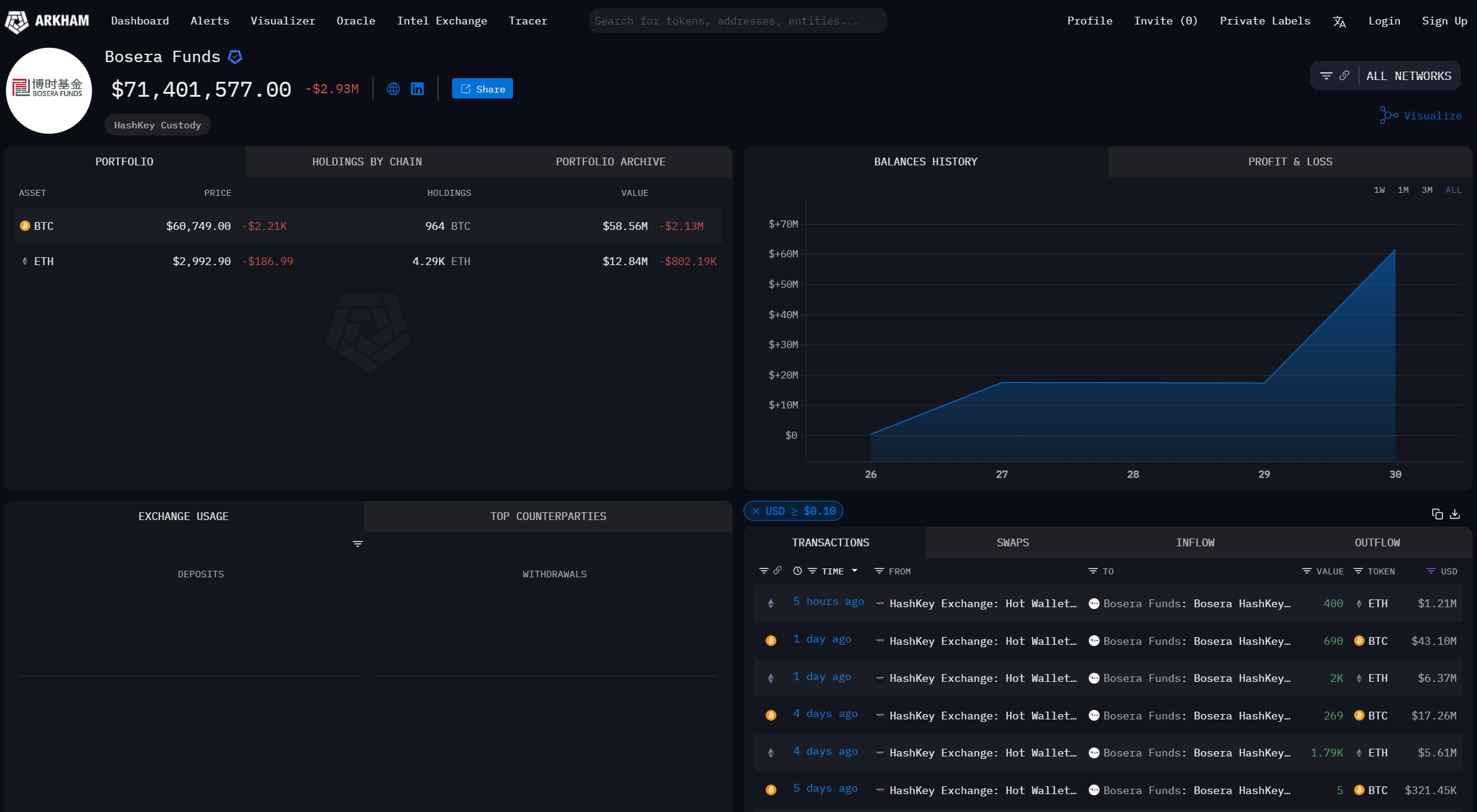

Hong Kong spot Bitcoin and Ethereum exchange-traded funds (ETFs), launched on April 30, successfully attracted over $200 million in funds. According to data provided by Arkham Intelligence, Bosera HashKey spot Bitcoin and Ethereum ETF funds have accumulated 964 Bitcoins and 4,290 Ethereums, reaching a total asset under management of $71.94 million.

Excitement Over ETFs in Hong Kong

During this period, Bloomberg’s senior ETF analyst Eric Balchunas revealed that the spot Bitcoin and Ethereum ETF funds created by ChinaAMC gathered assets worth a total of $123.61 million. The Hong Kong Stock Exchange has not updated asset management data for the third ETF issuer, Harvest Global’s spot Bitcoin and Ethereum ETF funds, but these two ETF funds have reached a total turnover of $23 million.

The value of the requested assets remains modest compared to their U.S. counterparts, where spot Bitcoin ETF funds drew about $4 billion in assets under management in their first week of launch, and $4.5 billion in volume on just the first day of trading, January 12. Balchunas commented on the issue:

“We’ve been trying to temper everyone’s expectations about Hong Kong. However, if you localize the numbers, this was a big deal; for instance, the ChinaAMC Bitcoin ETF fund gained $123 million on its first day, placing it sixth among the 82 ETFs launched in Hong Kong over the last three years and in the top 20% overall.”

Additionally, Hong Kong’s crypto ETF funds allow investors to invest directly using Bitcoin and Ethereum, a feature not yet available in their U.S. counterparts.

Hong Kong and the Crypto Market

Hong Kong regulated crypto exchange OSL conducted a survey on April 28, revealing that 76.9% of participants with knowledge of crypto in the city plan to invest in the new spot Bitcoin and Ethereum ETF funds. Gary Tiu, OSL’s general manager and head of regulatory affairs, shared his thoughts on the matter:

“This positive investor sentiment strongly indicates the growing acceptance and importance of crypto assets in the regional economy, and Hong Kong is once again positioning itself as a crypto asset hub.”

Despite this enthusiasm, Hong Kong’s crypto ETF funds are currently only accessible to the city’s estimated 6.4 million residents. Chinese investors, numbering over a billion, are currently barred from accessing the new ETF funds unless they have a Hong Kong residence permit.