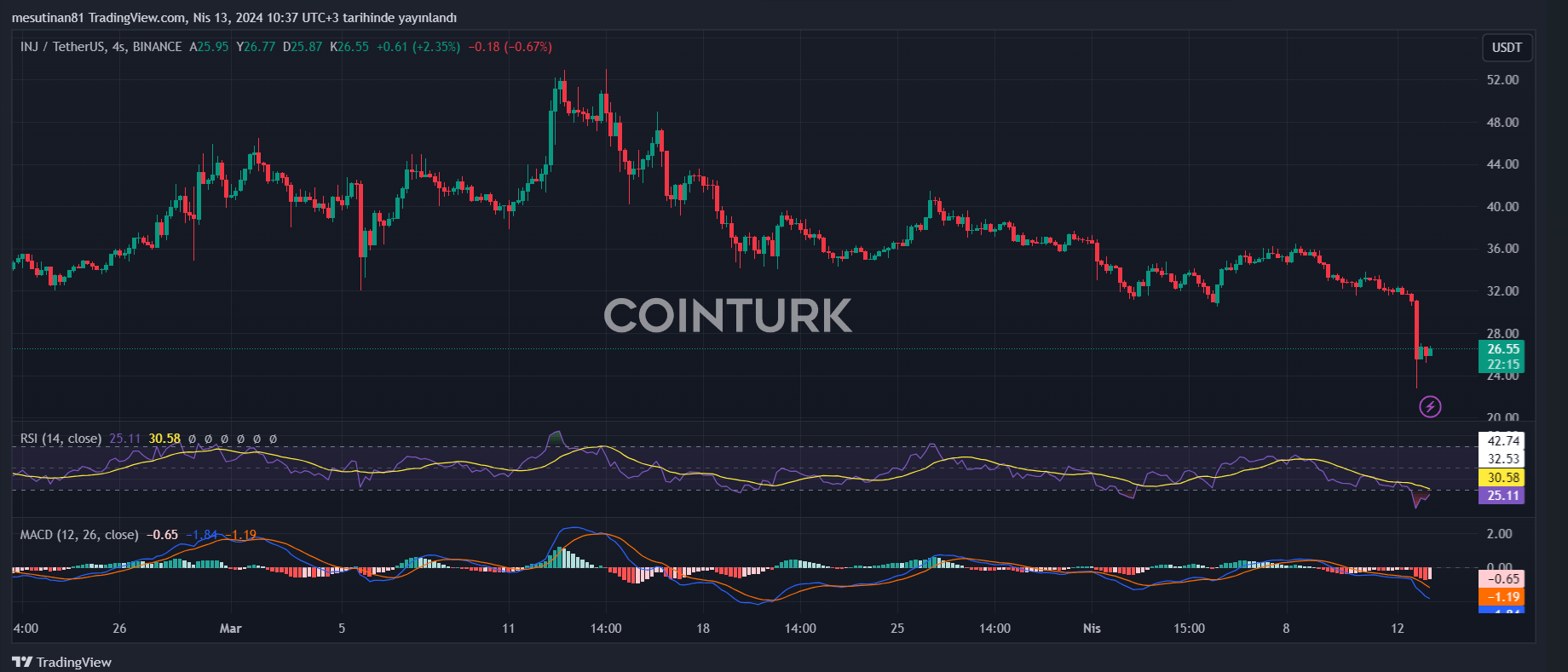

Injective price fell by approximately 20% on Friday, succumbing to the broader market crash. INJ is likely not to lag behind and could trap those taking short positions, depending on Bitcoin‘s price performance. Falling below a price tag of $20 would mean the invalidation of the bullish thesis for INJ.

Injective Cryptocurrency Price Could Start Rising After Market Crash

The price of Injective (INJ) fell during the Friday crash, following the sharp movement of Bitcoin, the flagship of cryptocurrencies. However, for the bulls, this situation could be an ideal entry level as the BTC halving approaches.

The cryptocurrency Injective price saw a drop of about 20% on Friday, reaching its lowest level since January 3rd at $29.21. This move could be a quick liquidity grab triggered by large sell orders that rapidly absorbed the market’s available liquidity. Participants may rush to take advantage of perceived opportunities, leading to swift price movements and liquidity fluctuations.

Is a Pullback Possible for INJ?

With the Relative Strength Index (RSI) below 30, the cryptocurrency INJ is currently oversold and could experience a pullback. In the event of a correction, the likely play would be to turn the $29.27 blockade into support, followed by a retest of this resistance-turned-support before reaching the $37.24, 50% Fibonacci level.

Breaking above $37.24 would encourage more buy orders and likely lead to gains that could propel the Injective price to as high as $45.21. In a potentially rapid ascent, the cryptocurrency INJ price could clear the aforementioned level to reclaim the $53.00 peak. This would represent a climb of approximately 98% over current levels. The projected recovery will depend on how quickly the Bitcoin price and the broader cryptocurrency market can rebound.

On the other hand, if the bears hold sway, the price of INJ, ranked 44th in the crypto world, could continue to fall. Dropping below the Friday low of $22.77 would invalidate the bullish thesis, leading to a lower low. This could result in INJ prices seeing levels below $20.

Türkçe

Türkçe Español

Español