Bitcoin and altcoin market volatility increased with the first net outflows from spot BTC ETFs since their launch. In the last 24 hours, the price of Bitcoin fell to $50,649. This development, which weakened investors’ appetite for risk, did not surprise analysts expecting a price correction. Meanwhile, Grayscale is back in the spotlight.

Why Did ZEC Coin Rise?

DCG, the largest umbrella company in the cryptocurrency markets, has mobilized Grayscale for a new privacy-focused ETF. Although the Bitcoin price fell with the first net outflows from spot ETFs after their launch, ZEC Coin began to rise following the major announcement. The application to the SEC is based on five fundamental sectors, including blockchain and artificial intelligence.

The sectors that the ETF will track range from data protection and privacy services to cybersecurity. The following details are included in the application made by Grayscale;

“The index aims to passively capture investment exposure to privacy and security-focused digital assets through ZCSH, a public and SEC reporting vehicle that invests solely and passively in Zcash, allocating a 10% share to the Privacy Protection Protocol sub-theme.”

Zcash conceals the identities of senders and recipients as well as the transaction amount. The token, commonly used by those who value anonymity, surged by 20% today.

ZEC Coin Commentary

Grayscale, which manages $27 billion in cryptocurrency assets, is already the largest crypto fund issuer. While countries like Dubai, Japan, South Korea, and Australia ban privacy coins, the fate of this ETF is a matter of curiosity. However, the price increase following the application indicates that there are more investors buying into the expectation than previously thought.

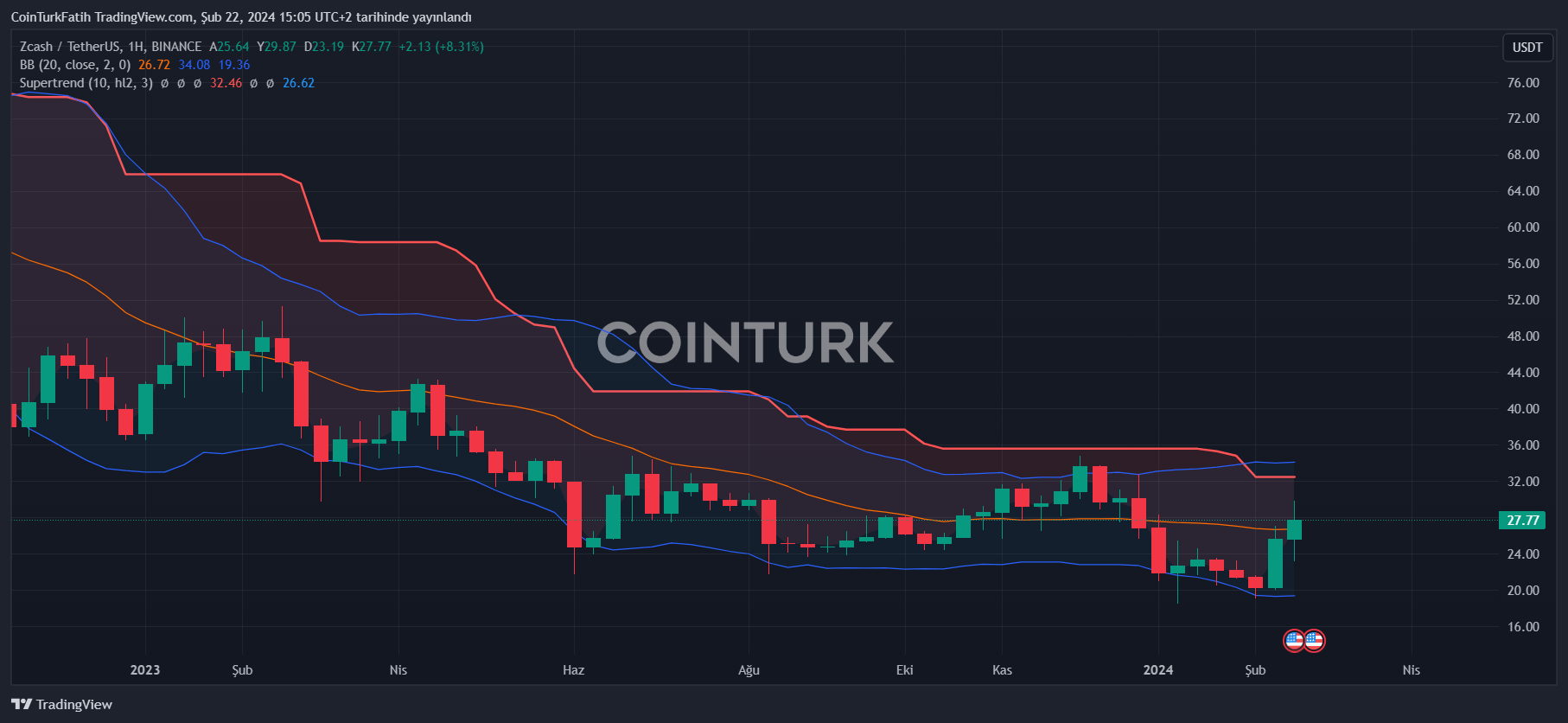

In the weekly chart, $28.3 is a key area, and if ZEC Coin can close above this, it may return to the $30 threshold. In the medium term, the resistances at $32.8 and $34.84 remain relevant. On the other hand, if the price surpasses the $44 threshold, the belief that the downtrend has ended and a parabolic rally has begun will strengthen. In a bullish scenario, new peaks could come in the range of $84 to $171.

The risk of a global ban on privacy-focused altcoins continues to be the biggest concern for now.

Türkçe

Türkçe Español

Español