Bitcoin‘s (BTC) price has recently been fluctuating around $52,000, while U.S. stock markets, including the S&P 500, have reached record levels. The S&P 500 has hit the 5,000 mark, registering a 5.54% increase since the beginning of 2024, fueling optimism among market participants.

Goldman Sachs Revises S&P 500 Index 2024 Target

Goldman Sachs strategists have swiftly revised the S&P 500 index’s 2024 target following its significant breach of the 5,000 level. The team, led by David Kostin, highlighted increased earnings forecasts as the primary factor behind the revision, now expecting the index to climb to 5,200 by year-end. This forecast represents a 2% increase over the previous estimate.

Kostin’s team had initially projected in November 2023 that the S&P 500 would reach 4,700 by the end of 2024, which highlights Goldman Sachs’ new bullish stance with a target of 5,200.

Other market analysts, including Tom Lee from Fundstrat Global Advisors and John Stoltzfus from Oppenheimer Asset Management, also share a similar optimistic outlook for the index.

Bitcoin May Follow S&P 500’s Lead

Historically, Bitcoin and the S&P 500 have moved closely together, and after Bitcoin’s rally in the fourth quarter of 2023, BTC’s price has aligned with the index’s performance. This suggests that Goldman Sachs’ revision may also imply a gear shift for Bitcoin.

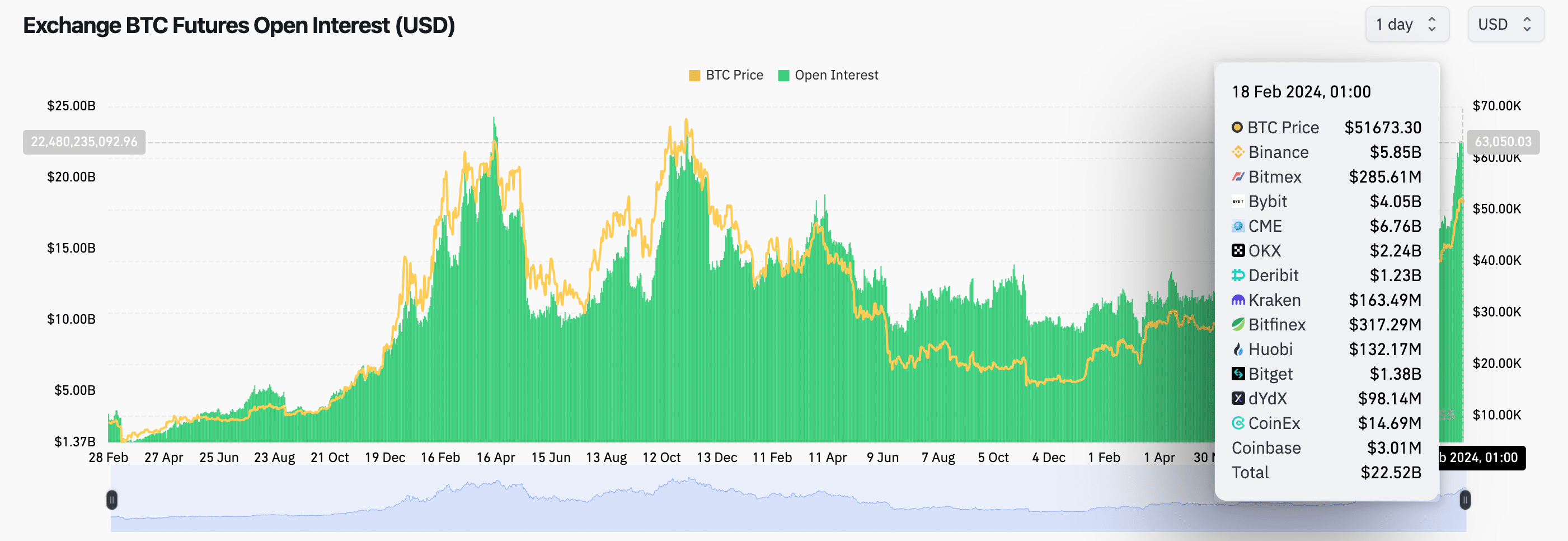

Currently, derivative data points to further gains for Bitcoin. The open interest for the largest cryptocurrency hit a three-year peak of $22.5 billion on February 18th, indicating continued bullish sentiment among investors.

Nevertheless, BTC faces a significant hurdle near the $53,200 threshold—a strong resistance level where many investors have held losses since December 2021. If bulls manage to overcome this resistance, a strong upward momentum could be triggered, potentially retesting the $60,000 region.