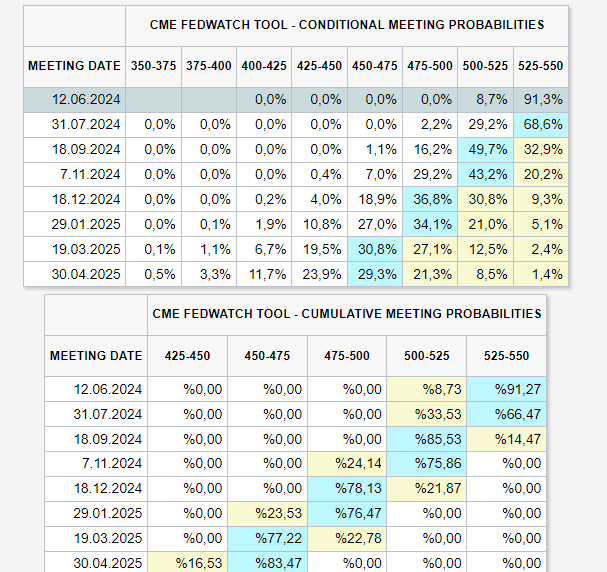

Bitcoin price fluctuations are also a result of problems in the US economy. Uncertainty prevails in the short term. Recent data indicates that the economy is weakening while inflation has not decreased to the desired extent. On the other hand, while the Fed interest rates aim for a 75bp cut this year, the market’s expectation of a 150bp cut has already been forgotten. Even whether a 75bp cut will occur remains uncertain today.

Fed Statements

The importance of statements by members following the recent data and the Fed’s May interest rate decision has increased. As this article is being prepared, Fed Member Kashkari appears doubtful about the current tightness of interest rates. The ongoing statement begins as follows;

“Progress in inflation seen in the second half of 2023 seems to have stalled. The real question is whether disinflation is still ongoing or just taking longer. Considering the inflation data, I question the restrictiveness of the policy. The housing market has proven more resilient against tight monetary policy than in the past. The resilience in the housing market raises questions about the neutral interest rate. The flexibility in the housing market could mean at least a short-term increase in the neutral interest rate. The question facing the Fed is whether disinflation is still ongoing. I modestly raised my neutral interest rate estimate from 2% to 2.5%.”

A half-point increase from 2% could also lead to a change in the inflation target on the inflation front. Under current conditions, it seems unlikely that the Fed will reach its 2% inflation target within the set timeframe.