The Securities and Futures Commission (SFC) of Hong Kong has granted a principle approval to the Hong Kong Virtual Asset Exchange (HKVAX) to operate as a virtual asset trading platform under the region’s securities laws. The principle approval consists of two different types of licenses for individual and institutional investors. Hong Kong, which has been emphasizing crypto regulations following FTX’s bankruptcy, continues to take significant steps in this regard.

Approval for Two Separate Licenses

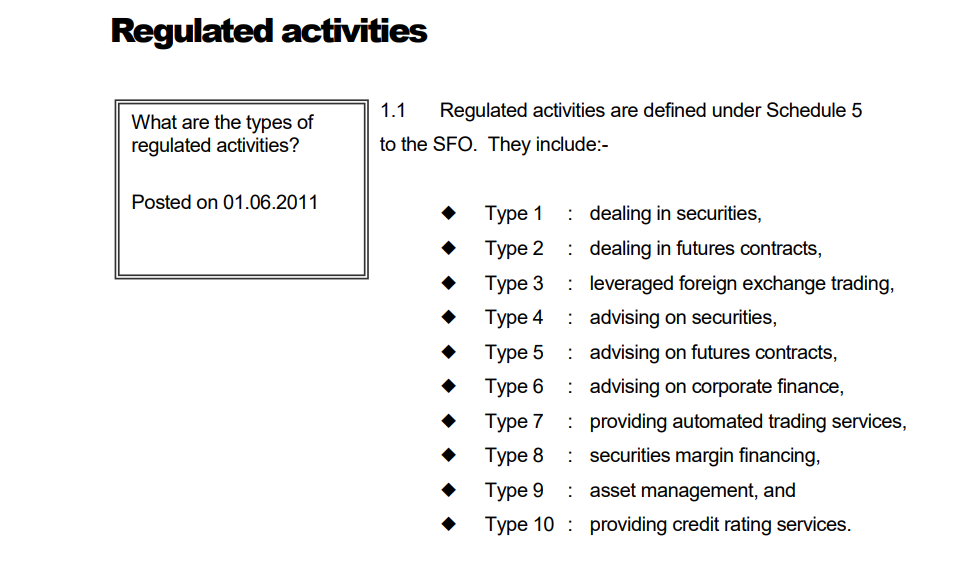

On August 11, HKVAX announced that it had received a “principle approval” from the SFC to conduct regulated activities. The announcement highlighted that the Type 1 license allows the platform to operate as a digital asset trading platform dealing with securities, while the Type 7 license officially permits the company to provide trading services to retail users and institutional investors.

According to the announcement, HKVAX aims to offer a product category called security token offerings to take advantage of Web3 investment opportunities. After obtaining final approval, the exchange stated that it will provide an intermediary service that allows users to trade between fiat and digital assets, as well as a professional-grade exchange platform and insured custody solution.

Anthony Ng, the co-founder and CEO of HKVAX, stated in the announcement that as the exchange grows, it will continue to expand its product offerings in Hong Kong and work with strategic investors for future funding rounds.

Attention to Regulatory Measures

HKVAX’s announcement comes after Hong Kong’s HashKey and OSL exchanges started crypto asset trading. Both firms became the first to obtain the necessary licenses to offer crypto trading services in Hong Kong on August 3.

Hong Kong regulators have recently focused on regulating crypto since the collapse of FTX. On June 24, SFC CEO Julia Leung Fung-yee stated that crypto trading has become a significant part of the virtual asset ecosystem since the collapse of the FTX exchange in 2022. Leung said in a speech that the new licensing system for virtual asset service providers will ensure investor protection while trading.