High-capital investors have been accumulating Bitcoin (BTC) since the beginning of the year, pushing the token’s price to all-time high levels. These investment activities can be observed through Bitcoin wallet addresses holding large amounts of cryptocurrency, also known as whales.

Whale Activity in Bitcoin

Specifically, a Bitcoin whale has accumulated approximately $90 million worth of 1,308 BTC since March 6. According to a post by Lookonchain, the address ‘bc1qag725vjxxpkkl5gshfkye9xn4p5vklrlhgkw5w’ currently holds this amount at an average cost of $68,617 per token.

Additionally, the most recent purchase on April 7 was for 113.735 BTC, valued at over $7.85 million, withdrawn from Binance. This transaction was the second largest during the whale’s accumulation this month. The largest single purchase was on April 3, with 123.128 BTC valued at over $8 million. Moreover, analytics firms have reported numerous bullish signals for Bitcoin whales and investors throughout the week.

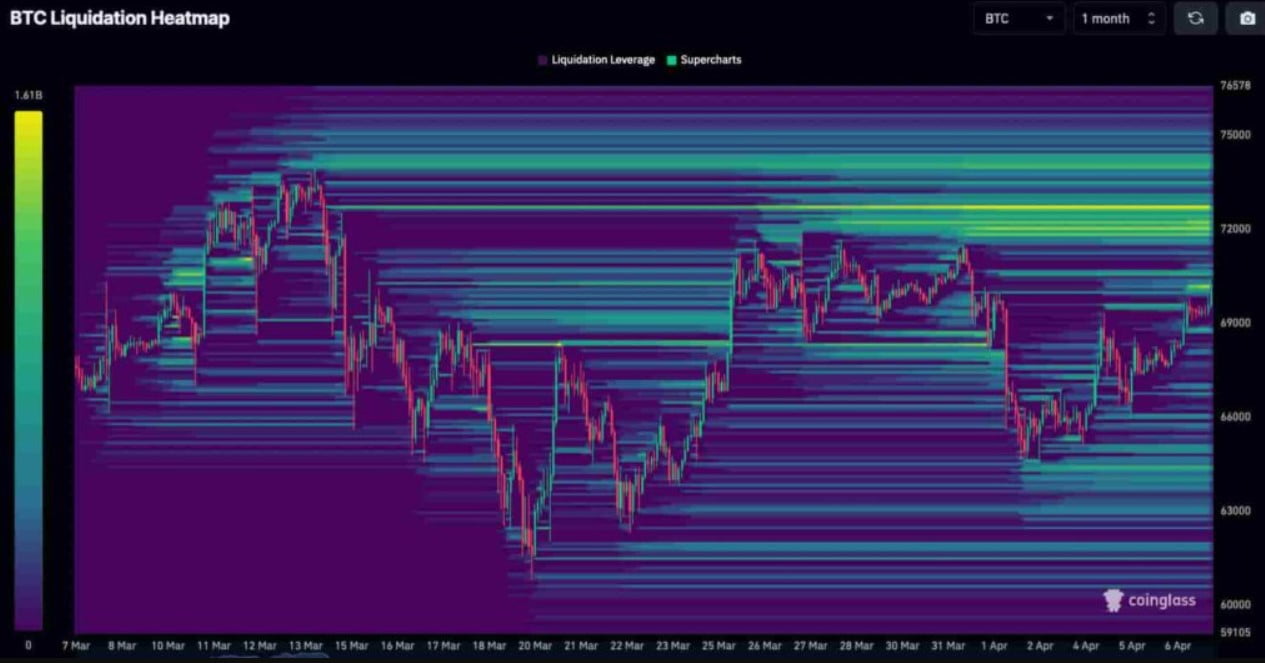

Coinglass Data on Bitcoin

Data from the cryptocurrency analytics firm CoinGlass indicates a potential short squeeze for BTC above $72,000. This is due to a large amount of leveraged liquidations accumulated in this region, and Bitcoin whales could become targets for increased profits in a potential breakout surge.

Despite all the positive whale activity and technical bullish signals, the Bitcoin community faces fundamental uncertainties. However, the expected Bitcoin halving on April 20 could shift investor focus to bullish economic fundamentals. Considering all these factors, Bitcoin’s future price movement remains uncertain but may generally support an upward trend. Experts advise that investors should exercise due diligence and understand the underlying risks and opportunities of investing in BTC. As a result, high-capital investors are driving up the price by accumulating Bitcoin. Whales are particularly noticeable with significant transactions, and analytics firms suggest that despite uncertainties, Bitcoin’s price may generally tend to rise.

Türkçe

Türkçe Español

Español