The agenda is extremely busy and crypto investors really need to get some sleep tonight. Because the rest of the week is likely to be filled with sleepless nights. Tomorrow is the final decision date for the Ark&21Shares ETF application, and the SEC must reach a conclusion.

The Race for a Spot Bitcoin ETF

After the ETF decision on Wednesday, investors are expecting sleepless nights. Thursday and Friday will be the first trading days, and whether the increase in the BTC price will continue will be determined based on the volume data of the ETFs. On Friday, the US inflation data will be released, and it is essential that it comes below expectations since the employment data was strong; otherwise, the macro pressure on risk markets will increase as we approach the January 31 Fed meeting.

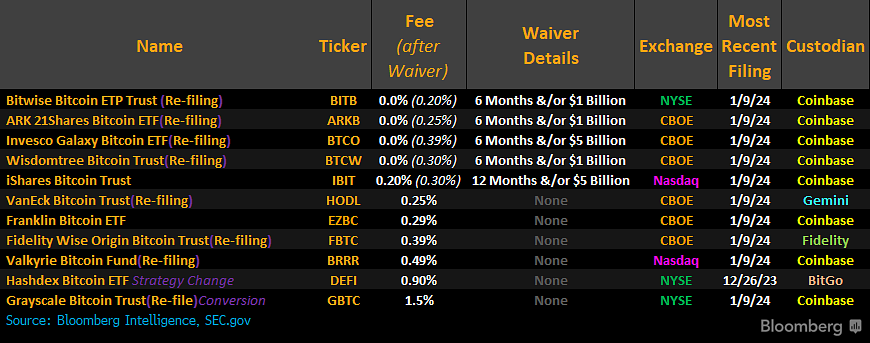

On January 24, Tesla’s last quarter balance sheet will be released, and everyone will focus on whether the company has sold any BTC or made purchases while the market was rising last quarter. While all this is happening, potential spot Bitcoin ETF issuers, as you can see below, have entered the race for the lowest annual management fee.

Three of the companies are slashing fees for the first 6 months, while BlackRock is doing so for 12 months. WisdomTree is waiving fees up to 1 billion dollars. Considering that the management fee for a gold ETF is 0.4%, it is exciting that such a speculative asset as BTC is starting trading with such low fees.

Investors are being lured into ETFs with lower fees, and the competition is already heating up.

Two Altcoin ETFs on the Horizon

Valkyrie Co-Founder Steven McClurg said there is a 95% chance that the ETFs will start trading on Thursday. He also predicts that after the approval of the Spot Bitcoin ETF, spot ETFs for ETH and XRP Coin could also be approved. However, these two predictions have not been confirmed or signaled by the SEC.

The optimism for an XRP Coin ETF is at least dampened for 2024 due to the collective appeal process that will start months later. The SEC may not grant such approval before the lawsuit is settled. The risk for ETH is the possibility of it becoming a security after the transition to PoS and acquiring various risks. We discussed the details of this in the last ETH ETF postponement decision and wrote that the SEC had five reasons for not favorably considering approval.

Türkçe

Türkçe Español

Español