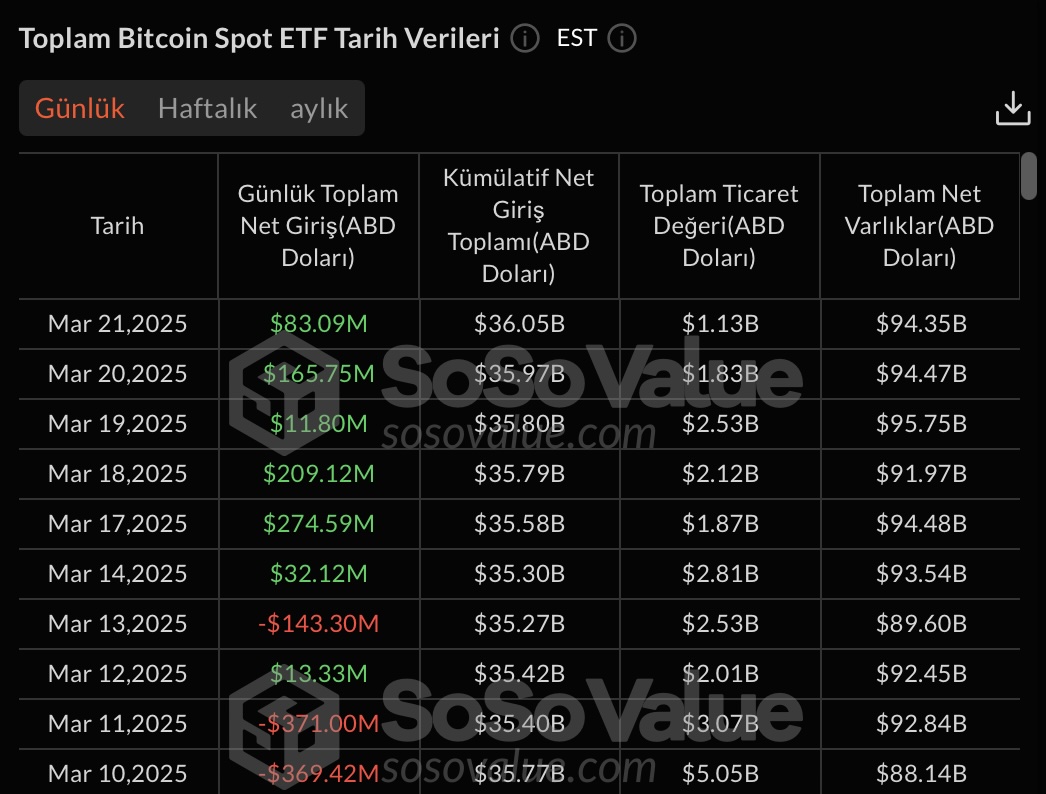

In the last six trading days, there has been a substantial influx of institutional capital into the spot Bitcoin  $103,795 ETFs in the United States. Major institutions like BlackRock and Fidelity have significantly contributed to these inflows. Data shows that just this week, there was a net inflow of 785 million dollars into the ETFs, indicating heightened demand for Bitcoin, the leading cryptocurrency, reaching its highest levels in recent years.

$103,795 ETFs in the United States. Major institutions like BlackRock and Fidelity have significantly contributed to these inflows. Data shows that just this week, there was a net inflow of 785 million dollars into the ETFs, indicating heightened demand for Bitcoin, the leading cryptocurrency, reaching its highest levels in recent years.

Intense Shift from Institutional Funds to Bitcoin ETFs

Spot Bitcoin ETFs gained attention after strong fund inflows during the first half of March. The interest from institutional investors towards ETF products has risen again. Notably, BlackRock’s iShares Bitcoin Trust saw a net inflow of 486 million dollars, Fidelity’s FBTC product received 70 million dollars, and Ark Invest’s ARKB fund had 100 million dollars. These fund flows indicate a renewed trust in the Bitcoin ETF market.

The total recent fund inflows of 785 million dollars reveal an increase in investor risk appetite and a revival of institutional demand for Bitcoin. This trend is reflected not only in the ETF market but also in the direct supply-demand balance of Bitcoin. The rising institutional interest is having a positive impact on overall market pricing.

On-chain Data and Strengthened Expectations

On-chain data also confirms the growing interest from investors. Recent analyses show that since February 23, a total of 172,705 BTC has been moved to wallet addresses by new investors. This transfer of BTC to new investor wallets stands out as one of the highest accumulations recorded since the collapse of the FTX exchange, suggesting that new market participants have medium to long-term expectations.

Crypto analyst Trader T highlighted the potential for significant liquidity inflows from U.S. retirement and target-date funds, suggesting they could have a liquidity potential of 103 to 122 billion dollars. According to Trader T, 5 to 10 percent of this amount could be directed towards alternative assets like cryptocurrencies. Popular analyst Altcoin Sherpa believes Bitcoin’s price could reach 90,000 dollars in the short term.

Currently, the general expectation among investors is that the price of the largest cryptocurrency will rise above 84,000 dollars to test new highs. However, analysts warn that volatility may continue, and caution should be taken against rapid price fluctuations.

Türkçe

Türkçe Español

Español