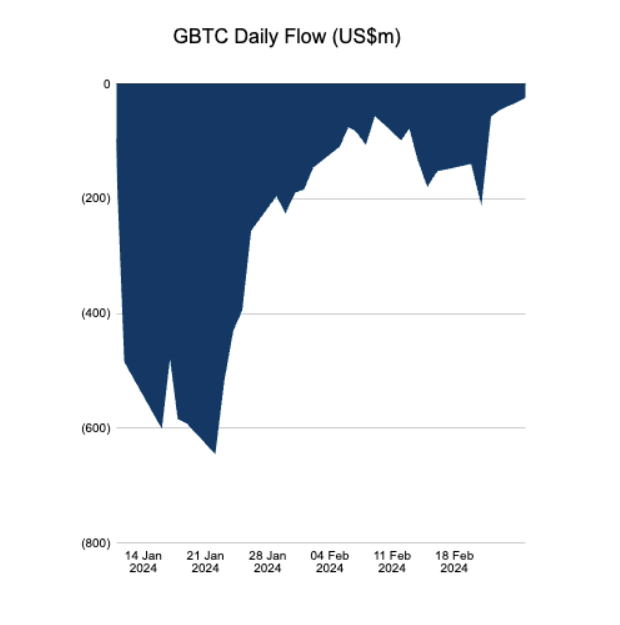

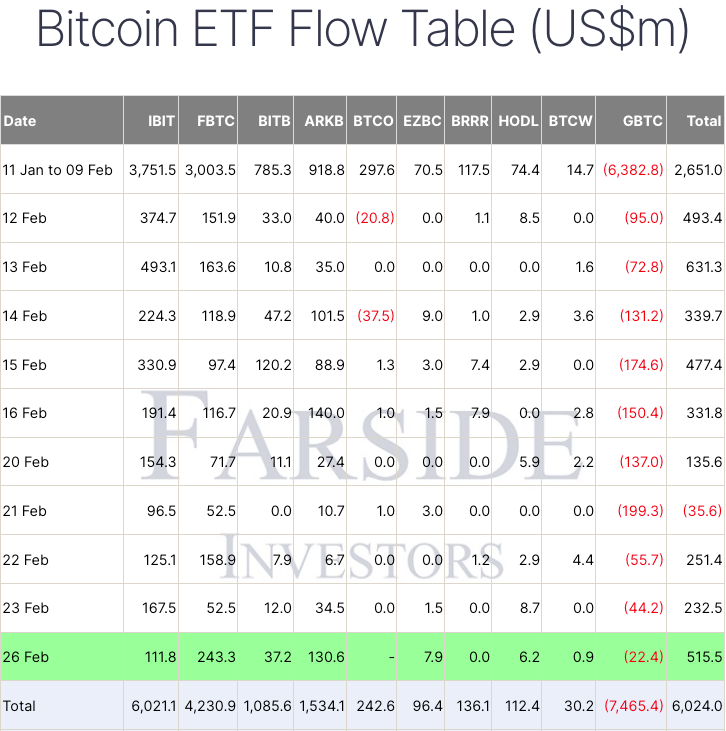

Grayscale’s spot Bitcoin exchange-traded fund (ETF) slowed down net outflows for the third consecutive trading day, reaching its lowest level at $22.4 million, while ETF funds achieved the highest net inflows in two weeks. According to data from Farside Investor dated February 26, Grayscale Bitcoin Trust (GBTC) slowed down net outflows for three consecutive days on February 22, 23, and 26.

Significant Developments in GBTC Fund

On February 23, the trading week closed with a daily net outflow of $44.2 million, and by February 26, the outflows were halved. However, since Grayscale converted to an ETF fund on January 11, it has experienced outflows for 31 consecutive trading days, with a total of $7.47 billion withdrawn from the ETF.

Blockstream’s CEO Adam Back wrote on February 26 that he was looking forward to the day GBTC would see inflows, highlighting a significant process. Back added that this could happen, but it would require a sufficient premium to encourage investors to arbitrage the ETF fund.

Henrik Andersson, the chief investment officer at asset manager Apollo Crypto, wrote in a separate post that Grayscale’s fund had its first net inflow, which would be a mega signal for the market. Meanwhile, Farside’s data from February 26 shows that the combined net inflows of all Bitcoin ETF funds, including those of Invesco and Galaxy, reached $515.5 million, marking the highest level in two weeks.

What’s Happening in the ETF Space?

ETF funds reached a combined net inflow of $631.3 million on February 13 but have since struggled to maintain momentum, even seeing a net outflow of $35.6 million on February 21 due to a relatively larger outflow from GBTC and smaller inflows to other funds.

Fidelity’s ETF fund accounted for nearly half of the day’s net total with over $243 million in inflows on February 26. This was also the second-highest single-day inflow for GBTC since January 17. The other half of the net inflow came from BlackRock’s ETF fund, as well as ARK Invest and 21Shares funds, which saw inflows of approximately $112 million and over $130.5 million, respectively.