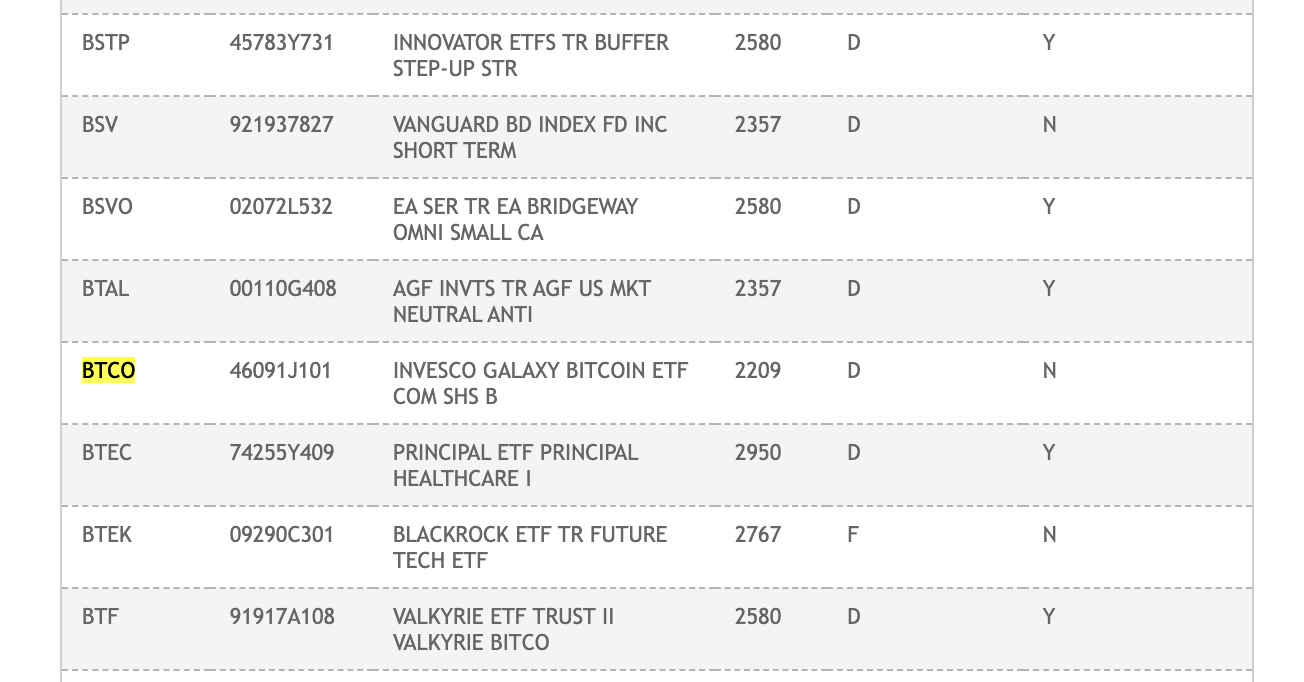

Invesco and Galaxy Digital’s spot Bitcoin exchange-traded fund (ETF), Invesco Galaxy Bitcoin ETF (BTCO), has been listed on the Depository Trust and Clearing Corporation’s (DTCC) website. This development signifies a significant step forward in the ETF application process for the two major asset management companies, similar to BlackRock’s iShares Bitcoin Trust listing on DTCC.

Invesco Galaxy Bitcoin ETF Takes Its Place on DTCC

The Invesco Galaxy Bitcoin ETF, abbreviated as BTCO, has been listed on DTCC. According to Cointelegraph, the spot ETF was added to the list within the past six days. Prior to the listing of Invesco Galaxy Bitcoin ETF, the listing of BlackRock’s iShares Bitcoin Trust on DTCC had caused great excitement.

It is important to note that being added to the ETF Products list on DTCC does not guarantee approval from the U.S. Securities and Exchange Commission (SEC). A DTCC spokesperson stated that adding a security to the NSCC Securities Compliance File as preparation for the launch of a new ETF is a standard practice. The spokesperson said, “The appearance of an ETF on the list is not indicative of any pending regulatory or other approval processes.”

The spot Bitcoin ETF, BTCO, jointly managed by Invesco and Galaxy Digital, was reactivated on June 21.

Wave of Spot Bitcoin ETF Triggered by BlackRock’s Application

The recent resurgence of spot Bitcoin ETF applications, including the application by Invesco and Galaxy Digital to the SEC, followed BlackRock’s groundbreaking application for a spot Bitcoin ETF on June 15.

Currently, BlackRock, Invesco, Galaxy Digital, as well as major players like ARK Invest, Bitwise, WisdomTree, Valkyrie, VanEck, and Fidelity, have their products awaiting approval from the SEC. ETF experts believe that the approval of one of these ETF applications by the SEC will inevitably open the door to a significant market surge, boosting demand and prices for Bitcoin and altcoins.