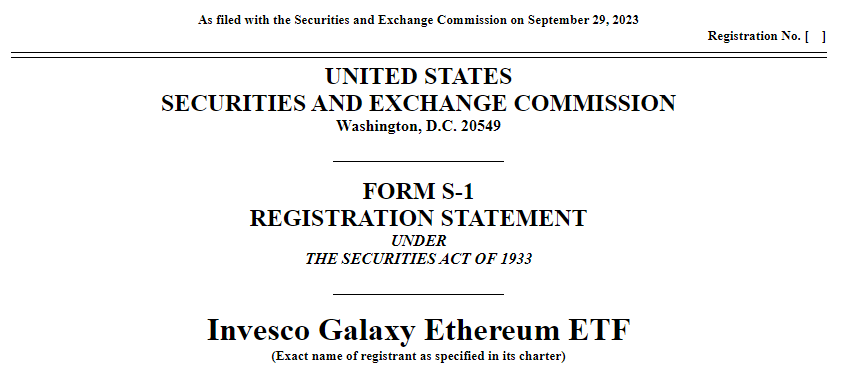

SEC has not reduced its pressure on cryptocurrencies, but fund companies are already preparing for the future. With today’s application, there have been a dozen ETF applications before the SEC. Companies want to take advantage of the potential increase in institutional demand over the next two years.

Spot Ethereum ETF Application

A few minutes ago, Invesco Galaxy applied for a spot Ether ETF. With the latest application, there are now three pending files for ETH in front of the SEC. These funds can lead to a significant increase in demand as they issue ETFs holding ETH or BTC through Coinbase. Unlike futures, spot ETFs can have greater positive effects on price.

Since the approval for ETH futures ETF came yesterday, the price of Ether has increased over BTC. However, the rise ended early due to the closing of open positions in crypto exchanges’ futures. If we do not see a new wave of increased demand in the Spot or Futures side, despite the good news, we may see the price of BTC fall below $26,500 again.

At the time of writing this article, ETH finds buyers at $1,673, and closing above this threshold can present an opportunity for further growth. ETH’s rise has historically been a driving force for altcoins as well.

Türkçe

Türkçe Español

Español