Altcoin investors have been disappointed in the last 24 hours as a decline in BTC prices has painted the crypto markets red. The negativity on the first day of April should not imply that the whole month will be terrible. We had seen that after such consolidation processes throughout the first quarter of 2024, the market often reached higher peaks. So, what do the current chart views tell us about FLOKI, BONK, and XRP?

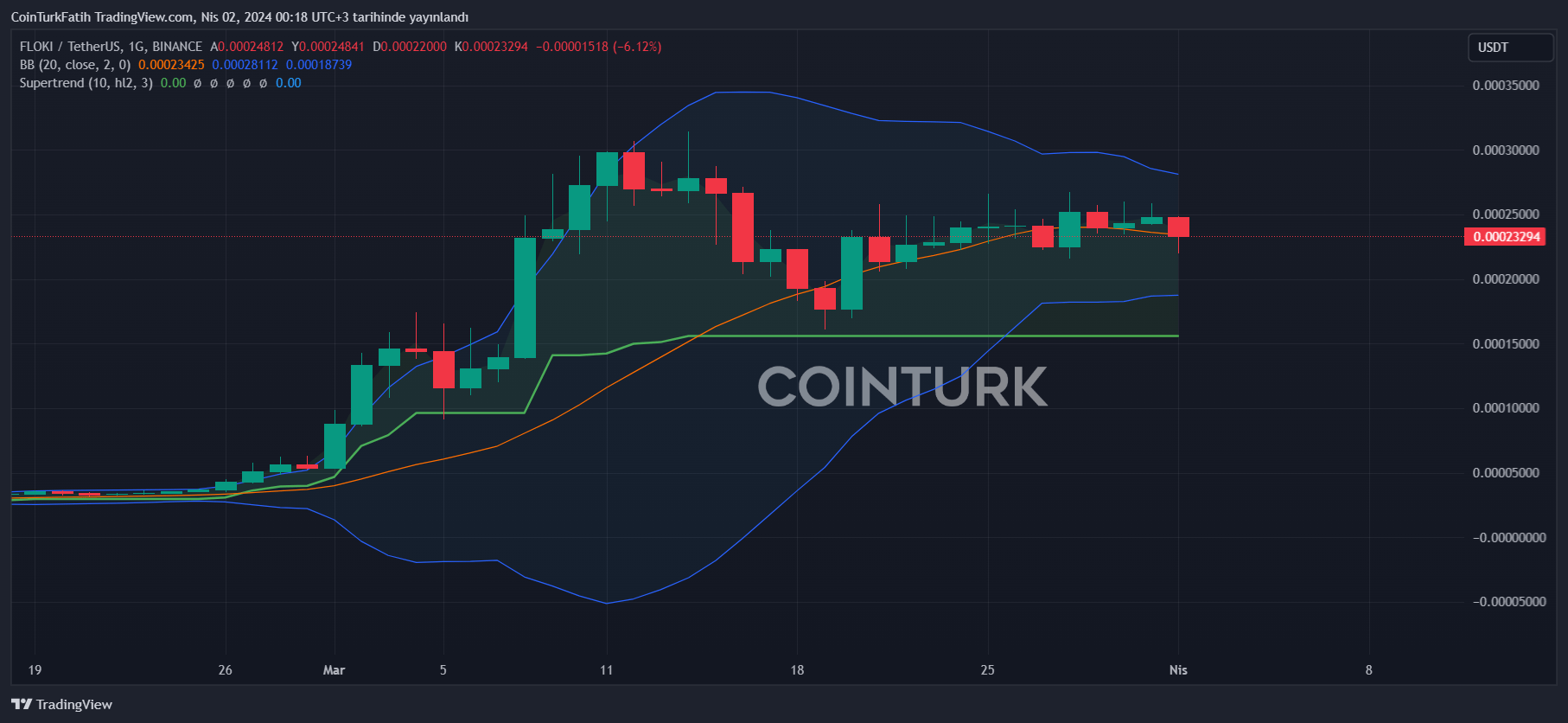

FLOKI Price Prediction

In March, it reached its all-time high and greatly benefited from the bull market’s momentum. Afterwards, as meme coin investors showed interest in other new meme coins on the WIF and Solana networks, FLOKI took a hit. Since March 21st, the price has been consolidating and is now nearing a breakout.

To set new all-time high levels, we should start seeing closures above $0.000255. On the flip side, if a decline begins, losing the $0.000216 support could lead to a drop to $0.000155 and then $0.000109.

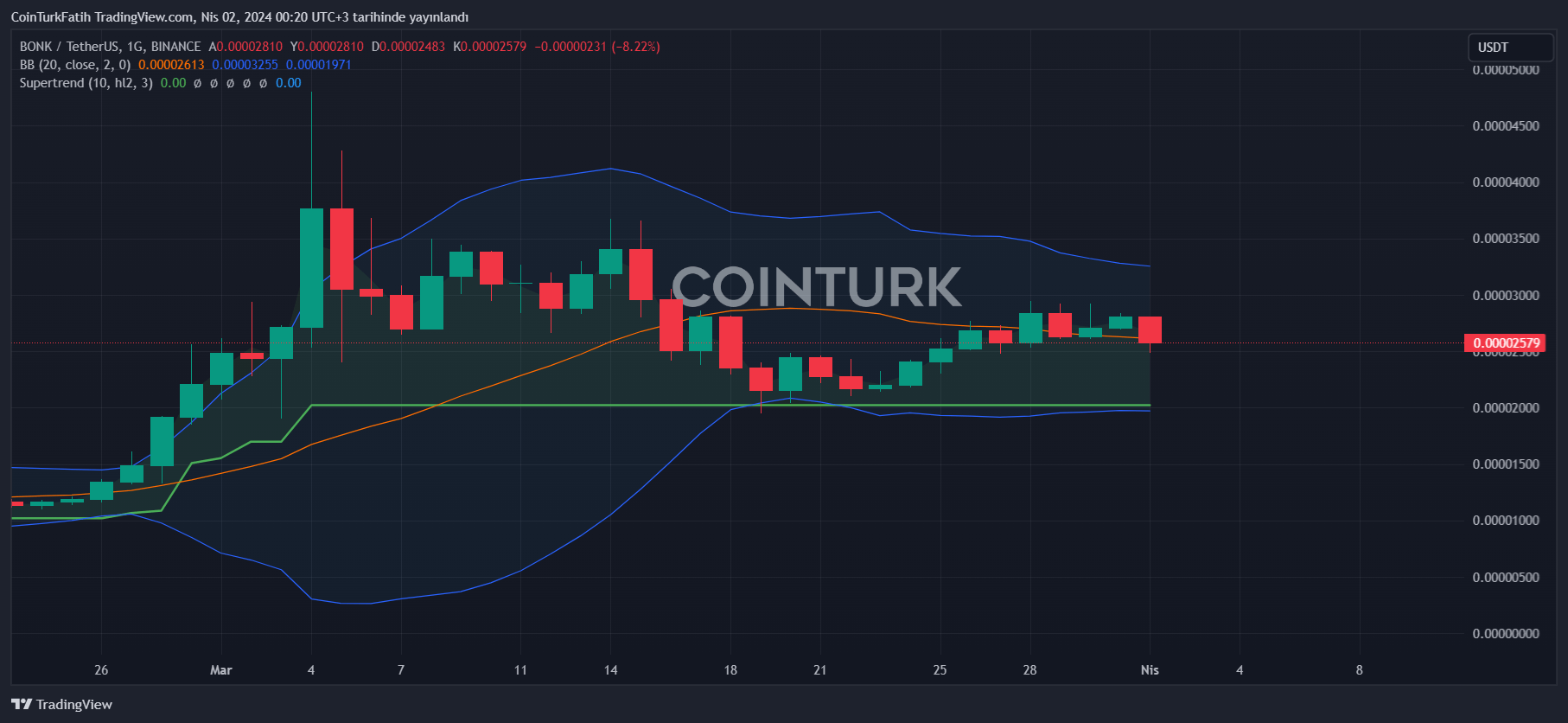

BONK Coin Price Prediction

A similar situation is present here with the price stuck in a tight range, awaiting a breakout. Being based on Solana is an advantage, and a new hype could quickly drive the price up. BONK Coin has a significant story in the community’s eyes as it emerged during Solana’s toughest days.

Closures below $0.0000287 are testing the $0.0000248 support level. If this area is also lost, a drop to $0.0000211 wouldn’t be surprising. Conversely, the all-time high seen on March 4th could be retested. For now, it seems BTC‘s price performance will also dictate the trend here.

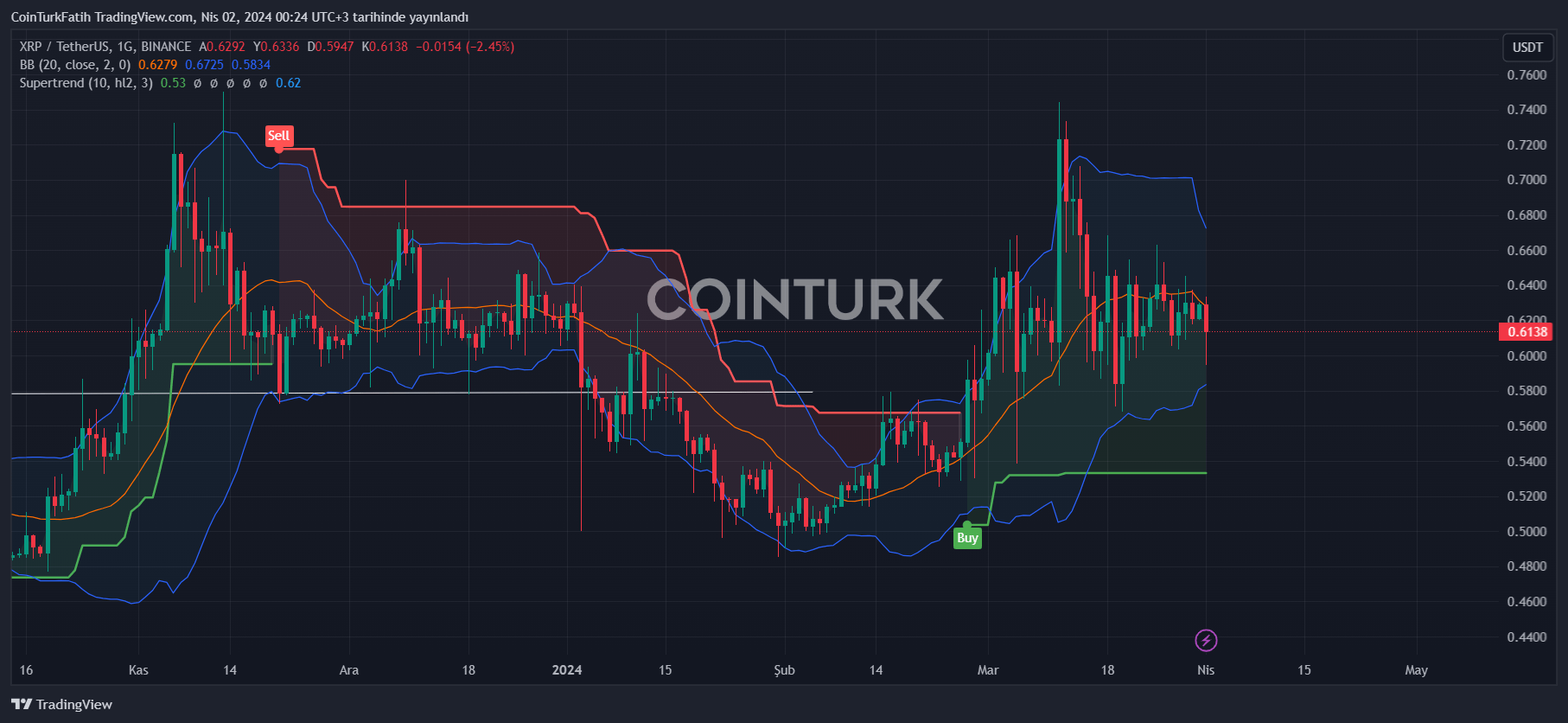

XRP Coin Predictions

The legal battle between the SEC and crypto exchanges over securities is escalating. The regulatory body has even taken action regarding ETH. All these developments could overshadow XRP Coin‘s gains from July 2023. As of writing, XRP continues to hover just below $0.62. However, the good news is that it has experienced much smaller losses in the last 24 hours compared to many other cryptocurrencies.

Long lower wicks on the daily chart may reflect buyer activity, but the expected strong stance above the $0.62-$0.63 range has not been demonstrated. In a potential rally, targets of $0.68 and $0.74 are on the horizon. In the opposite scenario, the $0.58 support level is current.

Türkçe

Türkçe Español

Español