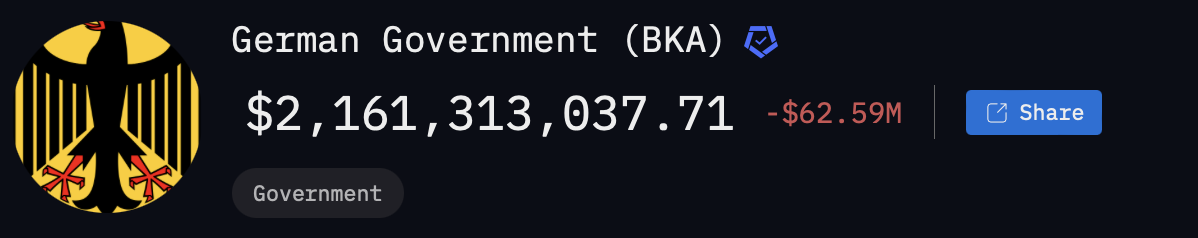

Germany, by selling its Bitcoin (BTC) holdings, continues to exert significant pressure on the cryptocurrency market. According to Arkham Intelligence data, Germany still holds 29,286 BTC worth 2.161 billion dollars. This potential selling pressure accounts for 9% of Bitcoin’s 24-hour trading volume and could have a serious impact on the market.

Germany’s Impact on Bitcoin

Germany started liquidating its Bitcoin holdings in mid-June. For those unaware, the source of these BTCs held by the German government is the German Federal Criminal Police Office (BKA), which conducted an operation on the operators of the privacy website Movie2k.to, last active in 2013. During the operation, 49,857 BTC were seized. Last month, 10,000 of these BTCs were liquidated, causing a sharp drop in Bitcoin’s price.

In the last four weeks, Bitcoin’s spot price has dropped nearly 20%, falling to 55,490 dollars. According to recent data, the price has dropped by 13% in just the last seven days.

Following the market turmoil caused by the German government’s sales, Tron founder Justin Sun took action and offered to buy the BTCs held by the German government outside of exchanges to prevent negative market impact.

Sales Considered a Strategic Mistake

On the other hand, some observers consider Germany’s Bitcoin sales a strategic mistake. In Blockware Intelligence’s July 5 bulletin, it was stated, “The German government has transferred over 390 million dollars worth of Bitcoin to exchanges in recent weeks to convert to fiat currency. Geopolitically, it is a strategic mistake for a nation-state to sell Bitcoin holdings for fiat currency because fiat currencies can be easily produced, while Bitcoin is much harder to obtain due to its limited supply and the physical energy required for mining.”

According to CoinMarketCap data, Bitcoin is trading at 55,749 dollars, down 2.57% in the last 24 hours. Recent on-chain data shows that the German government transferred a total of 1,000 BTC to Coinbase and Bitstamp exchanges, with 500 BTC each.

Türkçe

Türkçe Español

Español