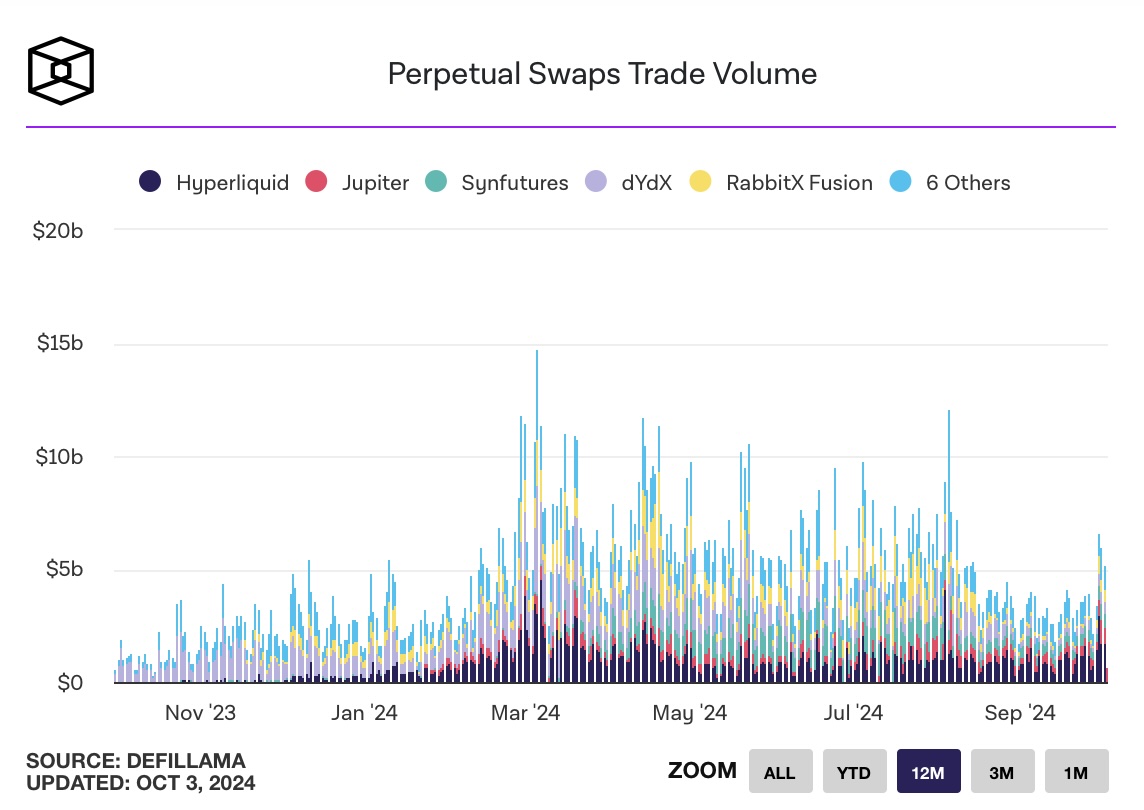

Recently, Hyperliquid has seen a significant rise among decentralized perpetual swap platforms, surpassing its competitors in trading volume. This platform has reportedly secured the top position in daily trading volume, recording 1.39 billion dollars. According to data from DeFiLlama, it outperformed competitors such as Jupiter, which reported 699 million dollars, SynFutures with 556 million dollars, and dYdX with 331 million dollars.

Hyperliquid’s Remarkable Surge

Hyperliquid is defined as a decentralized platform that allows users to conduct continuous derivatives trading by aggregating liquidity from various sources. The platform also facilitates leveraged cryptocurrency trading, enabling users to borrow funds to increase their purchasing power. Operating as a Layer 1-based application, Hyperliquid uses mainnet assets like Purr and Points.

In recent months, Hyperliquid’s average daily trading volume has exceeded 1 billion dollars, making it stand out among decentralized trading platforms.

Additionally, Hyperliquid operates as a protocol that does not provide custody services, allowing users to access their funds through their cryptocurrency wallets at all times.

Low Latency Trading Engine

Another reason for Hyperliquid’s rapid rise is its specially developed low-latency trading engine. This technology enables high-frequency trades to be executed quickly on the platform. Orders are processed rapidly on the Hyperliquid Chain, which is a significant advantage for active traders.

Perpetual swaps, often referred to as “perps,” are derivative products similar to futures but do not have a specific expiration date. Traders can maintain their positions indefinitely as long as they provide sufficient collateral. Initially developed in centralized exchanges like BitMex in 2016, these products have rapidly gained popularity on decentralized platforms in recent years.