Chicago Mercantile Exchange (CME), the derivatives giant, saw double-digit growth in cryptocurrency options trading volume in July, aided by increasing investor appetite for hedging instruments.

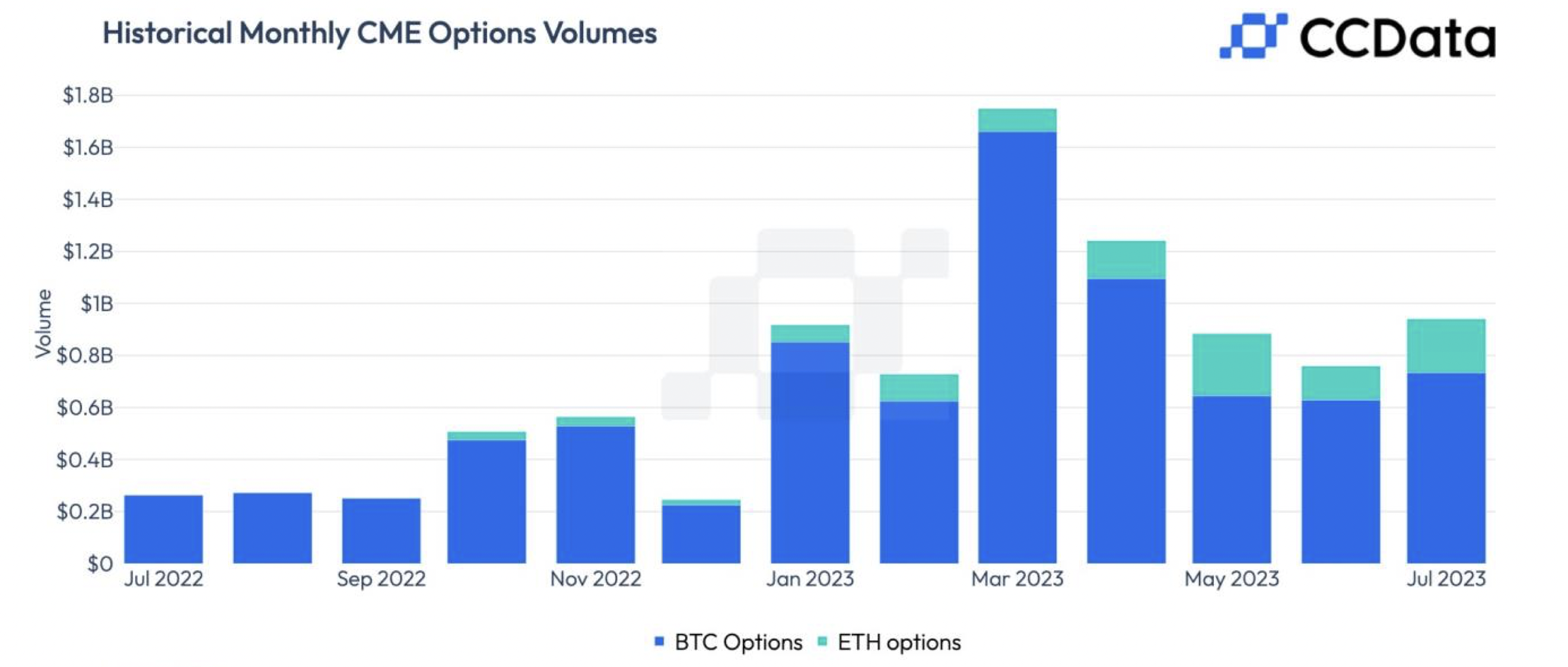

According to data tracked by CCData, the trading volume in cryptocurrency options increased by 24% to reach $940 million, marking the first increase in the past four months. The volume of Bitcoin (BTC) options increased by 16.6% to $734 million, while the volume of Ethereum (ETH) options reached $207 million, a 60% increase.

CCData evaluated that the increase in BTC options volume on CME indicates that institutional investors may be hedging their positions with options as uncertainty in the market continues.

Options are derivative contracts that give the buyer the right to buy or sell an underlying asset at a predetermined price on or before a specific date. A call option gives the buyer the right to buy, while a put option gives the buyer the right to sell.

CME’s options provide the buyer of a call/put option the right to buy/sell a cryptocurrency futures contract at a specific price on a future date. CME offers Bitcoin and Ethereum options based on the exchange’s cash-settled standard and micro BTC and ETH futures contracts. Standard contracts are sized at 5 BTC and 50 ETH. Micro futures contracts are sized at one-tenth of 1 BTC and one-tenth of 1 ETH.

Reasons for Institutional Investors’ Inclination towards Bitcoin and Ethereum Options

The declining optimism about the Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF, regulatory uncertainty, and the prevalence of recent DeFi hacks like Curve Finance (CRV) led Bitcoin and Ethereum to close July with a 4% decrease.

The relative underperformance of Bitcoin compared to stocks and gold in the second half of June pushed investors looking to hedge against directional risks in the cryptocurrency market towards crypto options.

The combined activity in BTC and ETH futures on CME also cooled in line with the global slowdown. According to CCData, the trading volume in cryptocurrency futures on CME decreased by 17.6% to $39.1 billion, and the total derivative trading volume (futures and options) decreased by 17.0% to $40.1 billion.