The world’s largest cryptocurrency exchange by volume, Binance, conducted a survey between March and May 2023 that shows institutional investors trading in the vast cryptocurrency market are looking positively, even optimistically, at cryptocurrencies for the next year and especially beyond.

Striking Numbers from Binance’s Research

The survey, conducted by the Binance Research and Binance VIP & Institutional teams between 31 March – 15 May, involved 208 clients. According to the research note, over half (52%) of the respondents have less than $25 million under management, while 22.6% have more than $100 million.

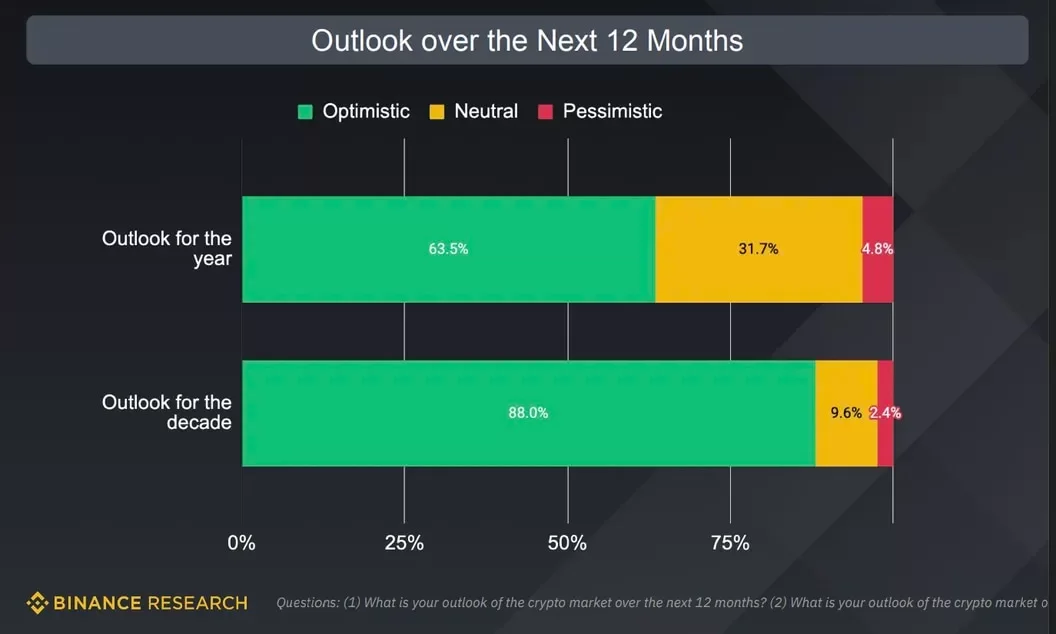

63.5% of the respondents are positive about the cryptocurrency market for the next year. A large majority are long-term optimistic about the cryptocurrency market. Accordingly, 88% of the respondents expressed optimism for the cryptocurrency market over the next decade.

The survey also provides striking information that, despite negative developments that hit the market last year, respondents continue to protect their cryptocurrency investments. 47% of institutional investors maintained their cryptocurrency investments last year, with more than a third increasing their investments. Only 4.3% said they plan to reduce the funds allocated to cryptocurrencies over the next 12 months.

The positive stance shown in Binance’s survey by institutional clients, despite the ongoing bear market that started last year and the increased regulatory pressure following lawsuits against Binance and Coinbase by the U.S. Securities and Exchange Commission (SEC) earlier this month, was interpreted as a positive development.

Infrastructure Projects are the Favorite of Institutional Investors

On the other hand, 54% of investors are interested in investing in infrastructure projects. 48% and 44% of the respondents follow Layer 1 (Layer 1) and Layer 2 (Layer 2) projects, respectively.