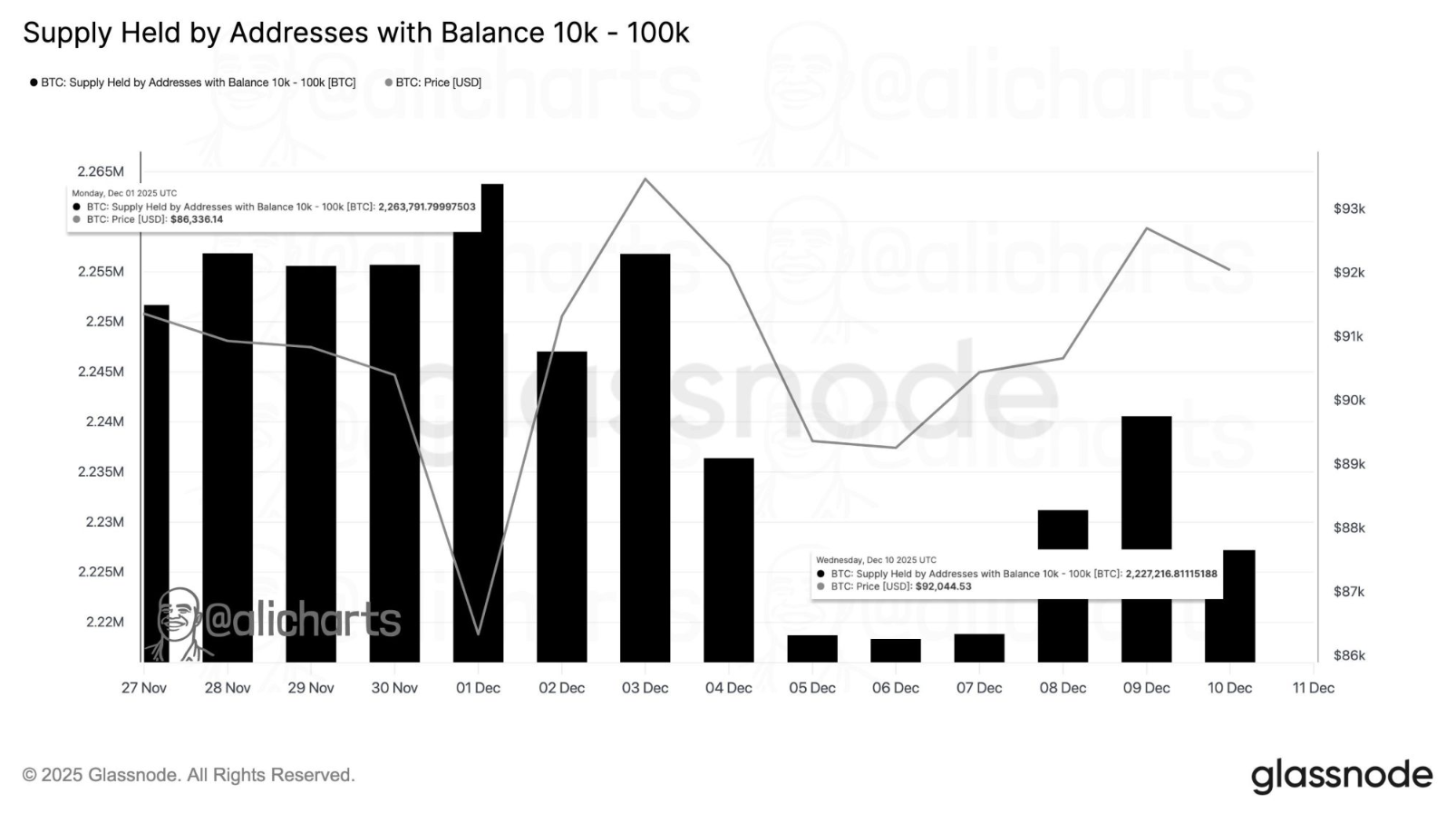

Recently, there has been a noticeable flurry of activity in the Bitcoin  $91,081 market. Particularly, major institutional investors and early miners holding between 10,000 to 100,000 BTC have conducted sales or redistributions totaling 36,500 BTC (approximately $3.4 billion) since December 1st.

$91,081 market. Particularly, major institutional investors and early miners holding between 10,000 to 100,000 BTC have conducted sales or redistributions totaling 36,500 BTC (approximately $3.4 billion) since December 1st.

Institutional Sell-Off and Worsening Liquidity Issues

Data from Glassnode reveals that this group has abandoned its accumulation trend and is now adopting a more cautious strategy. Bitcoin’s struggle to surpass the $94,000 resistance despite the Federal Reserve’s interest rate cut supports this outlook.

Bitcoin traded horizontally at $92,250 on the last trading day of the week, with the sell-off pressure from these major wallets catching the attention of investors. The $3.37 billion outflow over 12 days suggests a growing “stepping aside” tendency, particularly in institutional circles. Detailed examination reveals individual investors maintain high expectations, despite “smart money” adopting a different perspective.

The liquidity scenario is also less than ideal. According to data from FX Leaders, the influx of stablecoins into exchanges has decreased by 50% since August. This indicates a weakening of new purchasing power. Mudrex’s Chief Quantitative Analyst Akshat Siddhant notes that while the Fed’s monthly $40 billion treasury bond purchase program will have positive long-term effects, the market needs to first absorb this new liquidity in the short term.

Despite these circumstances, inflows of more than $610 million into Bitcoin and Ethereum  $3,094 ETFs over the past two days suggest that investor confidence hasn’t completely dissipated. However, closing above $94,140 remains crucial for achieving the $100,000 price target.

$3,094 ETFs over the past two days suggest that investor confidence hasn’t completely dissipated. However, closing above $94,140 remains crucial for achieving the $100,000 price target.

The Critical $88,000 Threshold

The main point of concern in the market is the differing perspectives between large and individual investors. While small investors focus on the Fed’s “turning point” narrative and maintain bullish expectations, major wallets view the current price range as an opportunity for redistribution. Both the $3.4 billion institutional outflows and the 50% reduction in stablecoin reserves indicate that the $88,000–$94,000 range has turned into a sales zone rather than a buying opportunity.

If Bitcoin loses support at $88,000, a sharp increase in volatility is expected. Such a breakdown could lead to panic selling among short-term investors, whereas long-term players might seek new position opportunities.

Meanwhile, a similar pattern was observed with Ethereum last week. Large addresses holding over 1,000 ETH sold around 220,000 ETH. Experts suggest that the cautious approach by large wallets in both Bitcoin and Ethereum will be decisive for the market’s short-term direction.