Commodity Futures Trading Commission (CFTC) Member Kristin Johnson recently presented three proposals concerning the regulation of artificial intelligence (AI) technologies applied in the US financial markets. During the Technology Advisory Committee (TAC) meeting held on May 2nd, Johnson outlined a tripartite agenda for the CFTC to assess risks and increased penalties associated with the integration of AI into financial markets.

US and the Field of Artificial Intelligence

The intentional misuse of AI and its growing integration into financial markets were discussed, along with the creation of a task force to evaluate, oversee, and harmonize guidance, supervision, and regulations.

While calls for government investigation task forces and common-sense risk assessment platforms are not new, Johnson’s claim that high penalties should be imposed for crimes committed using AI would bring significant changes to the existing legal framework. Referring to a previous speech by Deputy Attorney General Lisa Monaco, Johnson stated:

“Guns increase danger, hence when used to commit crimes, penalties are heavier. Similarly, AI can also increase the danger of crime.”

According to Johnson, the emergence of AI technologies and their potential for misuse should be similarly addressed:

“To address these concerns, the Commission should impose higher penalties on those who intentionally use AI technologies for fraud, market manipulation, or to violate our regulations. Bad actors intending to use AI to breach our rules should be warned and sufficiently deterred from using AI as a weapon to disrupt or compromise the operations or integrity of our markets.”

Details on the Process

The Commissioner’s speech followed shortly after the appointment of Ted Kaouk as the first AI Director of the CFTC. Kaouk’s previous role at the CFTC was as Chief Data Officer and Director of the Data Division.

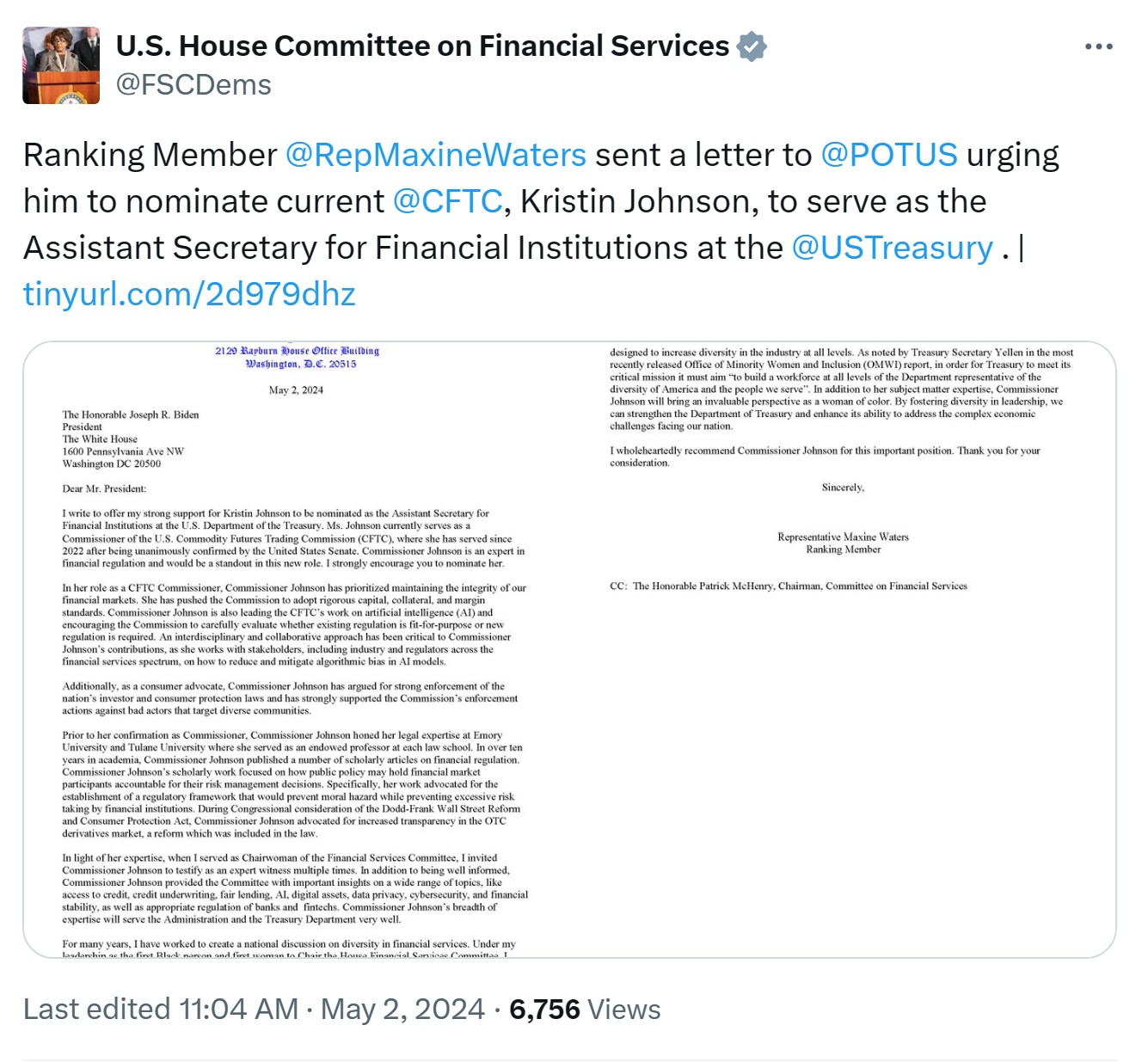

Meanwhile, senior member of the Financial Services Committee, Congresswoman Maxine Waters, recently wrote a letter to US President Joe Biden recommending Johnson for the position of Assistant Secretary for Financial Institutions at the US Treasury Department. If nominated and confirmed, Johnson will play a key role in shaping legislation and policies related to the US financial market.

Türkçe

Türkçe Español

Español