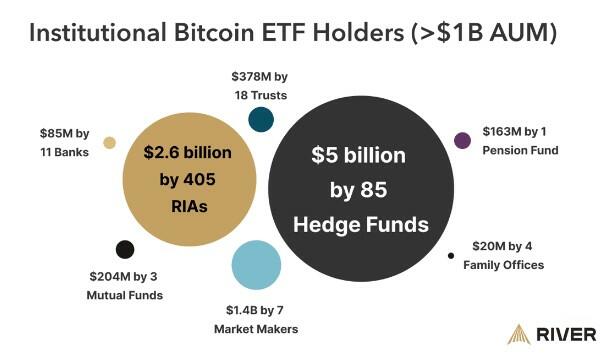

A recent analysis highlighted Bitcoin’s impact on the financial world. A study by River, a leading Bitcoin application, revealed that many major institutions in the United States have included Bitcoin ETFs in their investment portfolios. It was found that 534 institutions, each managing over $1 billion in assets, currently hold Bitcoin ETFs. This indicates that Bitcoin is increasingly accepted among various financial institutions such as hedge funds, pension funds, and insurance companies.

Notable Statistics

One notable statistic in River’s blog post is that more than half of the largest 25 hedge funds in the United States have turned to Bitcoin. Among these leading hedge funds is Millennium Management, which has a significant accumulation of $2 billion in Bitcoin assets. This trend is not limited to hedge funds; 11 of the largest 25 Registered Investment Advisors (RIA) and numerous smaller advisors have also invested in Bitcoin.

River’s CEO, Alex Leishman, emphasized the importance of holding Bitcoin assets. He noted that selling Bitcoin to major financial players like Blackrock could result in permanently losing access to these assets. This comment underscored the perceived value and increasing importance of Bitcoin in institutional portfolios.

Bitcoin Included in Financial Reserves

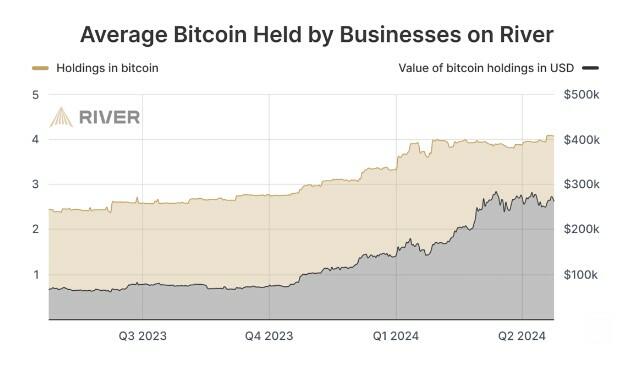

The number of businesses including Bitcoin in their financial reserves is also increasing. Over a thousand companies using River’s platform currently hold Bitcoin in their reserves. The amount of Bitcoin held by these businesses has significantly increased over the past year. Previously, a typical business held about 2.5 BTC worth $70,000, but now these assets have risen to over 4 BTC, exceeding $280,000 in value.

This increase in Bitcoin adoption is not limited to large companies. Smaller businesses across various sectors have also adopted Bitcoin as part of their financial strategies. This widespread adoption indicated a shift towards recognizing Bitcoin as a valuable asset for corporate balance sheets.

Bitcoin Achieves Regulatory Compliance

Bitcoin’s integration into the mainstream financial system is further reinforced by its compliance with regulatory standards. Michael Saylor, one of Bitcoin’s leading advocates, recently discussed in an interview how Bitcoin is increasingly complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Saylor mentioned examples such as Block, which sells $10 billion worth of Bitcoin annually through Cash App, and Fidelity Digital Assets, which manages billions of dollars in Bitcoin custody transactions. These developments highlighted Bitcoin’s transition from a niche investment to a widely accepted financial asset.