Cryptocurrency markets are experiencing days filled with both good and bad news. You can see this from the fluctuations in Bitcoin prices. In the last 24 hours, BTC prices moved between $66,867 and $62,573. Good news came from Hong Kong, and BTC began to rise. However, sales centered around Binance and net outflows in the ETF channel are cutting into bulls’ enthusiasm.

Hong Kong and Bitcoin ETF

Hong Kong has cleared the way for spot Bitcoin ETFs but they have not yet been launched. In June 2023, the autonomous administration added another pro-crypto step by offering individual investors the chance to invest in cryptocurrencies. However, despite the mid-2023 approval, we haven’t seen massive volumes in the region yet.

Last year’s development of crypto freedom in Hong Kong was seen as one of the most important and positive news, but it did not produce the expected results. Moreover, the region, which hosts $500 billion in investor capital, has only granted a few exchanges a service license so far.

Will Bitcoin and Cryptocurrencies Rise?

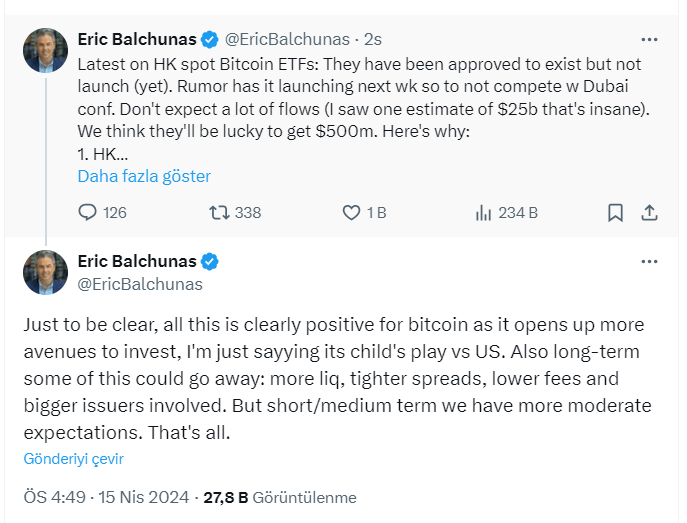

If the topic is spot Bitcoin ETFs, it’s worth asking an expert and seeing what they say. A few hours ago, Bloomberg’s senior ETF expert Eric shared his assessment of the latest development. The expert, known from the US-based spot Bitcoin ETF approval process, wrote the following;

“They have been approved for launch but have not yet been launched. Rumor has it that they will start next week to avoid competing with the Dubai conference. Don’t expect too much flow (I saw an estimate of $25 billion, which is crazy). We think even $500 million would be ambitious.”

Eric listed several reasons for his view.

- The ETF market in Hong Kong is very small, only $50 billion, and Chinese locals cannot officially buy them.

- The three approved issuers (Bosera, China AMC, Harvest) are very small. There’s no big company like BlackRock (yet).

- The fundamental ecosystem here is less liquid/efficient = these ETFs will likely see wide spreads (price slippages, wide bid-ask spreads) and early discounts.

- Their fees will likely be between 1-2%. They can’t come close to the very low fees in the US. (GBTC even charges 1.5% and it has the highest fee in the BTC ETF channel)

“To be clear, all this is clearly positive for Bitcoin considering it opens more channels for investment, I’m just saying it’s child’s play compared to the US. Also, in the long term, some of these might disappear: more liquid, tighter spreads, lower fees, and bigger issuers could come. But for the short/medium term, our expectations are more moderate. That’s all. And yes, Ether ETFs were also approved! Our $500 million estimate is for the total of all of them.”