Avalanche ecosystem users have paid $13.8 million in transaction fees over the last five days to mint inscriptions-based tokens and NFTs and to process transactions. Inscription-based tokens are created by writing code into ordinary blockchain transactions and using an off-chain numbering system to track them.

Inscription Madness in Avalanche

Bitcoin network’s lack of native support for tokens led to inscriptions as a temporary solution, which quickly spread to many other blockchain ecosystems for various reasons. One of the main reasons for this spread is that inscriptions can be transferred more cheaply than native tokens.

This low-cost process continues to be valid across most blockchain networks. While tens of millions of inscription-based tokens have been created in leading ecosystems like Polygon and BNB Chain, users have paid approximately one million dollars in total fees for each chain.

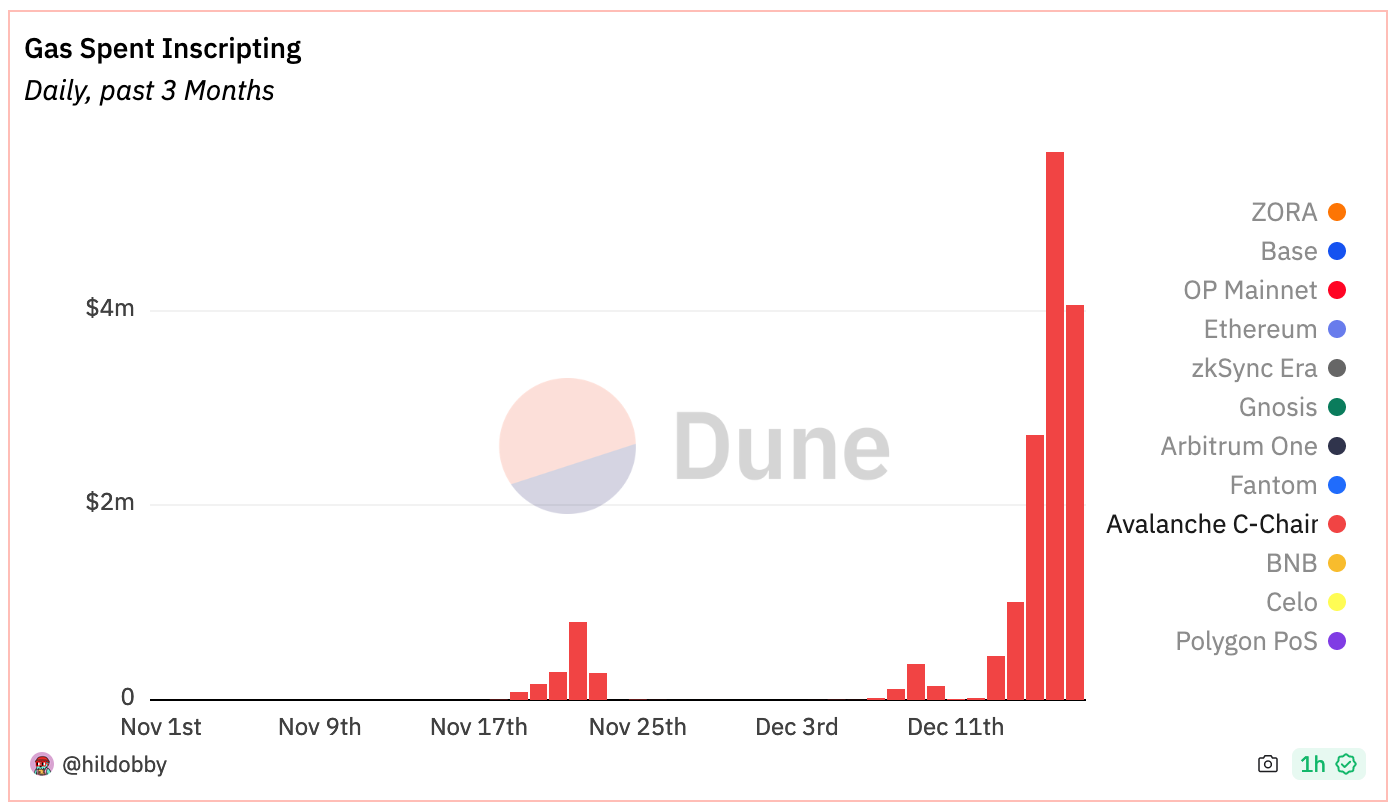

On the Avalanche front, according to a Dune Analytics dashboard created by Hildobby, a researcher at VC firm Dragonfly, transaction fees spent on inscriptions in the last few days have risen to $5.6 million per day. The total of $13.8 million accounted for about 70% of all fees spent across the entire blockchain ecosystem tracked by the dashboard, drawing attention.

Growing Interest in the Avalanche Ecosystem

Avalanche experienced two significant hype periods related to inscriptions. During the first hype period, which lasted about five days at the end of November, a total of approximately $1.5 million in transaction fees was collected. However, in the recent period, fees have been significantly higher due to both the increase in Avax price and the high level of hype.

One of the main reasons for this seems to be the significant increase in failed transactions recently, which in turn is causing an increase in overall demand for block space. While transaction costs have been steadily rising this month, there was a notable increase on December 18th, when the price per transaction in the Avalanche ecosystem exceeded 5,000 nAVAX.