Crypto currency market is on the rise today, and the total market value has increased by 2.80% in the last 24 hours, reaching $2.18 trillion on May 3. This includes gains from Bitcoin and Ethereum, which rose about 2.52% and 1.40% respectively during the same period. Key factors driving the crypto market upwards today include the Federal Reserve’s less hawkish tone and PayPal’s expansion into the crypto sector through a new partnership.

Fed and the Crypto Market

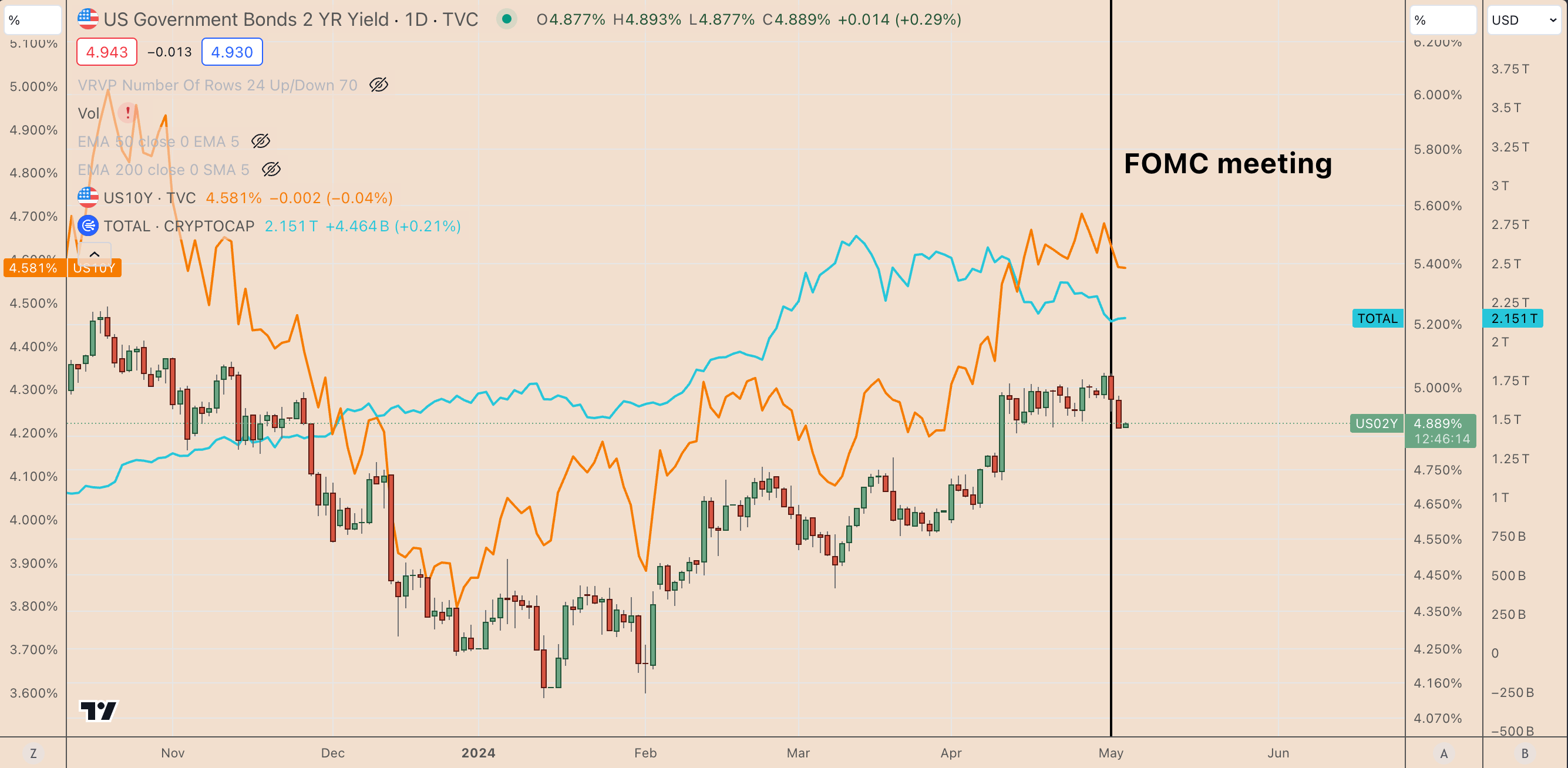

The Fed announced at the end of the Federal Open Market Committee (FOMC) meeting on May 1 that it will not raise interest rates in the near future. As a result, bond investors now see the first rate cut in November rather than July at the beginning of 2024. This adjustment occurred during the strongest two-day rise in short-term Treasury bills since January. The yield on two-year bonds, which are highly sensitive to interest rate changes, fell 331 basis points from the weekly peak on May 1 to 4.88%.

At the same time, the crypto market has recovered by 7% since May 1, including today’s gains. This indicates a revival in risk-taking among cryptocurrency investors, further encouraged by the falling yields of the benchmark US 10-year Treasury bonds.

What’s Happening in the Crypto Market?

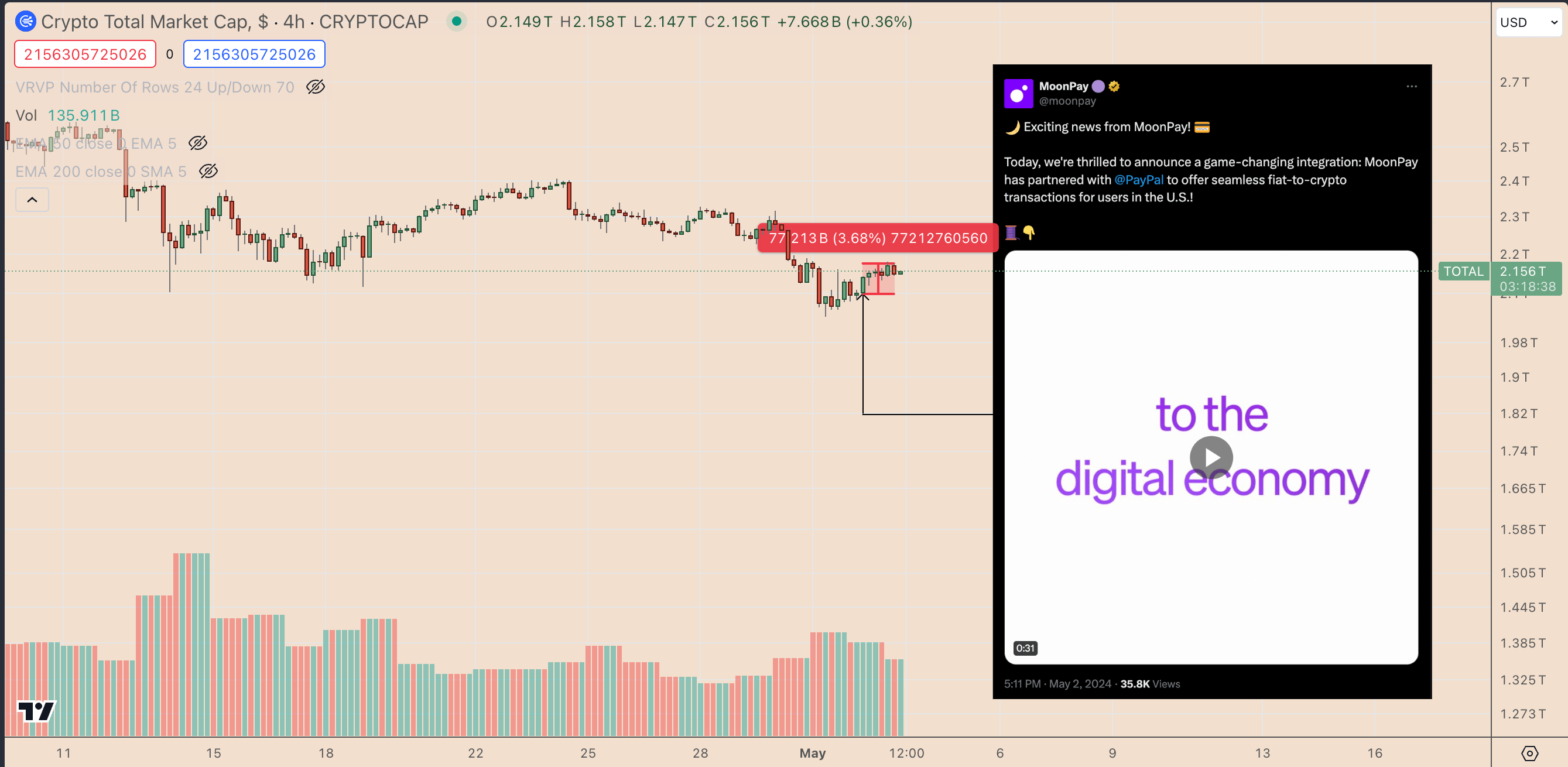

The recovery in the crypto market coincides with the news of payment giant PayPal’s partnership with the crypto application MoonPay, which will allow its 426 million US customers to trade in over 110 cryptocurrencies. When a major financial player like PayPal enhances its crypto services, it can validate the legitimacy of the market in the eyes of investors and the general public. As a result, investors anticipate an increase in demand and adoption, contributing to today’s gains in the crypto market.

Previously, PayPal offered options for Bitcoin, Ethereum, and its own US dollar-pegged stablecoin PYUSD. The company recently announced that PYUSD is now suitable for international transfers via its Xoom service.

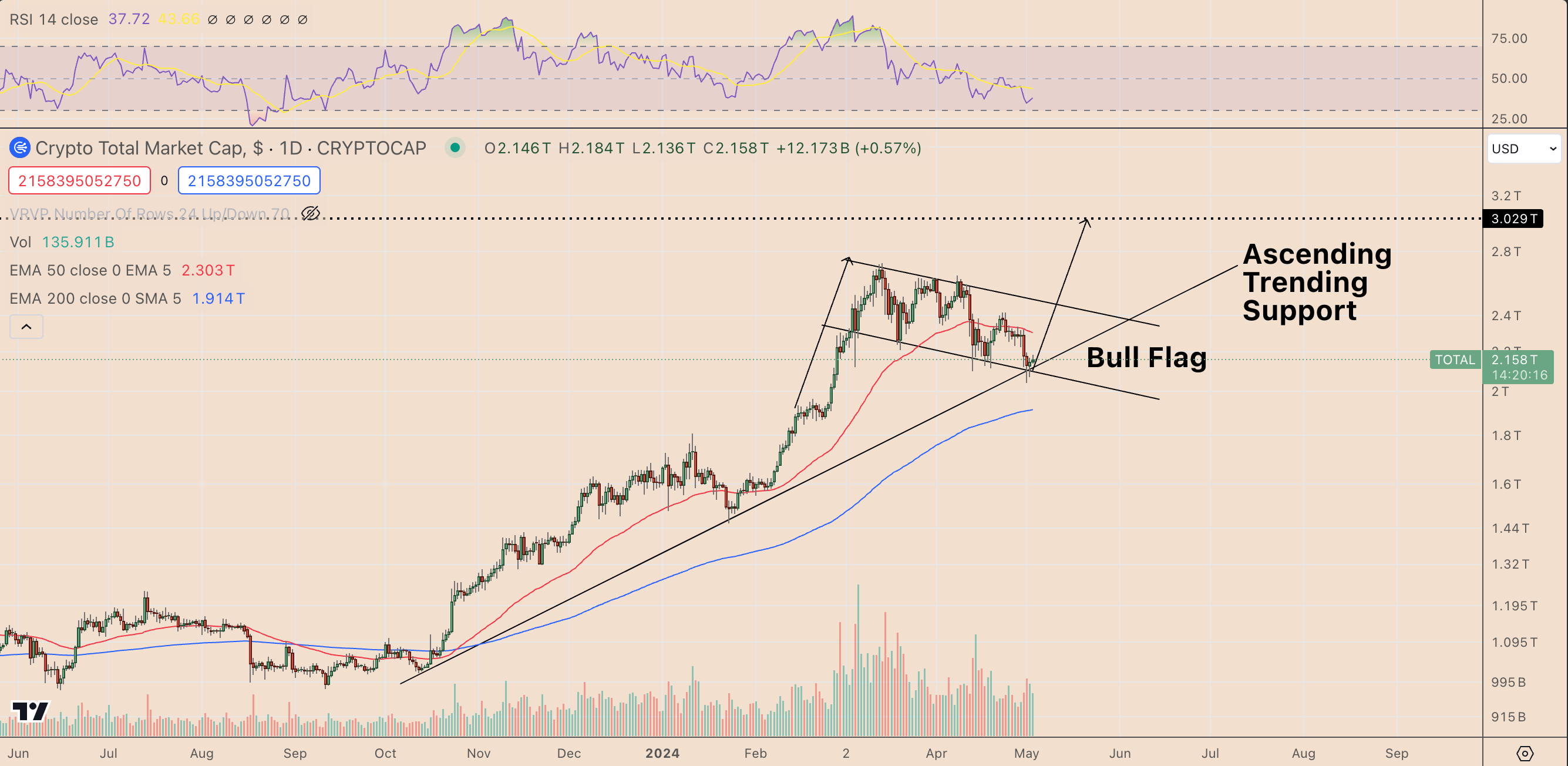

Today’s gains in the crypto market emerge as various indicators suggest the market is on an upward trend. For example, the graph below shows the market value recovering from a sub-trend line that looks like a bull flag. This continuation pattern ends when the price rises above the upper trend line and reaches the height of the previous upward trend.

As a result of this technical rule, the next upward target for the crypto market is around $3 trillion. In addition to the bullish outlook, the recovery’s proximity to the market’s several-month-long rising trend line support also shows that the long-term upward trend remains unbroken.