“`html

The 2023 first-quarter cryptocurrency sector report provided by the crypto data and pricing platform CoinGecko offers significant information on market trends, Bitcoin (BTC) and Ethereum (ETH) analysis, decentralized finance (DeFi) and NFT ecosystems insights, and includes trading volumes of centralized cryptocurrency exchanges (CEX) and decentralized cryptocurrency exchanges (DEX). Let’s now take a closer look at the details of the report.

Bitcoin, Ethereum, Exchanges, and Stablecoin Market

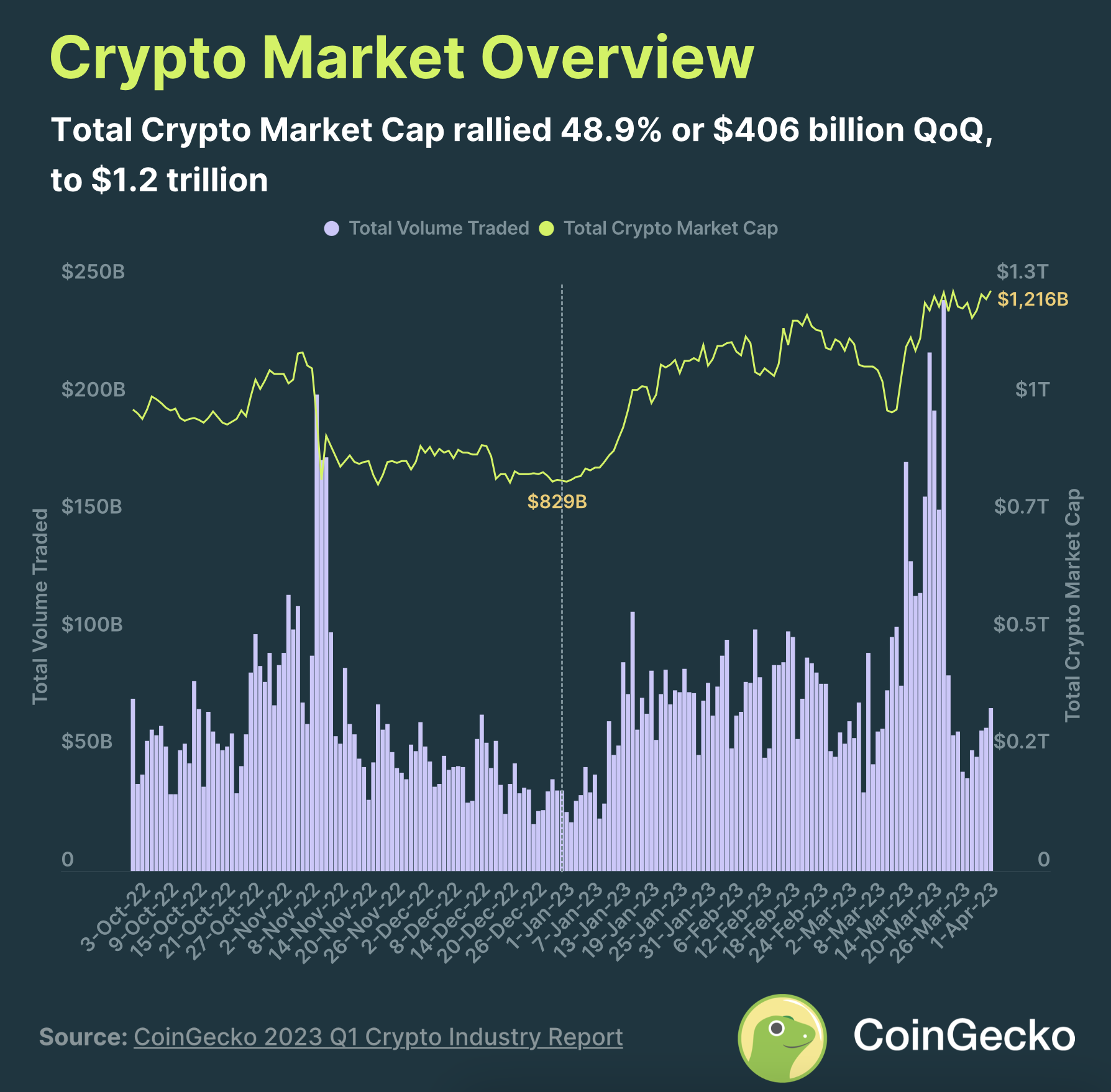

The cryptocurrency market had a strong start to 2023, waking up from its end-of-2022 slumber to achieve a 48.9% increase in total market value, reaching $1.2 trillion as of March 31. Bitcoin (BTC) and Ethereum’s (ETH) prices rose to approximately $28,000 and $1,800 respectively, with BTC leading the first quarter with a noteworthy gain of 72%.

The average daily trading volume of the cryptocurrency market in the first quarter increased by 30% to $77 billion, influenced by rising market activity and volatility. Throughout the quarter, Bitcoin outperformed traditional asset classes with a significant gain of 72.4%, outpacing both NASDAQ and gold. With the exception of crude oil, which lost 6.1% in value, other major asset classes ended the quarter on a positive note.

On the spot market side, the spot trading volume of the cryptocurrency market increased by 18.1% in the first quarter, reaching $2.8 trillion. Regulatory scrutiny over CEXs led to DEXs outperforming CEXs, with DEXs growing by 33.4% compared to CEXs’ 16.9% during the quarter.

On the stablecoin market front, there was a 4.5% decrease ($6.2 billion) mainly due to Paxos ending its support for Binance USD (BUSD) and a short-term USD Coin (USDC) depegging. The largest stablecoin Tether (USDT) maintained and strengthened its position, while USDC and BUSD saw declines in market value.

The DeFi Sector Grew Triple-Digits, NFT Sector Double-Digits

Significant developments also occurred in the DeFi and NFT sectors throughout the quarter. The DeFi sector grew by 65.2%, reaching $29.6 billion in the first quarter. Governance tokens of liquid staking protocols led this growth with a 210.9% increase in market value, surpassing lending protocols to become the third-largest category in DeFi.

The volume of the NFT sector rose to $4.5 billion in the first quarter, showing a 68% increase compared to the previous quarter. The new NFT marketplace Blur surpassed OpenSea in trading volume, becoming the largest NFT marketplace with a 71.8% market share as of March 2023.

- Q1 2023 shows a robust crypto market.

- DeFi and NFT sectors experience growth.

- Blur leads as the top NFT marketplace.

“`

Türkçe

Türkçe Español

Español