The state of global markets is affecting cryptocurrencies, and the Fed’s interest rate strategy is one of the most important issues of the year. The rapid increases seen in 2022 continued last year and have now stopped. With the interest rate ceiling now declared, the market has once again become overly optimistic. Will the Fed eventually smooth this out? How will cryptocurrencies be affected in this case?

Fed Interest Rate Cut

Gold, silver, the dollar, stocks, and ultimately cryptocurrency markets are heavily influenced by the Fed’s interest rate policy. This is normal because the dollar becoming more expensive has long pushed investors towards riskier assets. This has led to a lack of demand in risk markets, including cryptocurrencies.

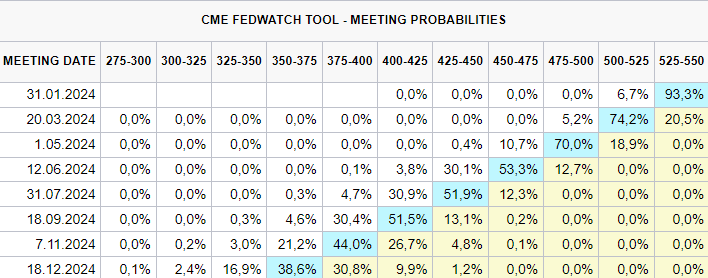

For some time, investors buying into the 2024 outlook have been thinking that the Fed will make sharp cuts in interest rates this year. Although Powell and his team’s estimate was 75 basis points, predictions were revised upwards to a cut of up to 160 basis points after today’s PPI data.

The real turning point will be the messages given at the Fed meeting at the end of January. Employment data is strong, but we know that members expect a weakening here. Inflation, however, did not rise as fast as expected. But the messages Powell will give are extremely important.

IMF and Wells Fargo Forecasts

Following the latest data, we see that the Fed’s front-loaded interest rate hikes are starting to yield the expected results. Despite short-term deviations, inflation is on a downward path, and even the hawkish members accept that we are on the right track.

The only problem is the insistence of a significant part of the Fed members that there should be no rush for rate cuts. Wells Fargo CEO believes that the ongoing uncertainty, although now widespread, needs to be converted into a timeline;

“There is significant uncertainty regarding the timing and scope of the Fed’s interest rate steps.”

IMF Spokesperson Kozack, on the other hand, is among the optimists regarding a soft landing;

“The general view of the IMF is that the global economy is ready for a soft landing with low inflation, but there is a risk that low-income countries will fall further behind.”

US short-term interest rate futures rose after the PPI data, and traders increased their expectations for a Fed rate cut. Investors’ predictions for the Fed’s easing in 2024 rose from 154 basis points to 160 basis points.

Türkçe

Türkçe Español

Español