GBTC outflows are slowing down, and investors did not panic following the approval of a $1.3 billion sale by Genesis. After seeing a net outflow of $5.64 in January, the Grayscale-initiated Bitcoin ETF GBTC observed daily outflows dropping to the $50 million range in February. As strong inflows continue into other ETFs, the appetite for risk in Bitcoin and altcoins is also starting to recover. So, what are the price predictions for popular altcoins?

Cardano (ADA)

Technologically lagging and rapidly gaining new competitors, Cardano is not standing out positively in the process. Moreover, Hoskinson continues to focus on unrelated global events, which he has been criticized for in the past, rather than on Cardano.

ADA Coin’s price was at $0.633 at the time of writing, continuing the day with a 2% increase. ADA Coin bulls also bought the dip to $0.56 during the February 17th drop. The long wick on the candlestick shows the bulls’ failure to push the price to higher levels, alongside their appetite in the support area.

The price is above the $0.62 resistance area, which could trigger a new attempt at the $0.68 resistance. In this scenario, an acceleration of the rally can be expected.

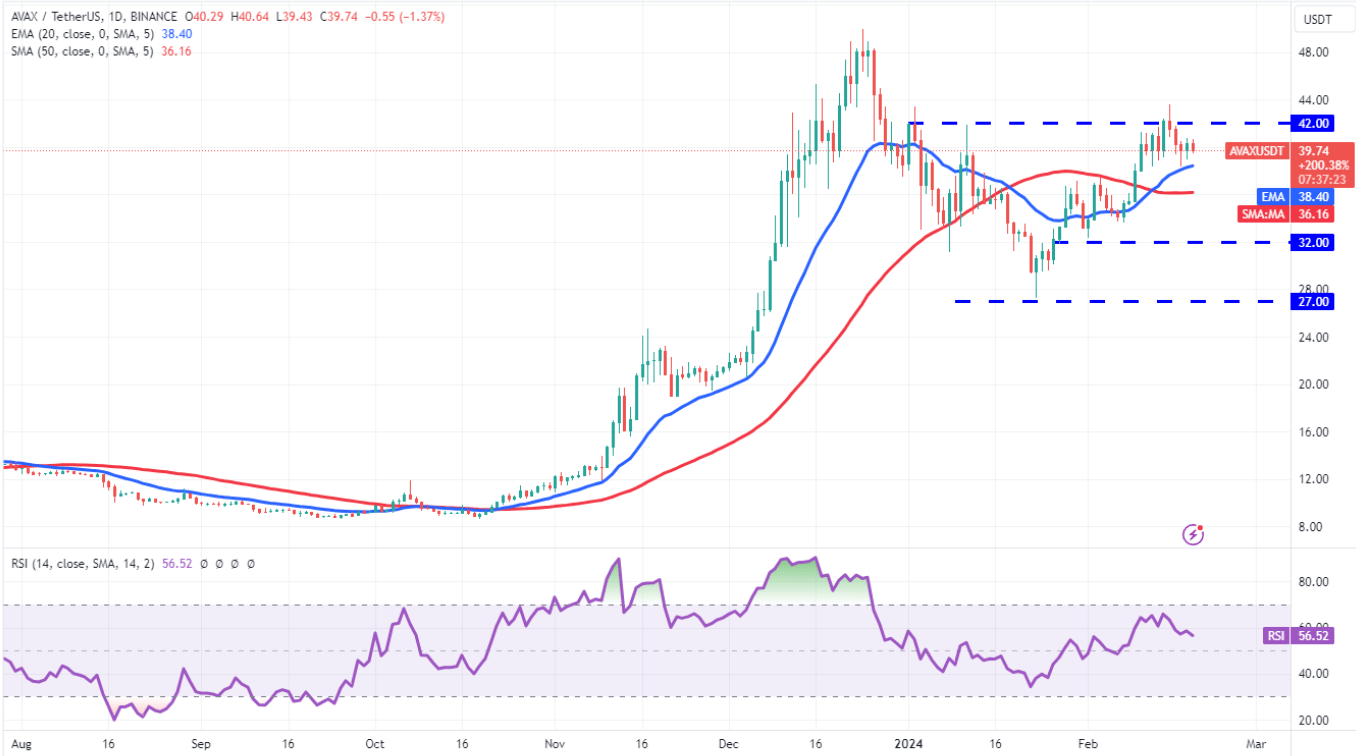

Avalanche (AVAX)

Avalanche was rejected from the $42 resistance on February 15th. We have been discussing how important this level is for a while, and current investors have already memorized the area. The $50 resistance test is a challenging hurdle.

If the price also loses the $34.40 support, we may see a continuation of the decline towards $36.16 and $32-31.5. This would mean the price will continue to consolidate in the $32-42 range for a longer period.

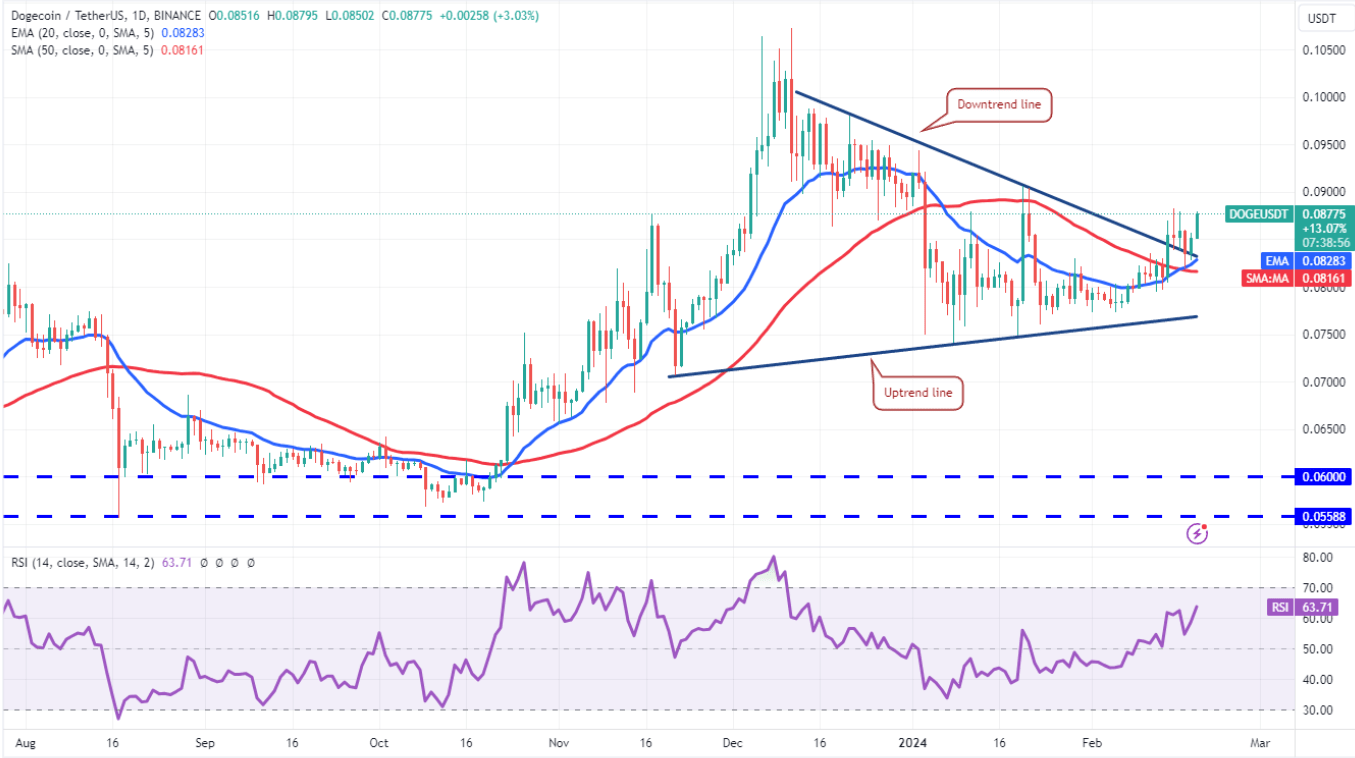

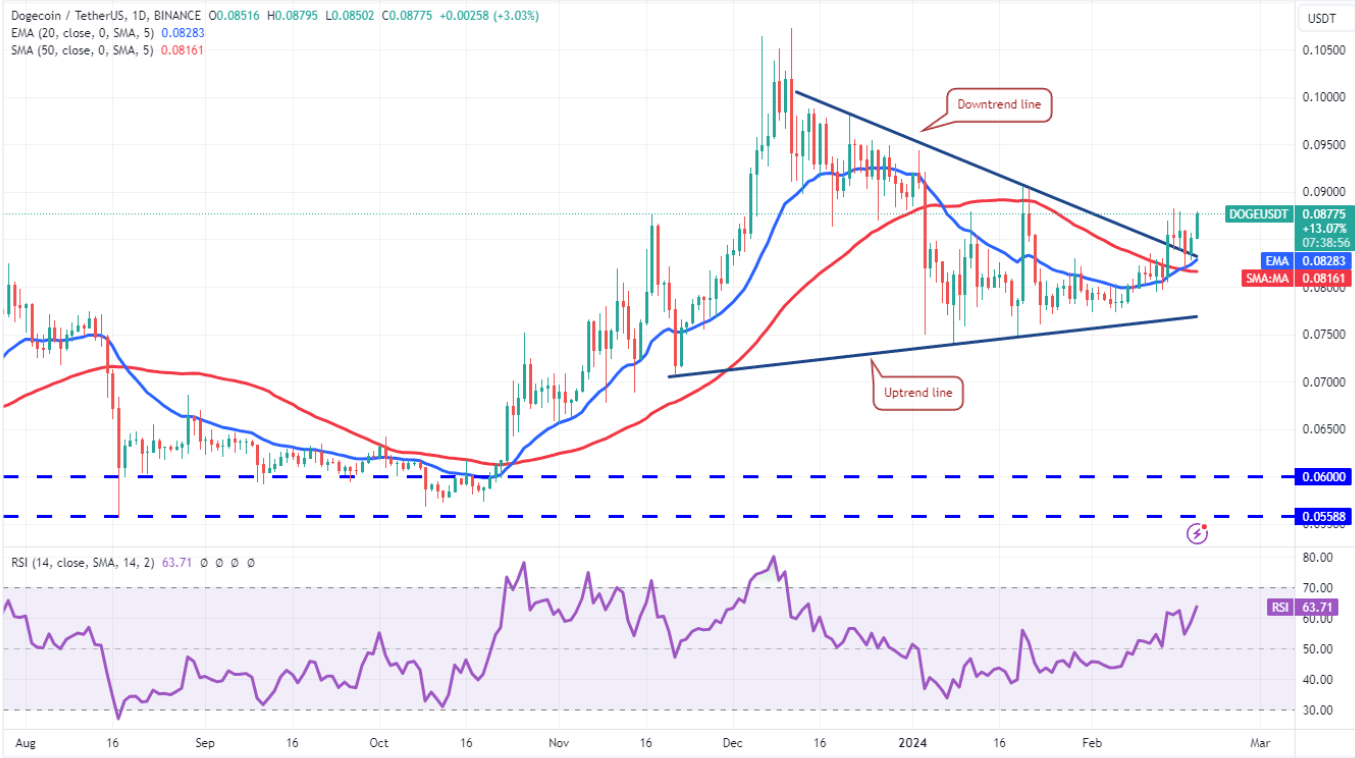

Dogecoin (DOGE)

Miners still have 4.17 billion Dogecoin (DOGE) to sell. This reserve was 36.2 billion in 2017 and dropped to 13.1 billion during the 2021 bull run. Even though miners continued their steady sales in the tough bear market environment and reduced the DOGE reserves to 4.12 billion by February 9th, there was some recovery afterward. However, this still does not reverse the 10.7% decrease from 90 days earlier.

The 20-day EMA ($0.08) is gradually rising, and the RSI has moved above the neutral zone. Miners are slowly returning to accumulation, which means DOGE could rise. If it reclaims $0.09, we might see the price rise to $0.11.

Türkçe

Türkçe Español

Español