A recent report by cryptocurrency analysis firm Santiment has shed light on the realities behind the latest fluctuations in the crypto market. Santiment’s latest data indicates that altcoin owners have made substantial profits. However, there are significant doubts about how sustainable these gains are, leading to questions about whether altcoin holders are sitting on a ticking time bomb. Let’s take a closer look at the analysis firm’s assessment.

What Does It Mean for Altcoin Wallets to Be Profitable?

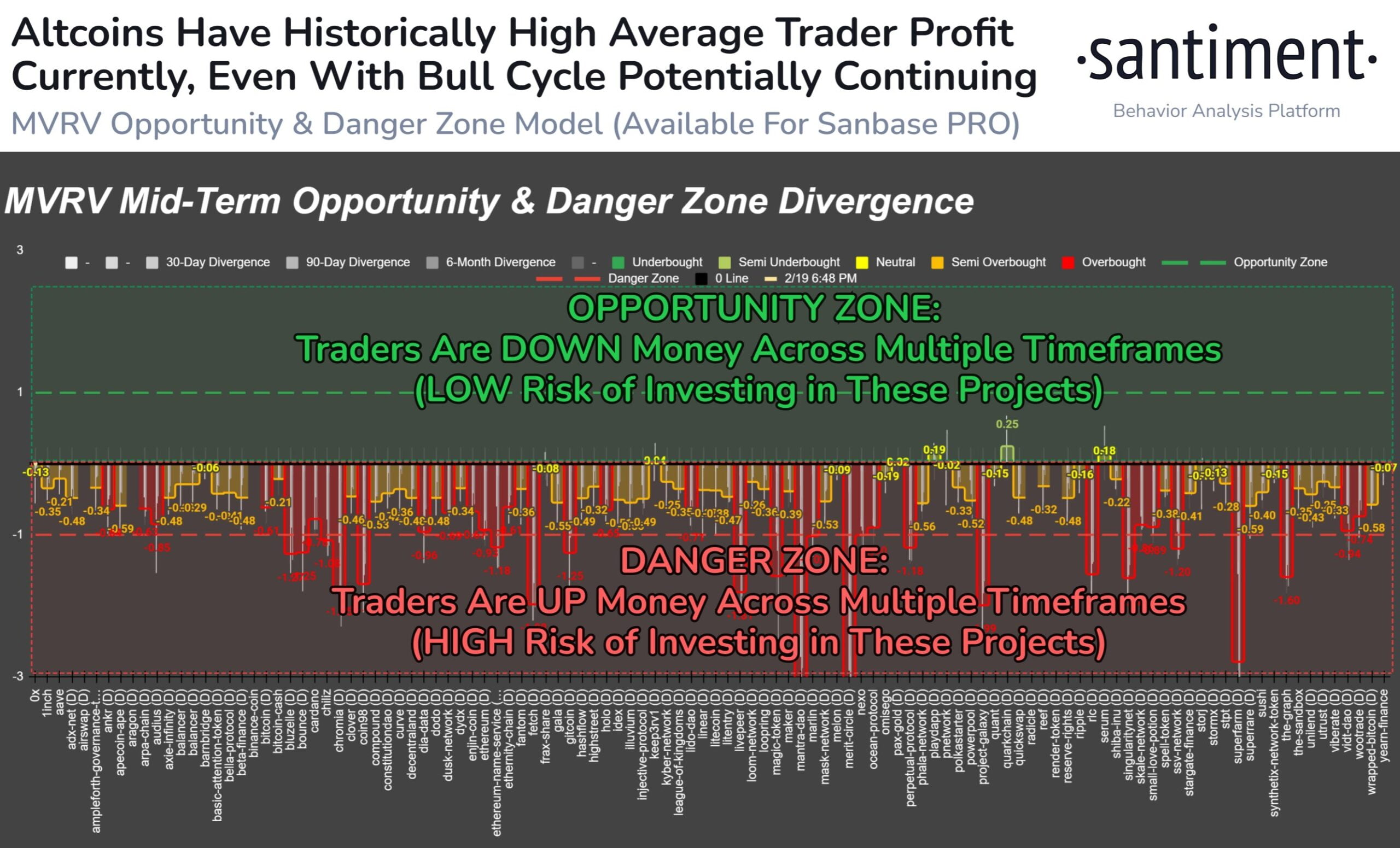

Santiment‘s analyses suggest that many altcoin wallets have achieved tremendous profits in recent months. Yet, it is important to note that these profits are unrealized and we are entering a period of increased risk. In particular, the blockchain analysis firm warns investors about overbuying signals. It also emphasizes the risks involved in opening new positions, stating:

“On a medium and long-term timeline, an average wallet has seen ‘understandably high profits’ from altcoins since the market turned green in mid-October 2023.”

On the other hand, a statement made by the analysis firm Santiment at the beginning of January highlights that the development processes of altcoins are often dependent on the stability of Bitcoin’s price. This means that Bitcoin’s price movements are a very important indicator for altcoin investors.

Looking at the recent data, there has been a 10.54% increase in the price of Ethereum over the last week, while popular altcoins such as Cardano (ADA) and Polygon (MATIC) have also shown significant rises in the past seven days. Cardano (ADA) gained 13.59% and Polygon (MATIC) increased by 13%, providing profits to their investors.

Could Opening New Positions Be Very Risky?

The recent activity in the cryptocurrency market continues to excite investors, and during this thrilling period, the MVRV indicator, which captures the attention of investors, is becoming an important tool in assessing the price movements of assets.

MVRV is a ratio obtained by dividing the total market value by the realized value of an asset. This ratio helps identify local peaks and troughs in an asset’s price movements. Therefore, investors can use this indicator to determine when asset prices are overvalued or undervalued.

According to the MVRV (market value to realized value ratio) metric, the risk of opening new positions during a rally of four months or more is increasing. This situation also raises concerns that the market may be facing a significant correction.

Türkçe

Türkçe Español

Español