A prominent Bitcoin (BTC) analyst who marked the end of the 2021 bull market stated that investors need to start looking at BTC from a different perspective. He also touched upon Ethereum (ETH) and stablecoins, making critical remarks.

Factors Behind Bitcoin’s Rise

The crypto analyst known as Pentoshi recently told his followers on social media platform X that Bitcoin investors seeking peaks need to look beyond the charts. According to the senior crypto analyst, a series of factors are working together to push Bitcoin into an uncharted territory of growth. In his statements, the analyst also mentioned that Bitcoin ETFs could be on a historic upward trend:

I think the right way to look at crypto is to extend your time horizon instead of always trying to reach the peak right now. The BTC exchange-traded fund (ETF) was the most bullish ETF in history. Suits loved it, people wanted it, and they didn’t know how to buy it. It will become easier to use with a better user interface, and more people will join. Central banks will print money, they always have and have shown they can’t stop. So, in theory, over any extended period, it should move up and to the right. When Covid emerged, I initially thought that such disasters would never happen again, or maybe they wouldn’t. But what happened was a generational mindset shift, where people became more online, and it could be the only way out of the current world system. So stop looking for peaks, zoom out, and think about where it will go in ten years.

Total Value in Cryptocurrencies

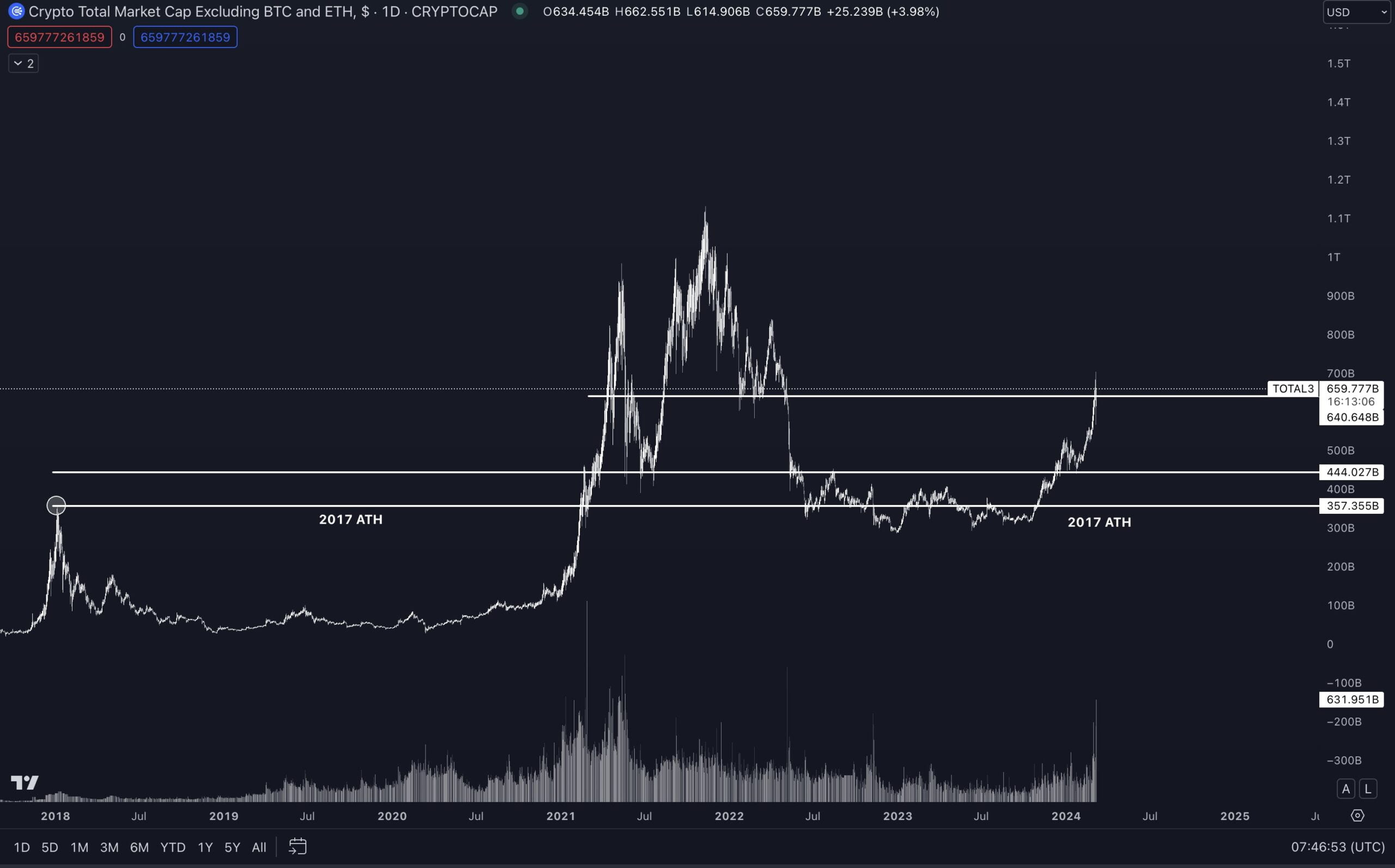

Pentoshi also discussed TOTAL3, which tracks the total market value of all cryptocurrencies excluding Bitcoin, Ethereum (ETH), and stablecoins. Sharing a chart that indicated the altcoin market was ready to rise after breaking a significant resistance level, the analyst stated:

In terms of alternatives, we haven’t seen anything yet. It’s not a matter of if, but when.

Türkçe

Türkçe Español

Español