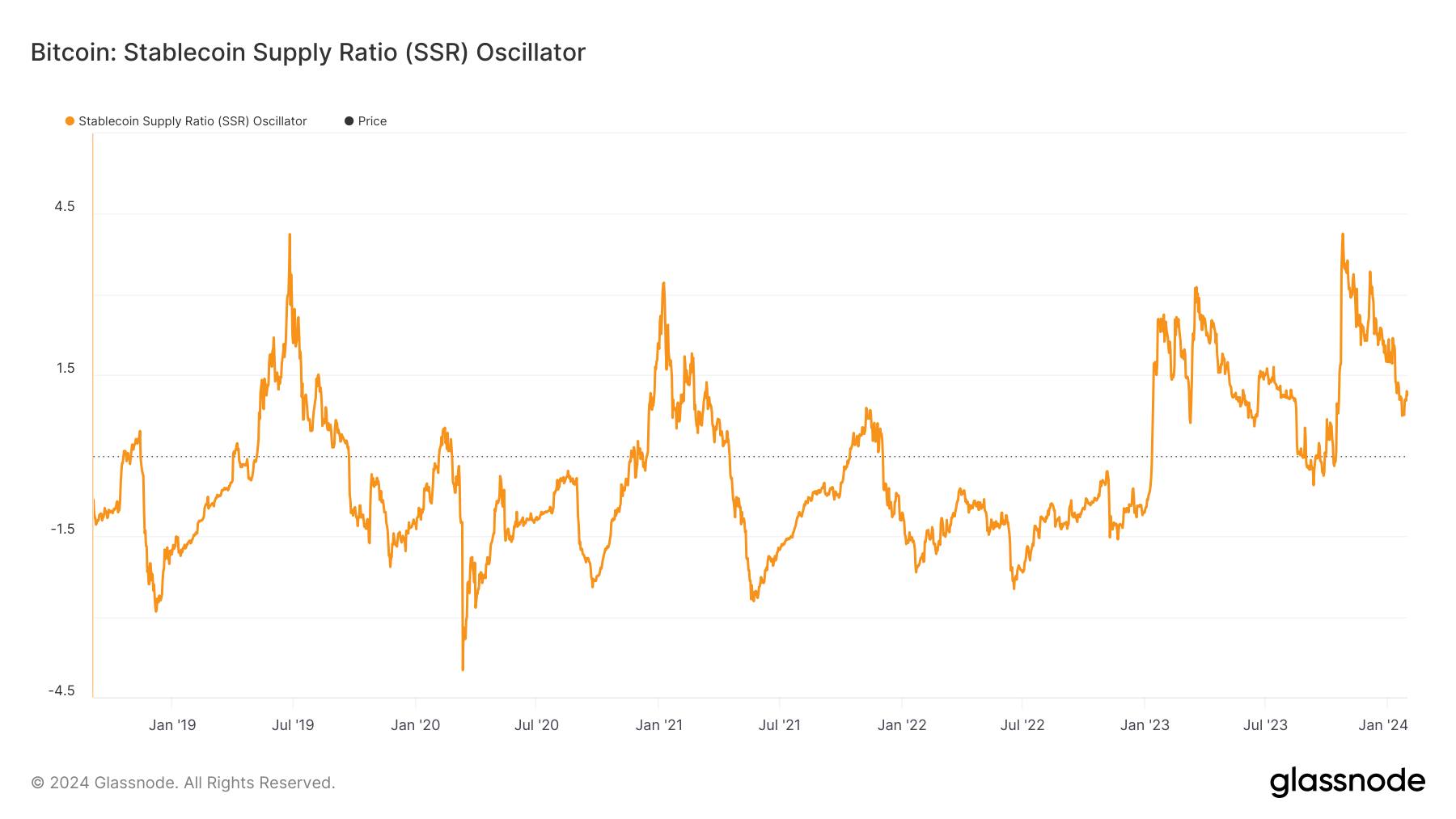

Bitcoin is benefiting from the increase in purchasing power due to the rising supply of stablecoins. According to data from Glassnode, there has been a noticeable decline in the stablecoin supply ratio (SSR) oscillator. Bitcoin reached its highest level in two years this month after initially rising in October 2023, and stablecoin data indicates this is not a coincidence.

Noteworthy Data on Bitcoin’s Market Dynamics

The SSR oscillator tracks the ratio between Bitcoin’s market value and the combined value of all known stablecoins. As explained by Glassnode, this data acts as a proxy for the supply/demand mechanics between Bitcoin and USD. When SSR values are low, stablecoins have more purchasing power to buy Bitcoin supply. After reaching an all-time high in October, the SSR oscillator significantly declined, dropping from 4.13 on October 25 to just 0.74 on January 22.

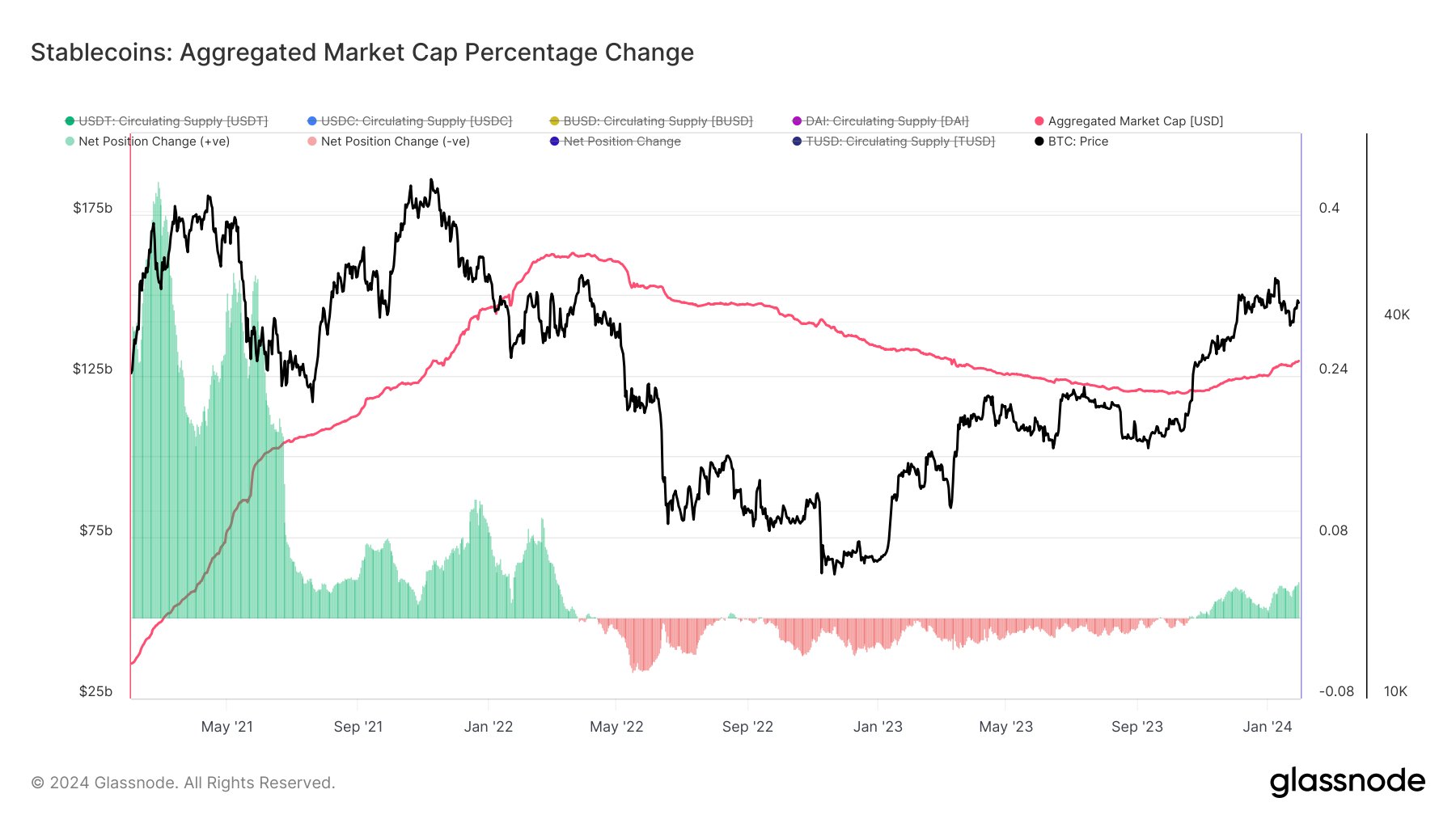

James Van Straten, a research and data analyst at blockchain data analysis firm CryptoSlate, analyzed changes in the overall stablecoin market value and noted an increase in supply starting from the fourth quarter of 2023. This trend is continuing this year. Straten made the following statement to X subscribers on January 31:

“As we saw last week with the rotation of stablecoins into Bitcoin, it sent Bitcoin above $42,000. The stablecoin supply is currently $10 billion higher than the lowest level and 3.5% higher in the last 30 days.”

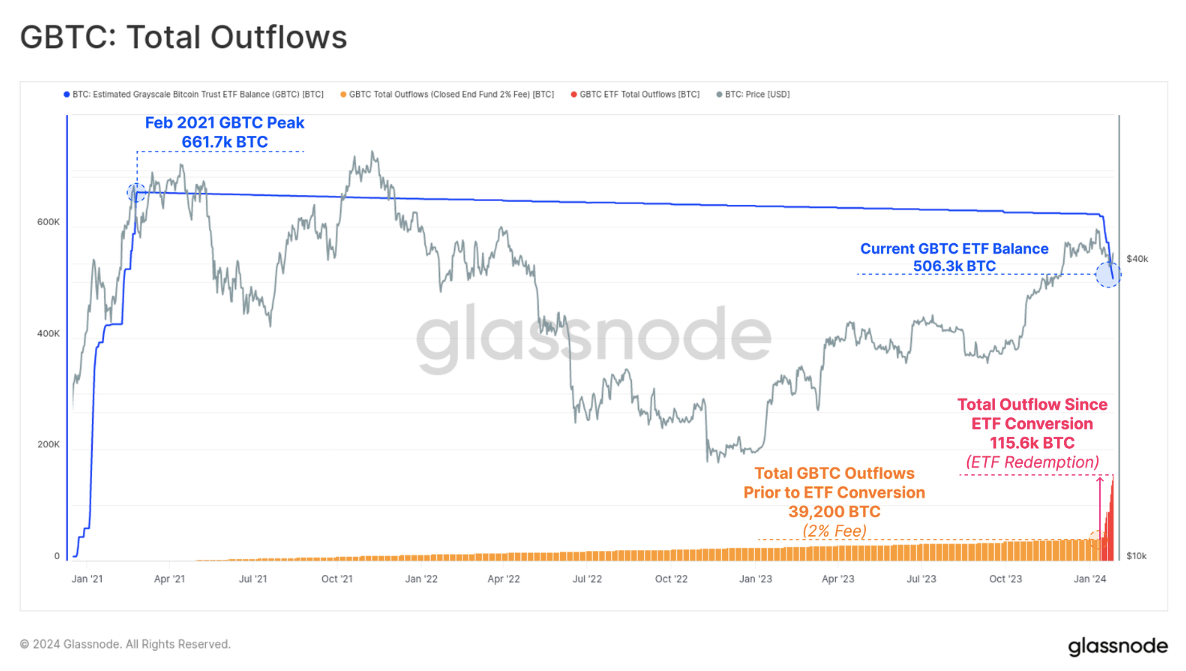

GBTC Outflows and Bitcoin

Bitcoin is currently facing changes in supply dynamics. These changes are due to the newly launched spot Bitcoin exchange-traded funds (ETFs) in the United States, which have opened the door to institutional capital flows for the first time. Glassnode acknowledges in the latest issue of its weekly newsletter The Week On-Chain that the on-chain flows remain volatile three weeks after the launch of GBTC as an ETF. The researchers commented on the matter:

“After trading with a very high NAV discount of around 2% for many years, the conversion to a spot ETF product triggered a significant rebalancing event. Since the conversion, approximately 115.6 thousand Bitcoin have been withdrawn from the GBTC ETF product, creating significant market tightness.”

While these outflows continue, predictions anticipate that volumes will rapidly decrease in the near future, reducing sell-side pressure. Glassnode also adds that institutional flows have increased broader on-chain volumes.