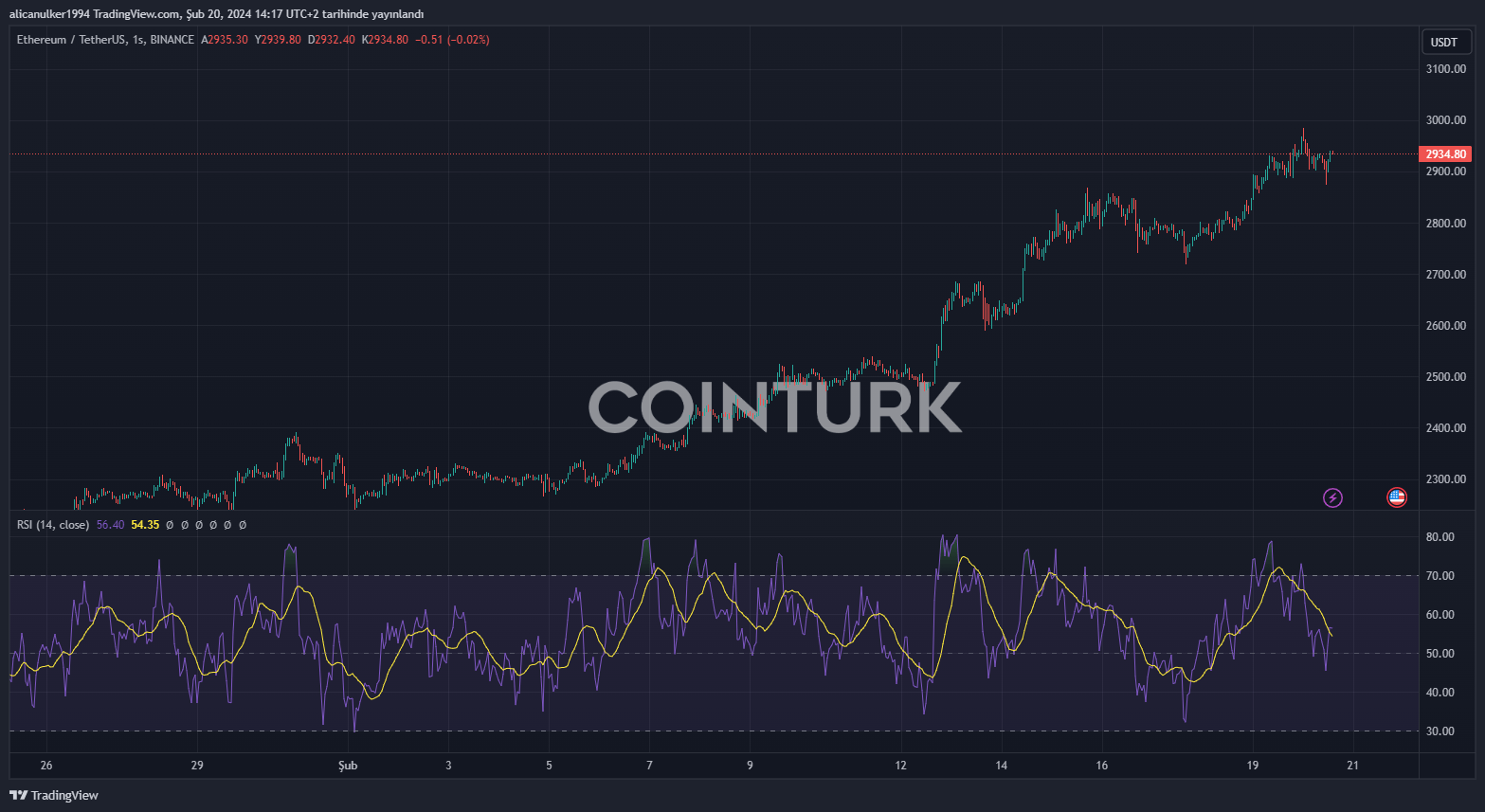

ETH price has risen to $2,934 with a 1% increase in the last 24 hours. The lowest price for ETH in the same period was $2,879, while the highest was $2,983.

Investors’ eyes seem to be set on the anticipated $3,000 mark for Ethereum in the short term. During this period, the trading volume also saw an increase of over 20% in the last 24 hours, indicating a rise in investor interest.

The interest of Ethereum whales in Ethereum seems to continue, and it is thought that this interest could drive the ETH price to $4,000. An Ethereum whale recently purchased 21,353 ETH at an average cost of $2,810 per token and made a profit of over $100 million in a short time based on the ETH holdings.

Türkçe

Türkçe Español

Español