Cryptocurrencies faced significant losses at the opening of Asian markets today but quickly rebounded. Geopolitical tensions seem to have subsided for now as the parties have exhausted their energies and have no intention of escalating matters. Cryptocurrencies shaken by stray rockets are returning to their previous levels.

Fed Statements on April 19

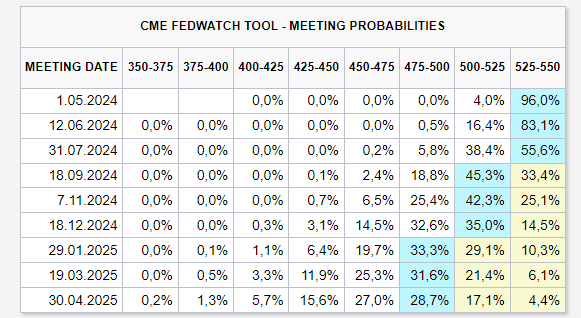

On the macroeconomic front, things are not going well. Following the latest inflation and employment data, expectations for a rate cut have been postponed to September. We had written in our Sunday review that this week would be extremely busy in terms of statements from Fed members. So, what is Fed member Goolsbee saying as this article is being prepared?

“It makes sense to wait for more clarity before taking action. Progress on U.S. inflation has stalled. All data does not show the labor market is overheating. I see more room for progress in service inflation than increases in labor supply. Persistently high housing inflation is a short-term fundamental issue. I am still hopeful about a return to improvement in inflation in the coming months. Future appropriate Fed policy will depend on the data. The Fed’s current restrictive monetary policy is appropriate. The Fed’s path for 2024 is more challenging. We have been very successful in employment but not in inflation. Reducing inflation to the 2% target will take longer. If you stay at this level of restriction for too long, you start to think about its impact on employment. Reaching 2% inflation without progress in the housing sector is more difficult. I do not know if the latest inflation is a sign of overheating. The Fed is deciding how restrictive it needs to be. If productivity continues, it will change everything.”

These were the key points in his statements, and if the April data also comes in poor, we might see days when the Fed becomes even more hawkish.