Bitcoin price dropped yesterday as the US economy grew 50% less than expected in the first quarter. This is interesting because although the slowdown in growth rate is relatively beneficial for risk markets, the current situation seems to trap the Fed as the economy weakens while inflation does not decrease.

US Data and Crypto

Crypto markets experienced a decline yesterday, but after the market closed, positive earnings reports from Intel, Microsoft, and Alphabet are expected to lead to a positive opening in the stock markets. The PCE data, which has not yet been announced at the time of writing, is also crucial here. This data, which the Fed monitors as an inflation indicator, will allow us to understand the current state of inflation. If the figure exceeds expectations, the situation could become more complicated. However, if it falls below expectations, this will be positive for risk markets and could shape an environment where the Fed can reduce rates without further damaging the economy.

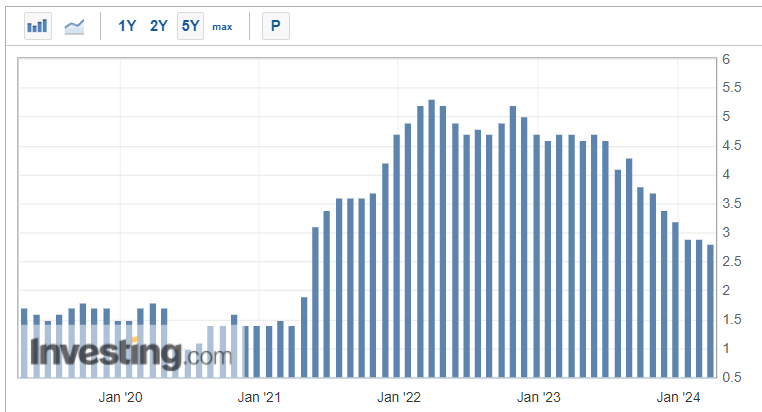

Expectations and announced data for PCE, which has been declining since the end of August last year, are as follows;

- US Core PCE Announced: 2.8% (Expectation: 2.7% Previous: 2.8%)

- US PCE Announced: 2.7% (Expectation: 2.6% Previous: 2.5%)

The data came in above expectations and was unfavorable for cryptocurrencies.

Türkçe

Türkçe Español

Español