The long-awaited approval of spot ETFs, which crypto investors have been eagerly anticipating, has not arrived for years, but significant developments have taken place. The involvement of BlackRock and the victory in the GBTC court can be considered as the top 3 achievements so far. The first one, as we all know, was the approval of Bitcoin ETFs for 2021.

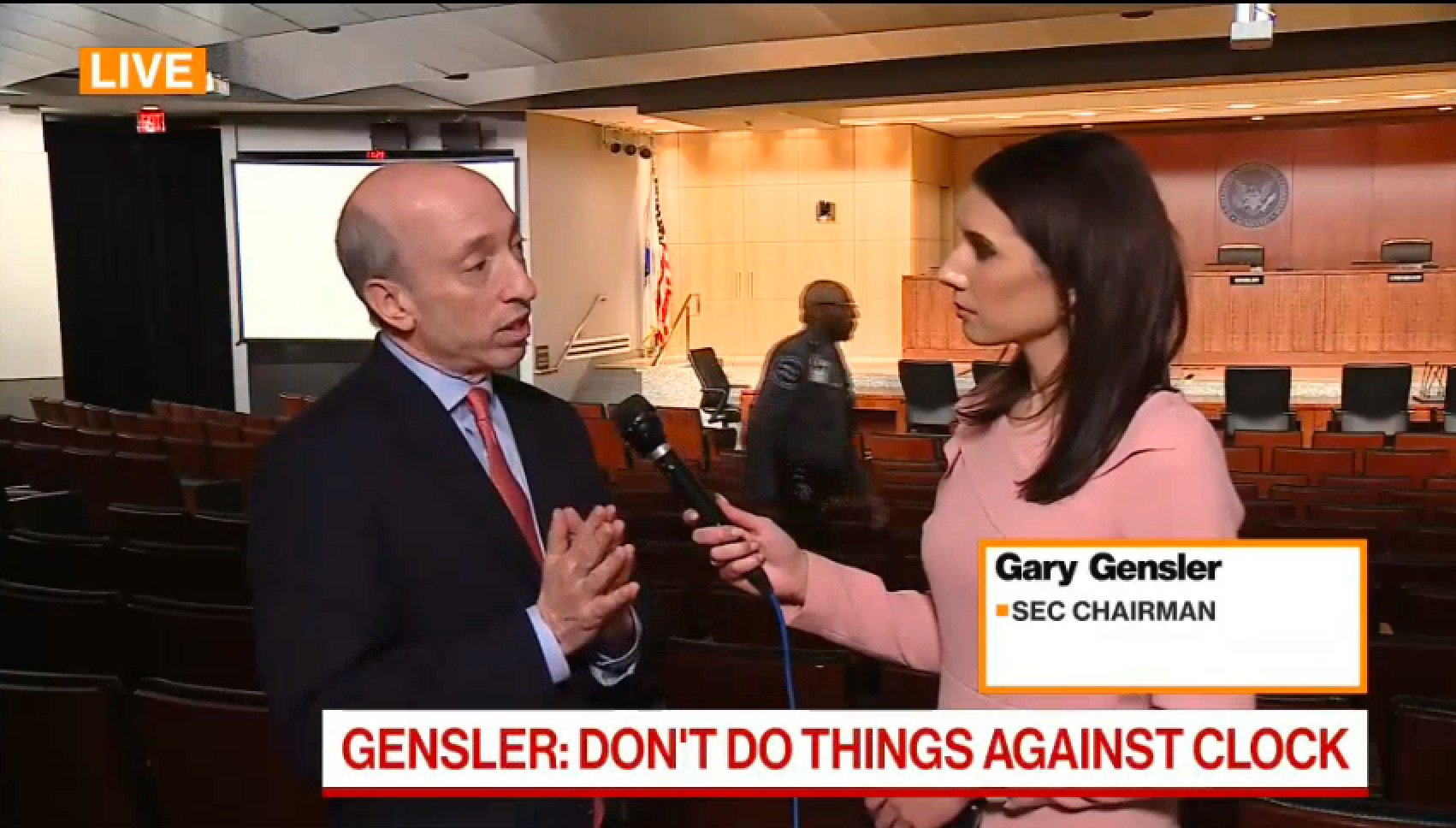

Statements by SEC Chairman

SEC Chairman Gary Gensler made his first statement after avoiding appeals for spot bitcoin ETFs on Friday. When asked about the status of the applications under review by the Securities and Exchange Commission (about 2 hours ago), Chairman Gary Gensler stated that the staff continues to review the applications without providing details.

The fact that Wise Origin and other applications have been updated for the past month was a sign of ongoing communication. The good news is that the SEC seems to have started working to make things run smoothly, setting aside negative discrimination.

Gensler said the following;

“I will not make a premature judgment. The staff is working on these multiple applications.”

Approval of Spot Bitcoin ETF

The fake visual that was shared citing Benzinga Pro on Monday had a great impact in the market. Even Bloomberg ETF expert James couldn’t be sure if the approval had arrived. Subsequently, BTC exceeded $30,000. This shows that a possible official approval could trigger a significant recovery in the markets, even when everyone is in doubt, the price can increase by $2,000. We can more or less predict what will happen in the official announcement.

Gensler was asked about the next steps in the regulator’s ongoing case against Grayscale Investments after deciding not to appeal a court decision last month. He also did not comment on the approval of bulk or partial ETFs.

BlackRock, Invesco, Valkyrie, and Fidelity have updated their application files in the past month based on the feedback they received to determine whether spot bitcoin ETFs will be approved.

“We have not one, but multiple files in front of us, I think there are eight or ten files, and the staff and ultimately the Commission are evaluating them. When an asset manager wants to bring something to the market, these products traded on the exchange need to be registered with the SEC and go through a filing process like going public. So, our Division of Corporate Finance is the one that responds to potential issuers and provides feedback, and our Division of Trading and Markets certainly reviews the filings. This is a process that dates back decades and has been tested over time. The Disclosure Review Team responds to potential issuers and provides feedback.”

Türkçe

Türkçe Español

Español