While public markets composed of stocks, bonds, and securities continue to attract investment, private markets such as venture capital funds may see a decrease in existing funds. According to records from the Securities and Exchange Commission, BitKraft fell short of its $240 million target for its second investment fund in 2023, raising $220.6 million. The capital is expected to be used in the information technology and gaming sectors.

Strong Interest in the GameFi Sector

According to the Pereira team, which states that the gaming sector represents a market of $330 billion, Web3 games have been a strong segment in the recovery of the fourth quarter of 2023, with positive launch activities expected both recently and for 2024.

However, a series of additional challenges may still persist, especially for early-stage ventures. Adam Struck, founder of VC firm Struck Capital, said that funds are likely to look for businesses with proven models that are ready to grow in the coming months:

“After the frenzy of 2021, startup leaders have become increasingly rational about company building, so I think the Series A and growth-stage fundraising markets will continue to unravel.”

Struck also predicts a positive year for the gaming industry and decentralized finance space, expecting more corporate capital to flow into blockchain ecosystems:

“As dozens of innovative games with seamless integrations into blockchain ecosystems come to life, I expect Web3 games to explode. With upcoming interest rate cuts and more real-world assets moving onto the chain, I expect the total value locked in DeFi to increase significantly this year.”

Continued Interest in the Web3 Space

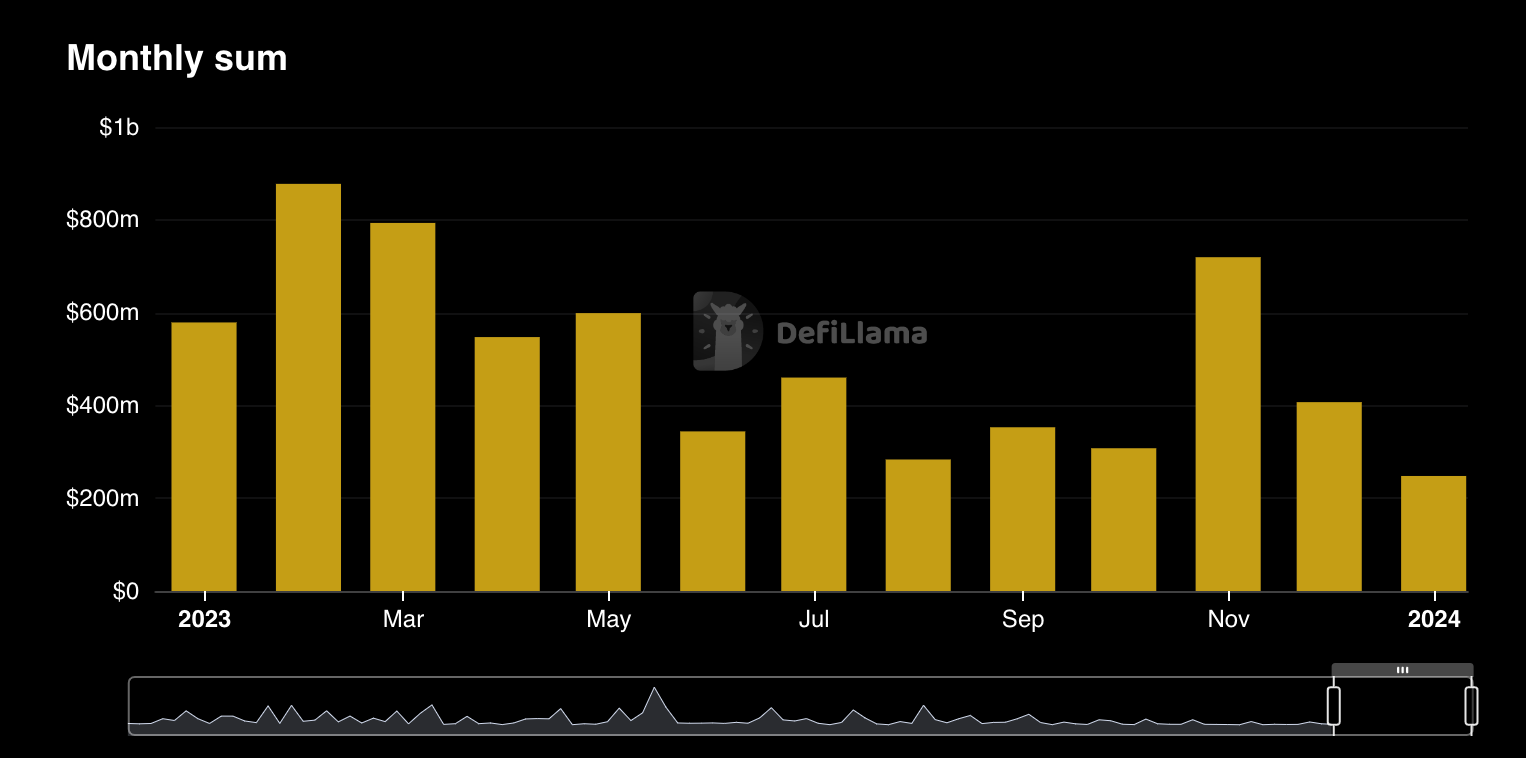

Data from blockchain data analytics company DefiLlama reveals that at least $5.7 billion in capital was allocated to crypto businesses in 2023. One of the crypto ventures that received funding last year was Lolli. The company offers Bitcoin and cashback rewards to individual users who shop through partners like Ulta Beauty, Groupon, and Booking.com.

Bitkraft Ventures led an $8 million Series B round for the venture, with supporters including Serena Williams’ Serena Ventures. Lolli’s CEO Alex Adelman believes that ventures can still be successful in the current environment. Adelman shared his thoughts on the matter:

“Last year’s downturn in the crypto market helped to some extent to separate companies with sustainable business models from those without.”