In about two days, Bitcoin will experience its own halving (block reward halving). However, Grayscale is ahead of the curve. When the Spot Bitcoin ETF approval came through, the company was the largest Bitcoin investor, holding a massive amount of BTC. The assets held in response to their customers’ GBTC trust purchases halved over the months.

Grayscale Halving

Since its launch, major Bitcoin investor Grayscale Investments has faced intense sales. The bankruptcy of crypto companies selling GBTC, investors trying to profit from negative premiums, and those switching to more reasonable options like Blackrock due to GBTC’s high commission fees were among the main reasons for this decline.

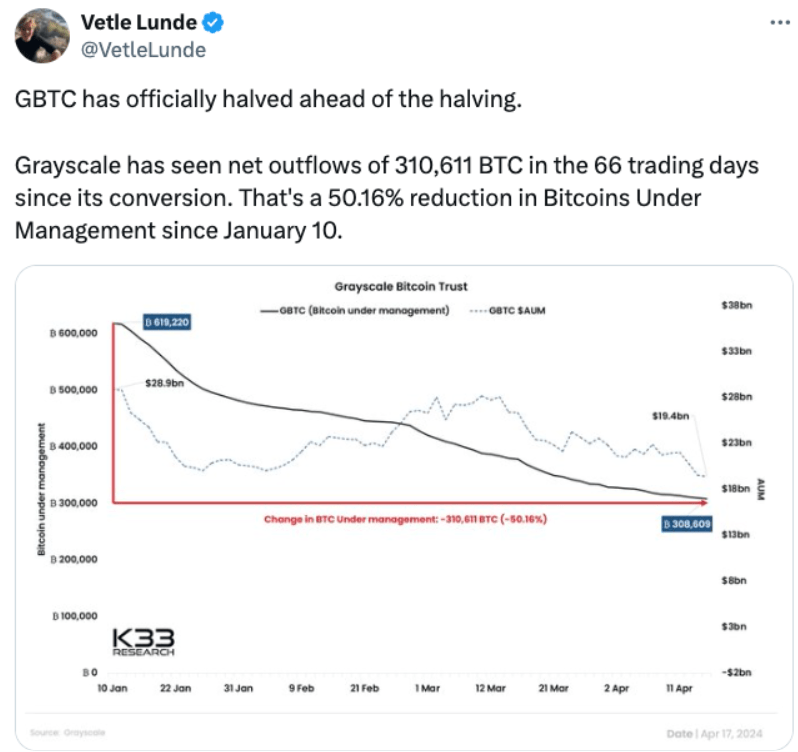

Grayscale started its first trading day on January 11 with a reserve of 619,220 BTC. According to GBTC data, the spot Bitcoin ETF had 309,871 BTC on its 66th trading day on April 16. The reserve size has decreased by 50% from the first trading day in January to the present. At the time of writing this article, the current reserve was $19.7 billion.

The halving in GBTC’s reserves occurred two days before the Bitcoin block reward halving. In two days, the mining reward will decrease by 50% from 6.25 BTC to 3.125 BTC. The Bitcoin network has a halving mechanism that occurs every 210,000 blocks, about every four years, thus halving the new supply introduced by miners every four years.

Bitcoin supply has entered circulation by more than 90%, so future halving events will not create as significant supply shocks. However, we will start to see days when demand increases while new supply remains nearly constant.

Spot Bitcoin ETFs

GBTC among the approved Bitcoin ETFs has the highest transaction fee. This was the current management’s idea to turn intense sales into a profit opportunity in the initial period. After sales stabilize in the future, Grayscale indicated it might lower its fees. On the other hand, some ETF traders find the current commission reasonable due to the volume created and weak price movement.

Most Bitcoin ETFs have lowered their fees to increase their competitive strength, setting transaction commissions between 0.2% and 0.4%. BlackRock’s iShares Bitcoin Trust (IBIT) has a fee of 0.25%. Starting trading on January 11 with a reserve of 2,621 BTC, Blackrock now alone reached a reserve of 272,548 BTC and could surpass GBTC in reserve size by growing another 13%.

Türkçe

Türkçe Español

Español