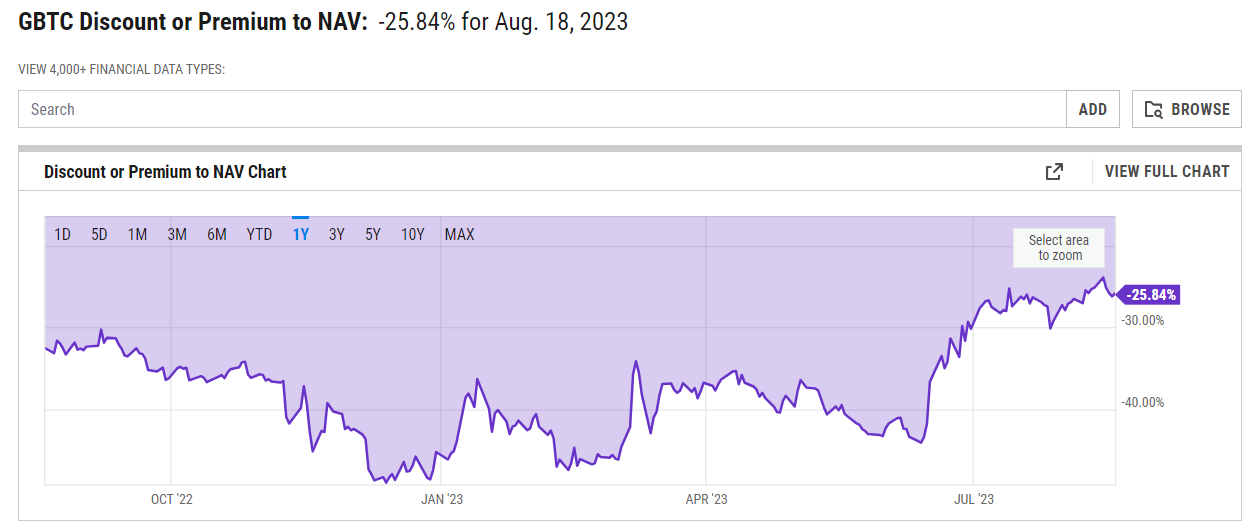

A new decision is expected tomorrow in the BTC case, but Grayscale is not only fighting the SEC. The trillion-dollar crypto asset management company, Grayscale, has been held responsible for the negative premium on its funds for some time. Negative premium refers to when an asset is traded below its expected value.

Latest News on Grayscale

The insolvency committee of FTX exchange has just invited its shareholders to join the Grayscale lawsuit. ETFs and Trusts have different mechanisms. Unlike ETFs, Trust-style investment funds do not have a redemption option. The absence of redemption causes the trusts to trade below their expected value when demand for the underlying asset decreases. For example, if you buy a GBTC share worth $1, you should have invested in BTC worth $1. However, in a bear market, you would invest in BTC worth $1.25 due to lower demand. This forces sellers to sell their $1 shares for $0.75 due to the negative premium.

The announcement states:

“According to Grayscale, this effort cannot continue unless current shareholders who collectively hold at least 10% of all shares in the Trusts come together as co-plaintiffs in a single lawsuit. Trust shareholders are encouraged to provide their information to participate as co-plaintiffs by using the designated website at GrayscaleLitigation until September 1, 2023. Balch & Bingham LLP is ready to represent eligible shareholders at no cost.”

FTX and Grayscale

The FTX announcement included details about the ongoing war with Grayscale:

“For years, Grayscale has deprived shareholders of billions of dollars by violating Trust agreements, charging exorbitant management fees, and preventing shareholders from redeeming their shares. We are pleased with the support we have received from other Trust shareholders who want to join Alameda in the fight against Grayscale’s terrible violations. Trust shareholders are determined to recover the lost value and demand justice for Grayscale’s continuous failure to protect shareholders’ interests. We call on others to sign and join to ensure the progress of our case. Since Alameda filed the first lawsuit in March 2023, GBTC Rescue Campaign and many other Trust shareholders have shown great support. In addition to UTXO Management, numerous funds, family offices, and individual shareholders have expressed their desire to join Alameda’s case as co-plaintiffs.”

The Grayscale team wants to convert GBTC into an ETF to eliminate the legal risks brought by these lawsuits. Grayscale is also a subsidiary of the billion-dollar DCG and needs one of two things to survive. Either the Bitcoin price quickly surpasses $50,000 and the negative premium disappears, or GBTC becomes an ETF, gaining redemption capability and escaping the negative premium.

Türkçe

Türkçe Español

Español