The industry tied to cryptocurrencies has been developing for years. This situation has paved the way for the emergence of many companies focused on cryptocurrencies and the technologies offered by related blockchains. At the same time, some of these companies’ shares began to be traded on the stock exchange, and some outperformed their competitors as of 2023. Crypto stocks of four major companies provided opportunities for significant profits throughout the year, which could continue into 2024.

Marathon Digital (MARA)

Marathon Digital (NASDAQ: MARA), which is at the top of the list when it comes to cryptocurrency mining, became the largest Bitcoin (BTC) mining company with a market value of $5.94 billion according to data provided by CompaniesMarketCap as of December 26, and its stock price increased by 685.59% in 2023.

Trading at $26.71, MARA had a better performance than 99% of all assets traded on the stock market by the end of 2023 and looked better than 98% of the other 281 stocks when the software sector was examined. According to data as of December 26, the price appears to have brought a weekly gain of 46.04% and a monthly gain of 134.09%.

Riot Platforms (RIOT)

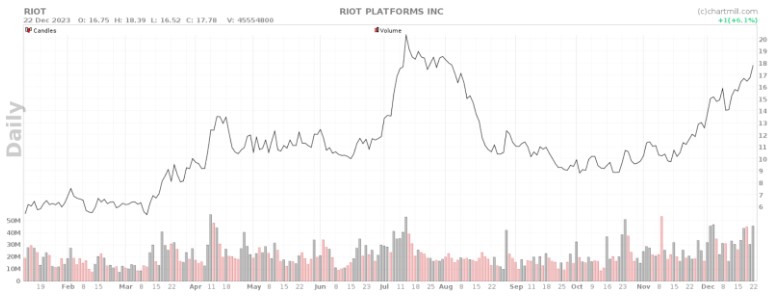

Riot Platforms (NASDAQ: RIOT), which made its investors happy by outperforming even the best S&P 500 companies like Nvidia (NASDAQ: NVDA) and Meta Platforms (NASDAQ: META), is in the position of the second-largest Bitcoin mining company with a market value of $3.67 billion, and some experts suggest that its stock price could soon reach $100.

Upon review, after the transformation in the crypto market in 2023, Riot hosted significant returns, performing better than 99% of all other stocks traded this year. Compared to the software sector, it left 96% behind and is currently finding buyers at $17.78, with a weekly increase of 13.76%, a monthly increase of 47.92%, and an increase of 427.6% throughout the year.

Coinbase (COIN)

Coinbase (NASDAQ: COIN), a centralized exchange, displayed an incredible performance in 2023 and provided extraordinary returns despite the allegations put forward by the United States Securities and Exchange Commission (SEC) this year. It gained 422.26% in value in just a one-year period and is currently trading at $175.48.

According to COIN’s annual performance review, it performed better than 99% of all other stocks, and it managed to outperform 99% of the other 207 stocks in the capital market sector. Moreover, it was seen to have risen by 18.65% in just the past week alone and supported a 51.88% increase over the month.

MicroStrategy (MSTR)

Lastly, MicroStrategy (NASDAQ: MSTR), perhaps the first company that comes to mind when it comes to cryptocurrencies, experienced a 327% increase only in 2023, parallel to the incredible rise in the cryptocurrency market throughout the year.

As of the writing hour, the stock price of MSTR was $619.24, and it had experienced an increase of 8.56% over the last seven days. In addition, the investment in Bitcoin initiated by the company’s chairman Michael Saylor in 2020 continues to yield massive gains and indicated a value increase of 19.03% on the monthly chart.

Türkçe

Türkçe Español

Español