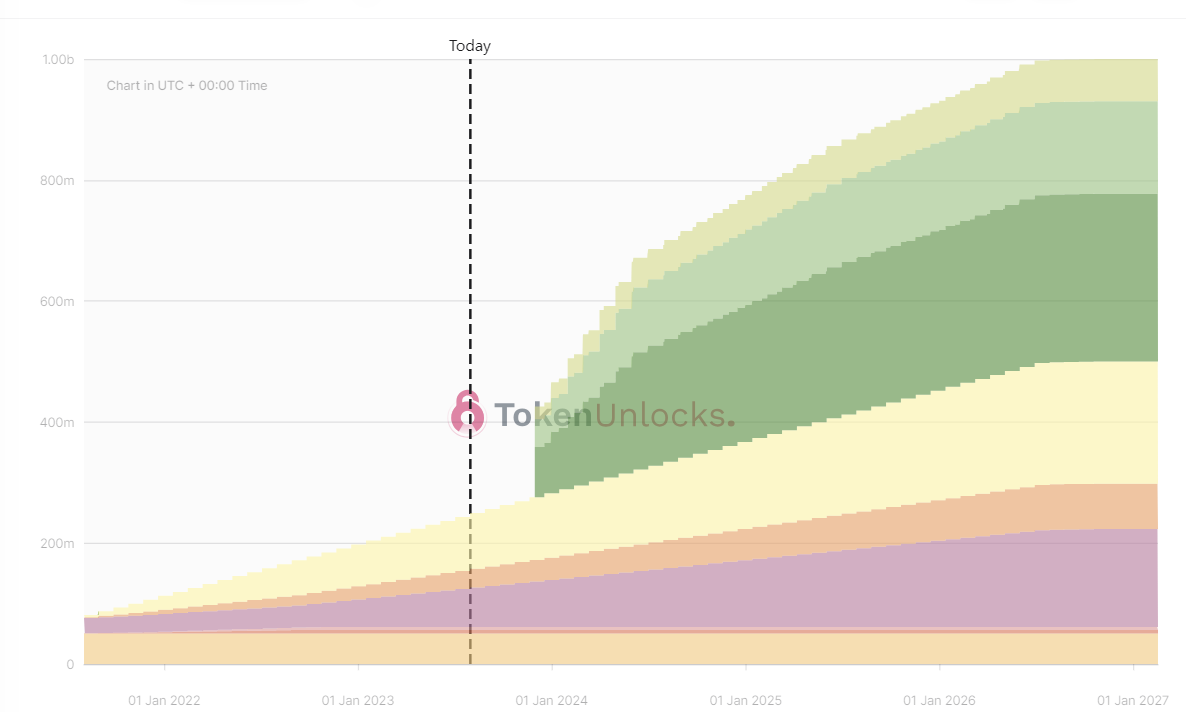

When it was released in 2021, there was very little DYDX token in circulation and its price was above $20. However, with the rapid increase in supply, long-term investors who bought in those days started to get worried. They noticed that the price was consistently dropping with each unlocking.

DYDX Supply Could Decrease

For investors, especially those involved in futures trading, the largest decentralized exchange (DEX) DYDX could take a big step. The DYDX community has proposed a governance proposal that could save the company $1 million per month and slow down the issuance of DYDX tokens. According to this proposal, the size of the reward given to liquidity providers will be reduced, while the value per token will be maintained.

If accepted, the governance proposal will reduce the amount of DYDX tokens given to liquidity providers per epoch to 575,342, which represents a 50% decrease equivalent to approximately $1 million at current prices. Antonio Juliano, the founder of dYdX, stated on Twitter that the total DYDX token emissions will be reduced by roughly 25%.

Will DYDX Price Increase?

Theoretically, a decrease in issuance can have a clear positive effect on the price of DYDX, based on the fundamental laws of economics (limiting supply can increase prices). According to a forum discussion on the proposal published by Max Holloway, the CEO of blockchain research and development firm Xenophon Labs, this change would be “generally positive for the community.” If unlocking events decrease, this will result in less selling pressure.

A 25% decrease in token issuance could mean a rapid increase in price by the same proportion. If the proposal is approved tomorrow, we might see a rapid increase in the price of DYDX. The popular DeFi altcoin has already started to price this in and continues the day with a 4% increase.

Investors need to carefully examine the roadmap for token issuance, especially in new projects. Many investors who did not pay attention to this aspect bought DYDX at $27 when only a small portion of the maximum supply was in circulation. Currently, over 15% of the supply is circulating, while there are still 850 billion tokens that could enter circulation. This means that if demand does not increase, the price could potentially drop by around 85%.

Very nice project

How will I work here?

Give me a video of it