Ethereum (ETH) bears dominated last week as the token’s price fell. However, this situation might be the last chance for investors to accumulate more ETH while the price is low. ETH was at a crucial resistance level, and a breakout above it could lead to a significant rise in the coming weeks or months. Data from 21milyon.com revealed that Ethereum witnessed a price correction due to a drop of more than 2% in its value last week.

Resistance Level in ETH

At the time of writing, ETH is trading at $3,687.02 with a market cap of over $442 billion. However, when ETH tested a significant resistance level, this downward trend might soon change. A popular cryptocurrency analyst, Milkybull, recently tweeted about this development. According to the expert, a breakout above the resistance could lead to a major bull rally.

Additionally, according to the analyst, this might actually be the last chance for investors to buy ETH below $3.7k in this cycle. According to CryptoQuant data, ETH’s net deposits on exchanges are low compared to the seven-day average, which could reflect high buying pressure. ETH’s Coinbase Premium is on a downward trend. This data might indicate a dominant selling trend among US investors.

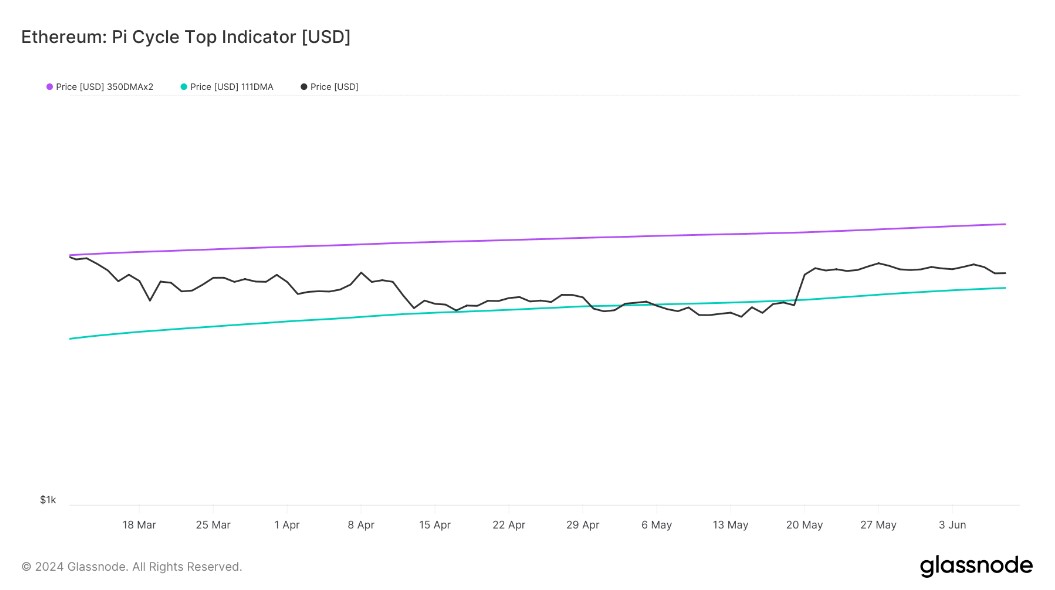

ETH Report from Glassnode

According to data from the cryptocurrency analytics company Glassnode, the Pi cycle top indicator revealed that ETH’s price is close to the market’s lowest level. This situation might mean that ETH has a high chance of gaining upward momentum in the coming days. In such a case, ETH could soon touch $4.8k, which would be a positive development.

According to analyses, the MACD showed a bearish crossover, which could be seen in favor of sellers. The Relative Strength Index (RSI) also continued its downward trend as it was below the neutral mark. These indicators might signal the continuation of the price drop. However, the Chaikin Money Flow (CMF) has been moving north towards the neutral level in the past few days, indicating an upward trend.

Türkçe

Türkçe Español

Español