With the Bitcoin halving event scheduled for April 20th approaching, Bitwise Asset Management highlighted that historically, the price movement in the month following the much-anticipated event has been disappointing. In a post dated April 16, Bitwise recorded past price movements showing a price decline in the month following the last three halving events; however, the following year saw price increases of at least three digits in percentage points.

Past Halving Cycles and the 2024 Halving Process

In the month following the 2012 halving event, Bitcoin gained 9% in value but showed an increase of 8,839% the following year. A similar pattern occurred in the 2016 halving event; Bitcoin dropped 10% the following month and reached $20,000 in 2017 with a 285% increase. Similarly, in 2020, Bitcoin saw a 6% price increase the month after the halving event, followed by a 548% price increase.

“The data is limited but presents an interesting pattern. Market prices show the short-term impact of the halving event but underestimate its long-term effect.”

The current market cycle has been recorded as the period when Bitcoin reached its all-time high for the first time before a halving event. The cryptocurrency reached its current peak of $73,679 on March 13 and has since corrected to $61,500 with a 16% decrease.

Industry Experts Comment on Halving

Industry executives are equally pessimistic in the short term. Markus Thielen, head of research at 10x Research, predicted on April 13 that $5 billion in sales could occur among miners after the halving event, which could create downward pressure on the markets. Meanwhile, Marathon CEO Fred Thiel stated that the halving rally has already been accounted for and highlighted what might happen after the post-halving rally.

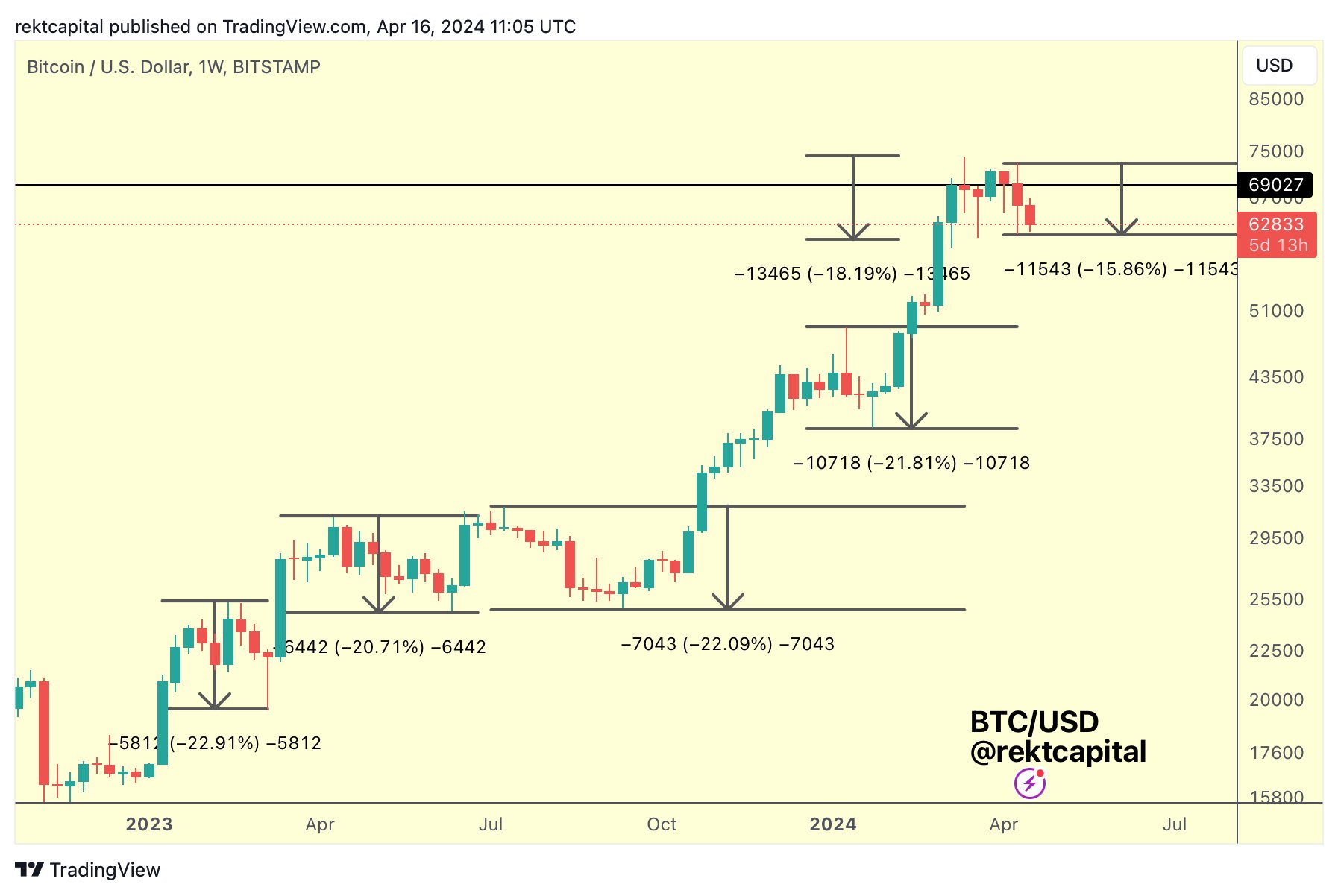

On April 16, investor and analyst Rekt Capital published a list on X of market correction magnitudes since the bottom of the 2022 bear market. There have been five significant pullbacks ranging between 18% and 23%. Currently, the markets have corrected by 16% and could potentially move further.

Meanwhile, analyst Cold Blooded Shiller mentioned that 30% corrections could be on the agenda, implying that Bitcoin could potentially drop to $51,000.

Türkçe

Türkçe Español

Español