The U.S. Department of Justice is preparing to sell 69,000 Bitcoin (BTC)  $121,837, with an anticipated value exceeding $6 billion. This significant sale may have a profound effect on the cryptocurrency market. However, past sales of similar magnitude have produced varying impacts on Bitcoin’s price. Experts are currently analyzing various market data to comprehend the potential effects of this sale. Glassnode is examining different datasets to evaluate the implications of this massive sale by the U.S. government on the market.

$121,837, with an anticipated value exceeding $6 billion. This significant sale may have a profound effect on the cryptocurrency market. However, past sales of similar magnitude have produced varying impacts on Bitcoin’s price. Experts are currently analyzing various market data to comprehend the potential effects of this sale. Glassnode is examining different datasets to evaluate the implications of this massive sale by the U.S. government on the market.

Comparison with Germany’s 2024 Bitcoin Sale

In July 2024, the German government sold 56,000 BTC, but this did not lead to a market collapse. Instead, the price of the largest cryptocurrency surged from $53,000 to $68,000. This indicates that large-scale sales do not always negatively affect the market.

However, history shows that not all sales result in positive outcomes. Glassnode has analyzed exchange net flows (30-day moving average) and the market cycle position to assess the impact of the U.S. government’s Bitcoin sale on the cryptocurrency market. Exchange net flows are considered vital indicators for measuring selling pressure.

Temporary Effects of U.S. Government Sales

According to Glassnode analysts, the impact of the upcoming Bitcoin sale by the U.S. government will depend on which cycle phase the cryptocurrency market is in during the sale.

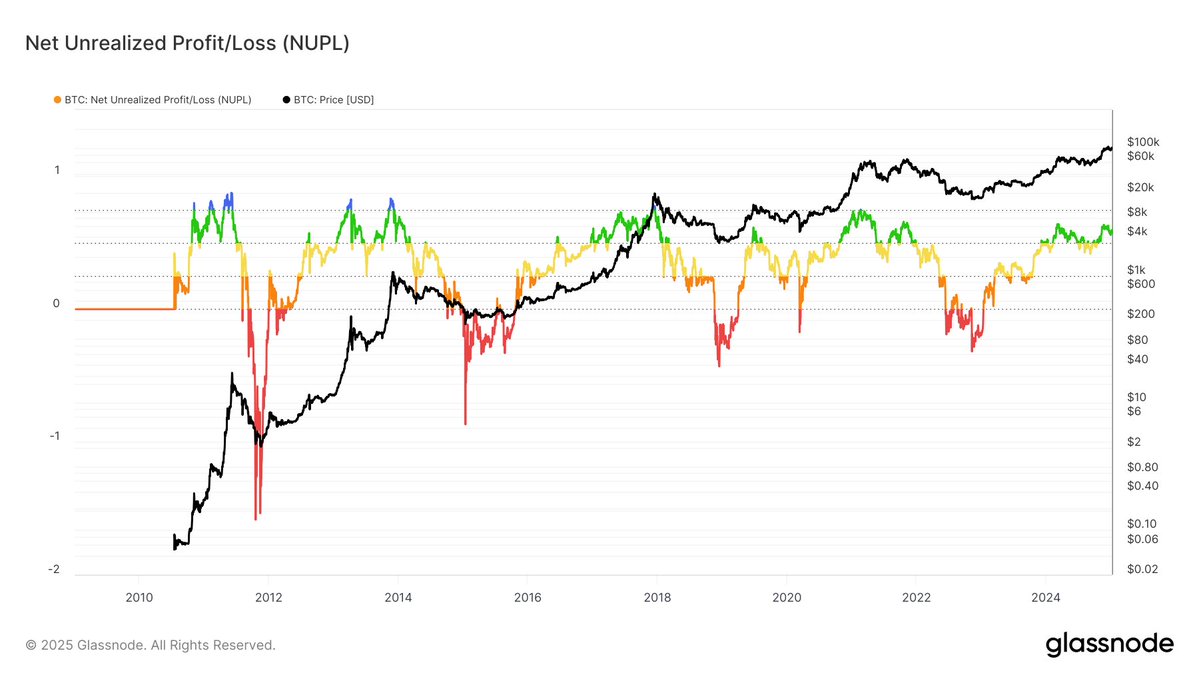

Currently, Bitcoin’s NUPL indicator is between 0.5 and 0.75, indicating a state of Euphoria/Greed in the market. This suggests that the effects of the U.S. government’s sale may be temporary and short-lived.

Türkçe

Türkçe Español

Español