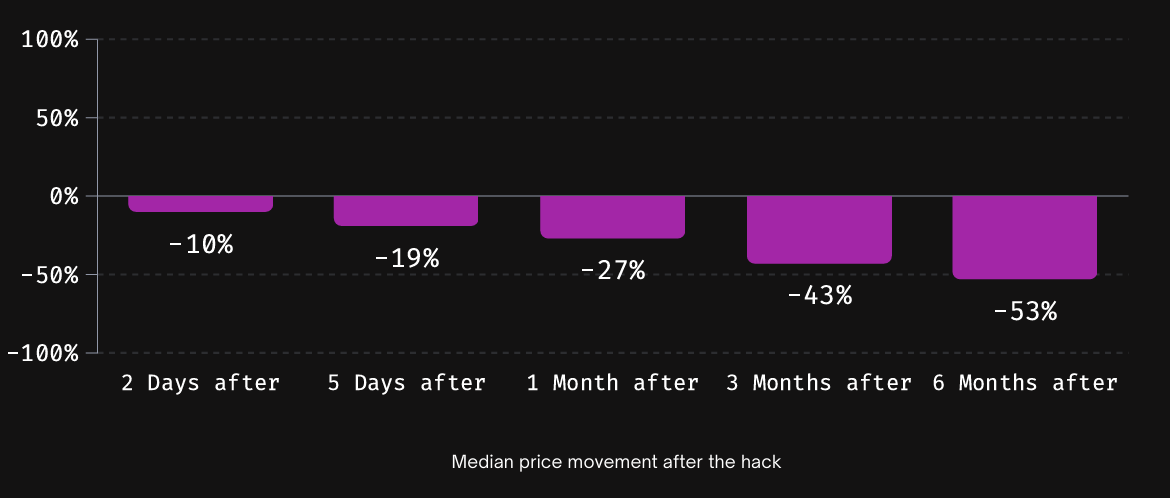

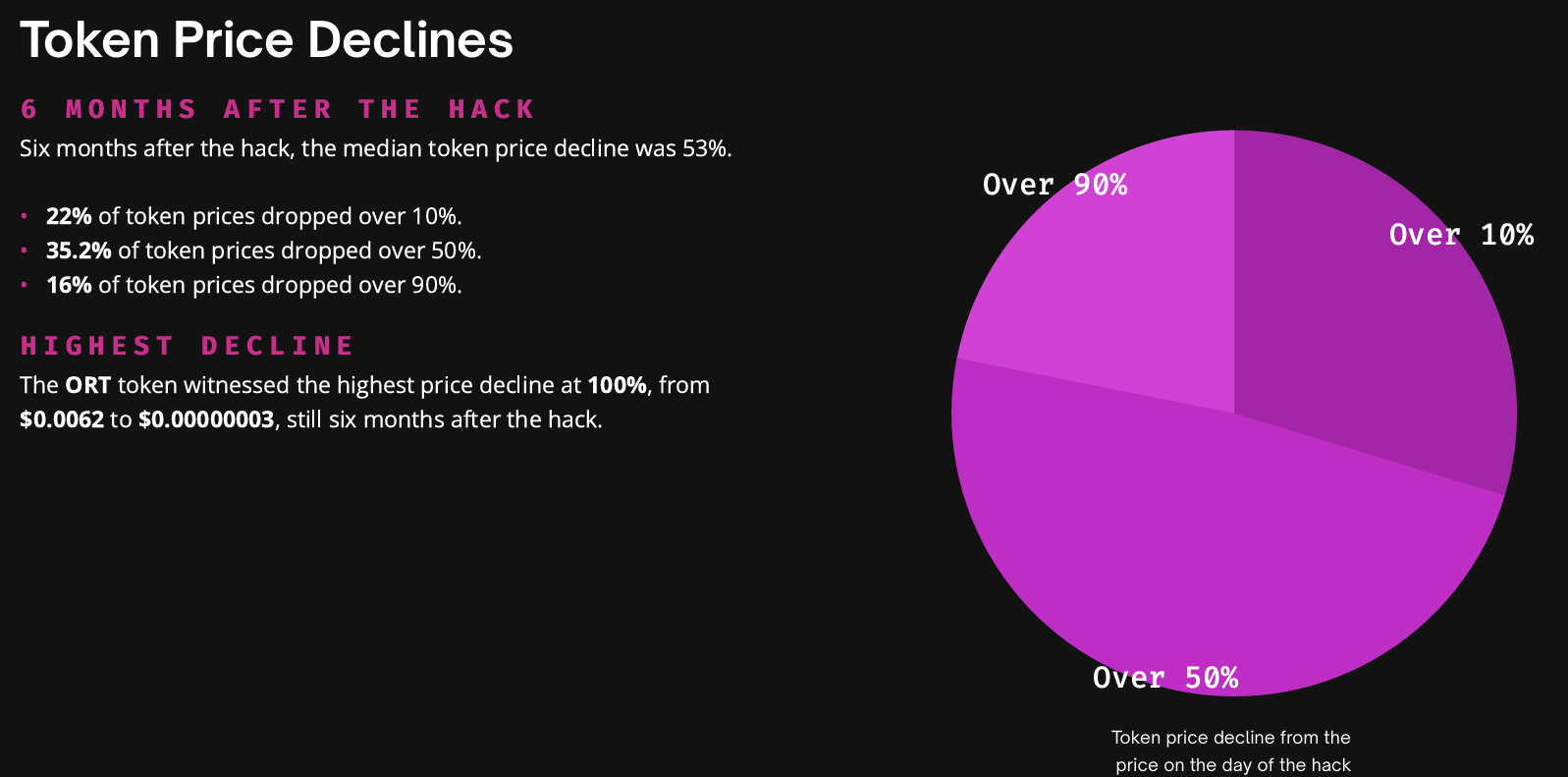

According to an on-chain security report, most hacked cryptocurrencies do not recover in terms of pricing from these attacks. More than 77.8% of hacked cryptocurrencies experienced continuous negative price effects six months after the hack. An Immunefi report states that 51.1% of hacked tokens saw a price drop of more than 50% six months after the protocol was hacked.

Cryptocurrency Sector and Hack Attacks

Immunefi’s founder and CEO Mitchell Amador states that hacked protocols sustain most of the damage after the hack. He said:

“The millions lost in hacks immediately foresee greater losses caused by months of rebuilding your emotionally shattered team and operations due to market and dependency effects.”

The report came about a month after a hacker stole over $230 million from the Indian cryptocurrency exchange WazirX in the second-largest crypto hack of 2024 so far. In the past, decentralized finance (DeFi) applications were mostly responsible for crypto asset attacks. However, according to Amador, centralized finance (CeFi) infrastructure has become the biggest security vulnerability for the crypto space, accounting for most of the losses in 2024. Amador said:

“Infrastructure breaches tend to be the most devastating attacks in the crypto world. For example, a leaked private key will lead to the theft of all funds under its control.”

Of the $1.19 billion worth of crypto assets stolen in 2024 so far, $636 million were attributed to CeFi security vulnerabilities.

Details on the Issue

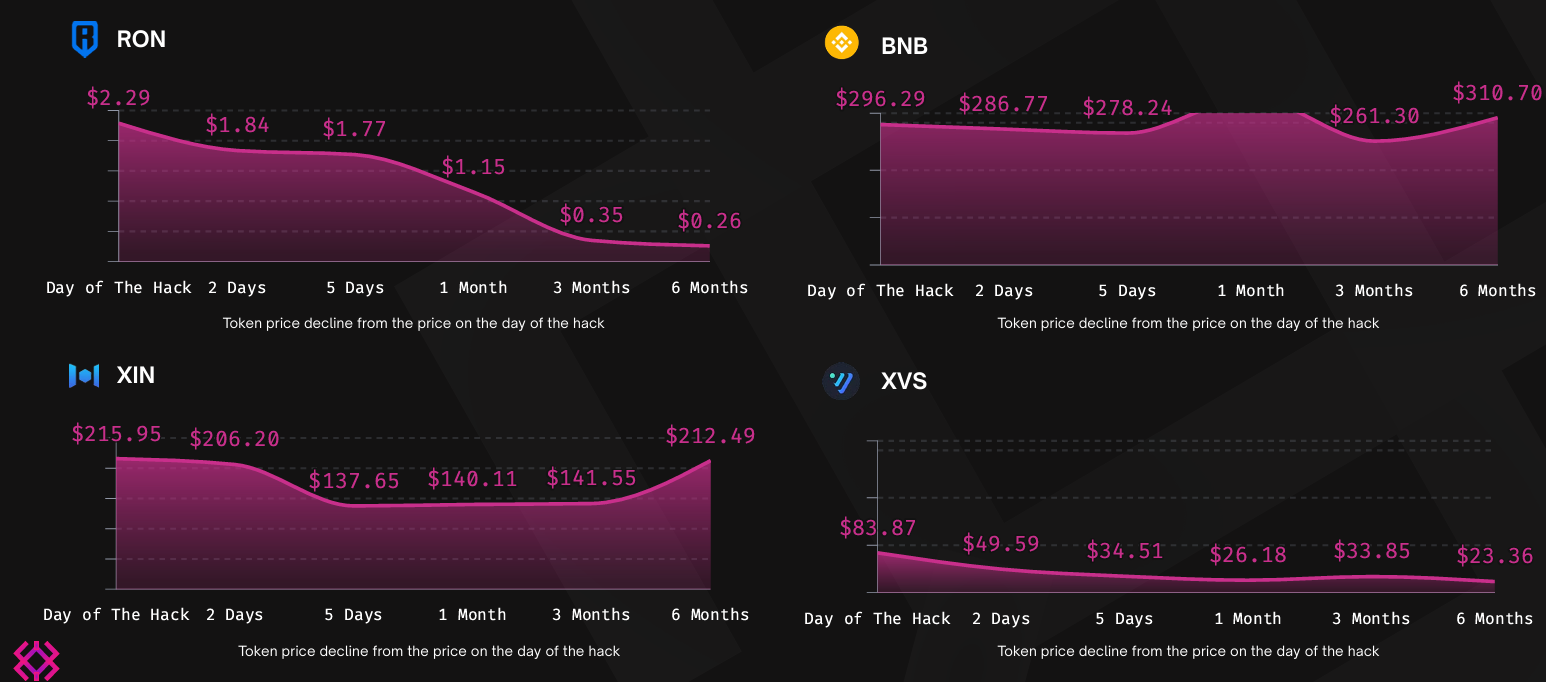

Some cryptocurrencies perform better after a hack attack. According to Amador, historically, tokens belonging to larger projects with more established teams are more resilient to attacks:

“Recovered tokens include projects like BNB Chain, SushiSwap, THORChain, Olympus, and Optimism. All these projects are either large ecosystems like BNB Chain or Optimism, or long-standing protocols with dedicated communities like SushiSwap.”

The main reason is the larger ecosystems behind these tokens, which apply more purchasing power after a hack event. Crypto attacks remain one of the biggest barriers to the mass adoption of cryptocurrencies, as the amount of stolen funds in 2024 could surpass the previous year. By February 29, over $200 million had been lost due to attacks since the beginning of the year, reflecting an increase of more than 15% compared to the same period in 2023, when $173 million worth of crypto assets were stolen.