While price fluctuations and uncertainties in cryptocurrencies continue, the BTC halving is drawing closer day by day. In the past, this process has hosted significant price movements. So, what do important figures in the market think about this topic?

Famous CEO Comments on Bitcoin Halving

In a recent statement by Bitwise CEO Hunter Horsley, it was mentioned that we are heading towards perhaps the most significant halving to date, which could bring substantial price movements. Horsley, in a post on X, compared the upcoming halving with the one in 2020 and made the following statements:

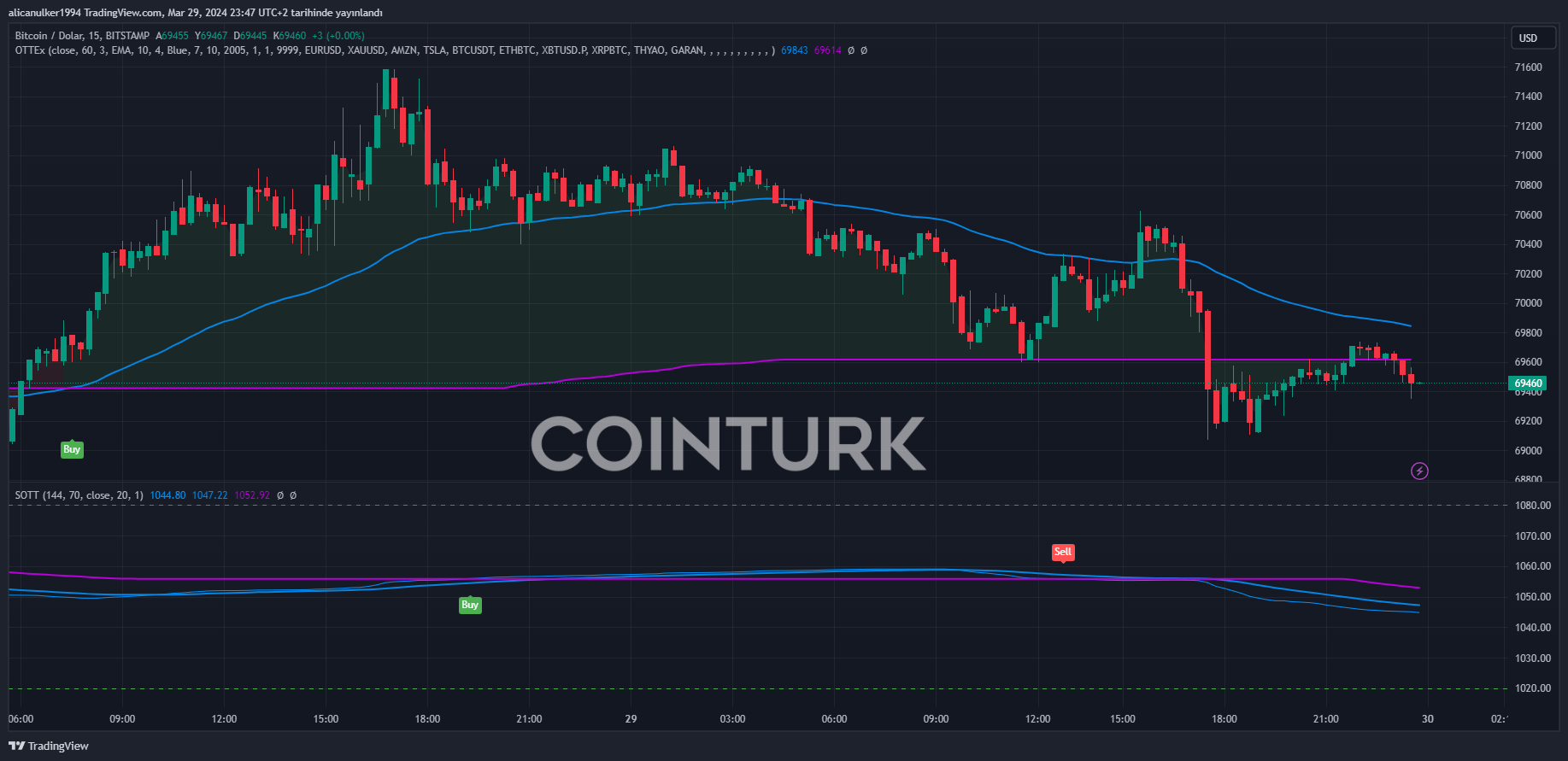

The last Bitcoin halving in 2020 took place when Bitcoin was around $9,000. At this halving, with Bitcoin hovering around $70,000, the reduction in supply will be more than three times greater in dollar terms.

The fourth Bitcoin halving is planned to occur on April 19th, considering the current conditions, and it is thought to be a significant trigger for a price surge.

The Future of Bitcoin

This halving should also be examined in parallel with other economic events. Before the previous halving, the Federal Reserve had reduced interest rates to zero, marking an incredible event, and had launched a large QE program.

Therefore, some market participants are curious whether the demand for Bitcoin ETFs, which have been trading for about three months, will bring a rise for Bitcoin as much as the Fed’s comprehensive assistance program. According to Horsley, while reviewing Federal Reserve interest rate cuts, similar fundamentals are expected to be part of the discussion this time as well.

How Will the Halving Affect Miners?

According to a recent report by Hashrate Index, if the Bitcoin price maintains its current level or experiences moderate growth following the event, an estimated 3-7% of the Bitcoin hashrate may go offline after the halving.

This will certainly bring corresponding adjustments in mining difficulty. On the other hand, a significant drop in the Bitcoin price could result in a larger portion of the hashrate going offline quickly, as observed by market participants and mining monitors.

After the halving event, operational margins are likely to remain low for a while. Therefore, focusing on increasing efficiency while protecting themselves against volatility and operational risks may be one of the key strategies for miners.

Türkçe

Türkçe Español

Español