Bitcoin‘s price continues its impressive rise, advancing at a pace that surprises even those expecting a rally. The same message has been echoed for months. As we have repeatedly stated, the price has been testing supports during declines and targeting new lows without deviation. Now, we are witnessing the opposite at resistance levels, with the BTC price reaching up to $42,154, much to the satisfaction of investors.

Cryptocurrency Report

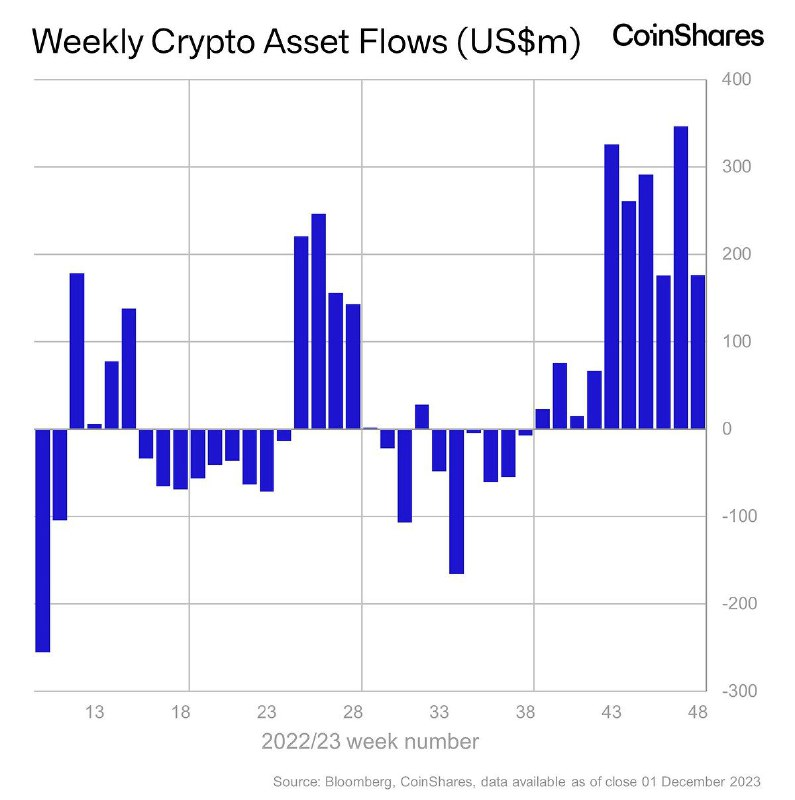

CoinShares publishes a report every Monday, which we have been sharing in real-time for a long time. This report is crucial for understanding the scale of institutional interest and current sentiments. For weeks now, institutions and accredited investors have been making entries into cryptocurrency funds. The net inflow has reached its tenth week.

Last week saw an influx of $176 million into crypto investment products. The total inflow over ten weeks has reached $1.76 billion, a figure last seen in October 2021 when the U.S. SEC approved a futures BTC ETF.

Canada, Germany, and the USA led the way with significant inflows, while Hong Kong experienced minor outflows. BTC garnered the lion’s share with an inflow of $133 million, while ETH saw an impressive inflow of $31 million. The total size of the funds increased by 107%, reaching a level of $46.2 billion. Although this is well below the all-time high of $86.6 billion seen in 2021, the data received today was promising for understanding the progress made.

Türkçe

Türkçe Español

Español