Ethereum ETF funds have recorded the longest outflow period since their launch. Scammers stole $700,000 after hacking McDonald’s official Instagram account to promote a memecoin project called Grimace. Meanwhile, BlackRock’s iShares Ethereum Trust is rapidly approaching $1 billion in net inflows. Here are three significant developments that marked the last 24 hours.

What Is Happening with Ethereum ETF Funds?

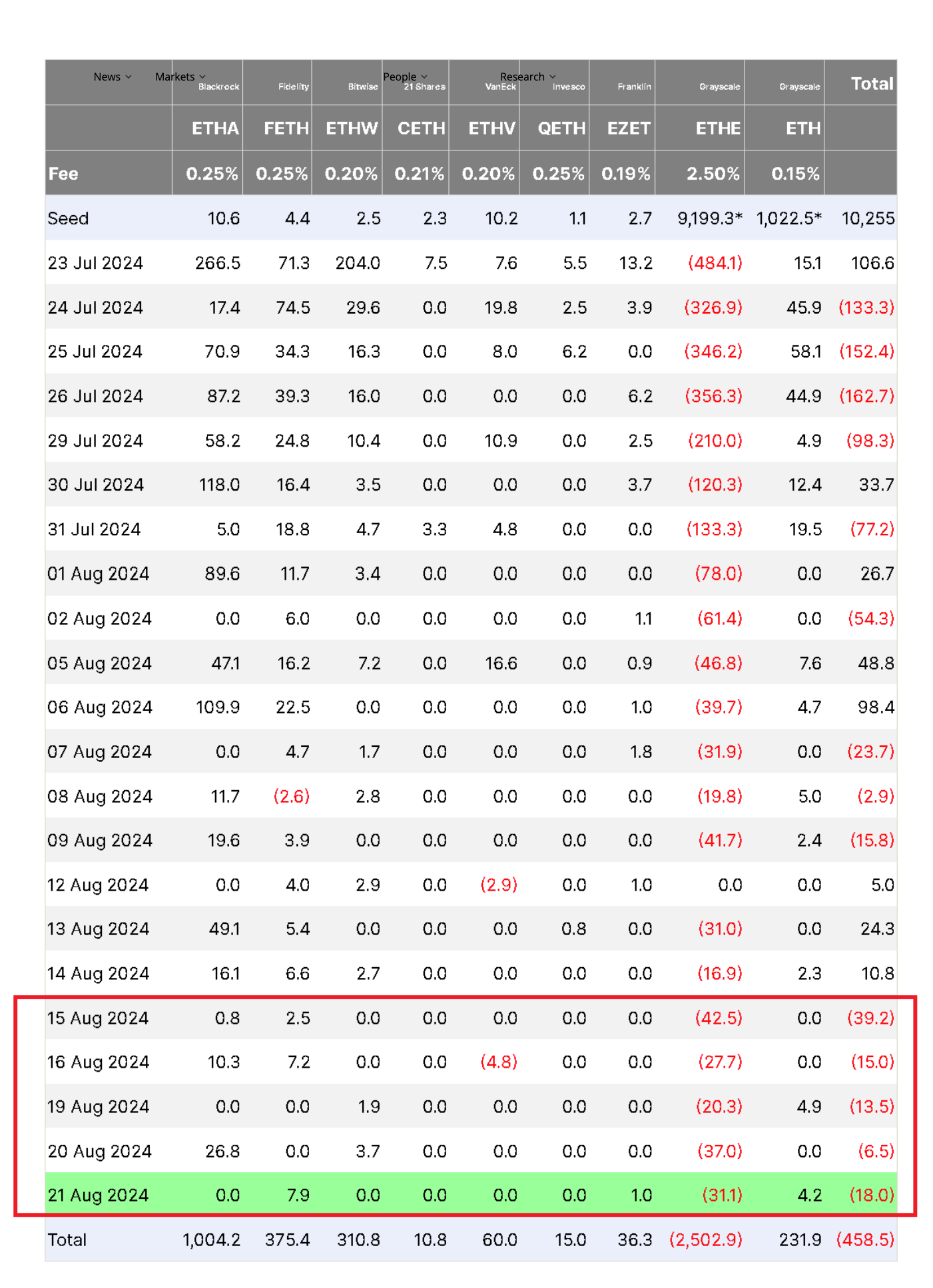

US-based spot Ethereum exchange-traded funds have recorded the longest continuous outflow period of five consecutive days since their launch on July 23. The investments made by the recently approved nine spot Ethereum ETFs have been overshadowed by outflows from the Grayscale Ethereum Trust (ETHE), which exceeded $2.5 billion as of August 21.

Farside Investors data shows that the outflows from ETHE were daily, but the Grayscale fund did not report net inflows on August 12. As shown below, spot Ethereum ETFs experienced the longest outflow streak, losing $92.2 million over five days from August 15-21.

McDonald’s Instagram Account Hacked

On August 21, scammers hacked the official McDonald’s Instagram page and used the fast food giant’s social media page to promote and spread a memecoin called Grimace, stealing over $700,000 in Solana. According to screenshots shared on X, McDonald’s Instagram page made a series of posts promoting a fake token based on the fast food chain’s purple mascot Grimace, claiming the memecoin was an experiment by McDonald’s on Solana.

Hackers used the Solana memecoin platform Pump Fun to seize 75% of the total circulating supply of the Grimace token and then distributed it across approximately 100 different wallets. Blockchain data analysis platform Bubblemaps stated that the attackers made an illicit gain of about $700,000 in Solana (SOL). The value of the fake GRIMACE memecoin surged from a few thousand dollars to $25 million within 30 minutes before plummeting to $650,000 after the hackers began selling their tokens.

What Is Happening in the ETF Sector?

BlackRock’s iShares Ethereum Trust (ETHA) is rapidly approaching the $1 billion net inflow mark while continuing to dominate the spot cryptocurrency exchange-traded funds market. According to Morningstar, ETHA has accumulated approximately $992 million in net inflows and is on track to surpass $1 billion soon. Bryan Armour, director of passive strategies research at Morningstar, stated that this milestone could be reached by the end of trading on August 21:

“Two things affect net assets: net flows and performance. Weak performance kept net assets much lower than total net flows into the fund.”

Although Ethereum’s price has struggled to gain momentum since the ETFs were launched, fund issuers say institutional investors have shown significant interest in Ethereum. Kyle DaCruz, director of crypto asset products at VanEck, said that evaluating and explaining Ethereum to their clients is easier. Bitcoin’s spot ETF funds were launched with much controversy in January.

Türkçe

Türkçe Español

Español