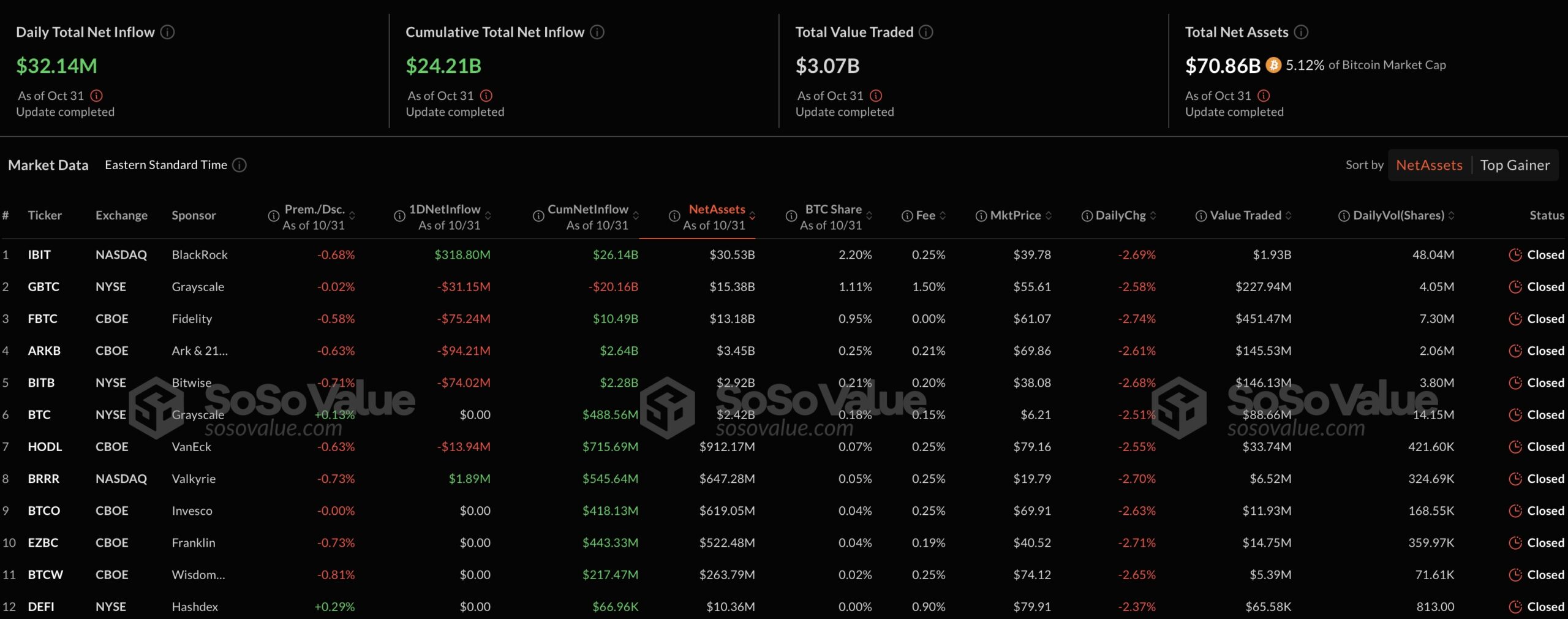

Recent developments in the U.S. spot Bitcoin  $119,923 ETF market highlight significant changes. According to SoSoValue data, total net inflows for spot ETFs reached $32.14 million as of October 31. However, Grayscale’s ETF experienced a net outflow of $31.15 million from its GBTC product, indicating shifts in institutional investor positions.

$119,923 ETF market highlight significant changes. According to SoSoValue data, total net inflows for spot ETFs reached $32.14 million as of October 31. However, Grayscale’s ETF experienced a net outflow of $31.15 million from its GBTC product, indicating shifts in institutional investor positions.

Interest in BlackRock’s ETF Remains Strong

Analysis by InnoMin Capital reveals that BlackRock’s spot Bitcoin ETF, IBIT, is witnessing high demand. This surge in interest emphasizes institutional investors’ growing inclination towards spot Bitcoin ETFs, bolstered by regulatory support that enhances confidence in these products.

Additionally, the net inflow of $1.89 million into Valkyrie’s spot Bitcoin ETF, BRRR, indicates that interest in such products is not limited to major players. Experts predict that this trend could generate increased liquidity and investor confidence in the Bitcoin and broader cryptocurrency markets.

Growing Interest in Spot ETFs Signals Market Maturity

The strong interest from large asset management firms like BlackRock and Valkyrie showcases a robust trend among investors seeking exposure to Bitcoin through structured financial products. This situation indicates that the cryptocurrency market is maturing, poised for a new wave of liquidity.

Current data shows Bitcoin trading at $69,397, down 3.87% in the last 24 hours, yet up 2.67% over the past week.

Türkçe

Türkçe Español

Español