Leading crypto analysis platform Spot On Chain has indicated that liquidators of FTX and Alameda Research recently deposited approximately 2,500 ETH, worth about 8.56 million dollars, into Coinbase. According to Spot On Chain, the officials carried out a significant deposit transaction at a price of around 3,426 dollars shortly before the recent ETH price drop. The fact that the move occurred before the fall in prices is being questioned in the crypto world.

Indeed, The Timing Is Interesting

Following the development, the analysis platform stated that the FTX and Alameda Research liquidators seem to have a knack for choosing their exit points. Using historical data, the platform demonstrated that the group timed their transactions just before the price collapse, aligning their liquidations near perfection.

Spot On Chain discovered that the bankrupt exchange FTX and Alameda have deposited 15,850 ETH worth 58 million dollars at approximately 3,659 dollars to central exchanges (CEX) since March 1. The platform also revealed that dramatic price changes tend to occur immediately after each deposit transaction.

Meanwhile, the group made their most recent deposit transaction as Ethereum retested its recent low of 3,413 dollars. The price initiated a decline that broke the established support, pushing the cryptocurrency ETH down further within a few hours. The leading altcoin printed a bearish candlestick on the daily chart reflecting a drop of over 11%. The price spiked down to 3,100 dollars.

Cryptocurrency Ethereum Price Recovers

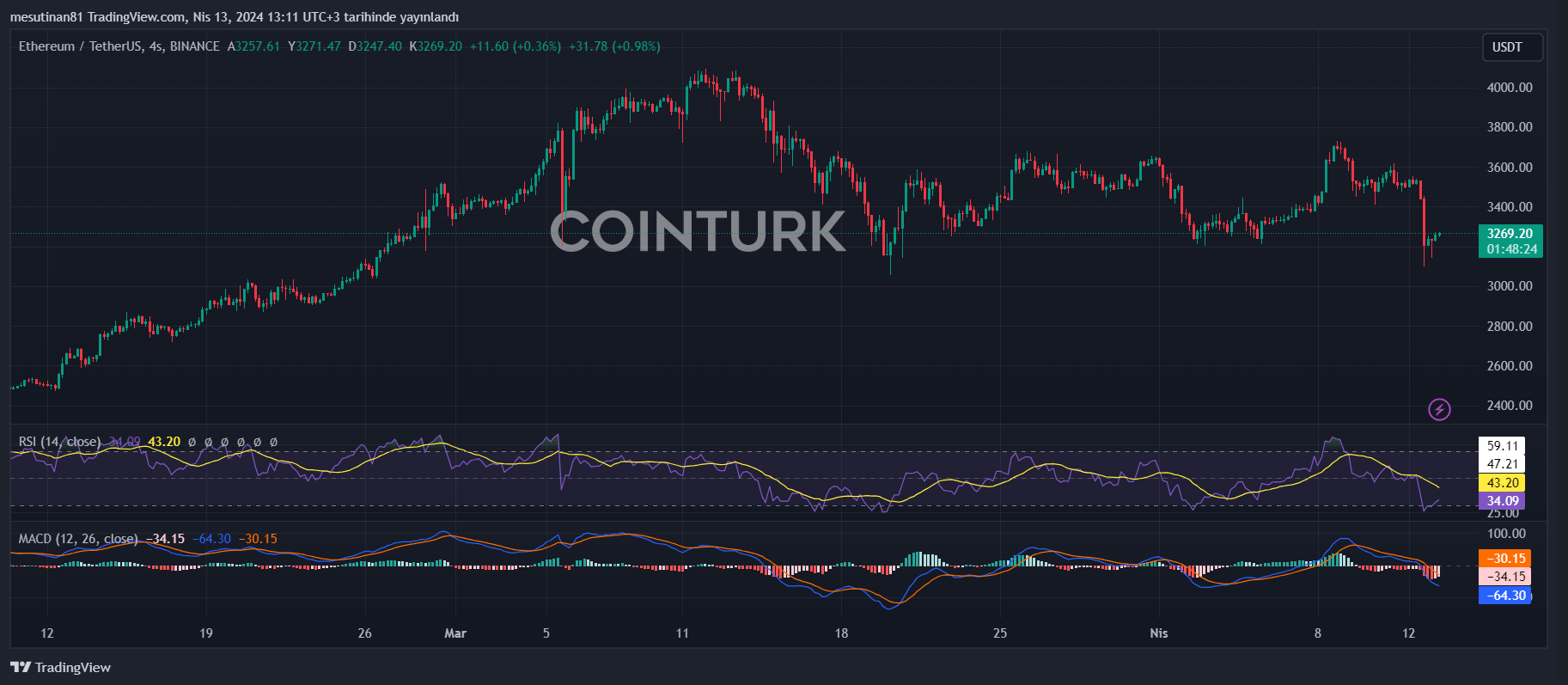

Ethereum retested a support level set on March 20, dropping from the liquidators’ deposit price of 3,426 dollars to 3,100 dollars. According to data from TradingView, the price bounced from the support level and reached up to 3,269 dollars at the time of writing.

With the recent decline, Ethereum, a leading altcoin in the crypto world, returned to the base of a horizontal range established after Bitcoin, the flagship of cryptocurrencies, pulled back from a dominant rally in 2024. The cryptocurrency ETH fell from its highest level of the year at 4,095 dollars, following an approximate 90% rise. The pullback in ETH signifies a serious 25% drop as bulls and bears battle for dominance ahead of the anticipated altcoin season.

Türkçe

Türkçe Español

Español